Retirement planning and advice

Give yourself the freedom to shape your ideal retirement, with paid financial advice from our experts.

With investing, your capital is at risk. We provide 'restricted advice', which means we will only make investment recommendations on the products and services that we offer.

Planning for your retirement

Life after work should be a time you're excited about, and being in a financial position to choose how you want to spend retirement can make all the difference – so it's important to have a clear plan in place. With advice from our experts, you can feel confident about what your ideal retirement looks like, how you could fund it, and what you could do right now to bring it one step closer.

Our financial advisers will analyse your individual circumstances, your current assets, and your retirement goals to put together a personalised plan to help you get to where you want to be. You'll also get recommendations for making the most of your available tax allowances, and potentially paying less in fees, too.

Boost your investments with 1% cashback on ISA and pension transfers

Get 1% cashback on transfers of up to £500,000 from ISAs, pensions, Lifetime ISAs, Junior ISAs and Child Trust Funds.

Capital at risk. £10k min. Initiate by 30th May 2025 and keep invested until 30th May 2026. Product rules and T&Cs apply. Compare existing benefits and fees before transferring.

Get the offerHow financial advice works

It starts with a free consultation

Book in today for a free, no-commitment call to tell us about your current position, get your initial questions answered, and help you decide which level of advice – Core or Enhanced – could be the right fit to help you achieve your goals.

We get to know you better

If you go ahead with our paid advice service, you'll meet with one of our financial advisers. They’ll do an in-depth assessment of your assets, income and outgoings, and calculate the best way to align them with your ambitions. Then, they'll get started on designing your personalised plan.

You get your personalised plan

This will give you a comprehensive strategy, including specific recommendations on how you could turn the retirement you're hoping for into a realistic goal. Plus, with our Enhanced advice, we'll show you what the future could hold depending on how you move forward with your strategy.

Time to put your plan into action

You'll now have a clear path to help turn your ambitions into reality – and you can always get our free guidance along the way. If within five years you have any life changes or feel it's time for an update, our paid Review service could help.

Find the right financial advice for you

We've designed our service with all investors in mind – from first-timers to seasoned pros. If you're not sure which level could be the best choice for where you are right now, our financial advisers can help you decide.

Book your free consultationCore

(inc VAT)

If you're looking to build wealth for the future.

Expert, tailored financial advice.

Our financial advisers get to know where you are and where you want to be, in a way that works for you. We'll then create your personalised plan, recommending ways you could achieve your short- and long-term goals.

Your plan will include:

And, our free general investing guidance whenever you need it.

Enhanced

(inc VAT)

For complex finances or if you're near to retiring.

Everything from Core, plus even more.

We'll model and compare potential investing outcomes, helping you see how later life could look depending on the decisions you make. You'll get an Enhanced financial plan, recommending the best strategy to help achieve the future you're aiming for.

A Core plan, plus:

And, our free general investing guidance whenever you need it.

Review

(inc VAT)

If we've given you advice in the last 5 years.

An in-depth review of your Nutmeg financial plan.

If your situation has changed – like you've had an inheritance – or you need more than our free general guidance to help keep your portfolio on track, a review could help you make the right adjustments.

An updated plan with:

Why invest with Nutmeg?

Take control

Choose how you want us to manage your investments and which risk profile is right for your goals.

Stay on track

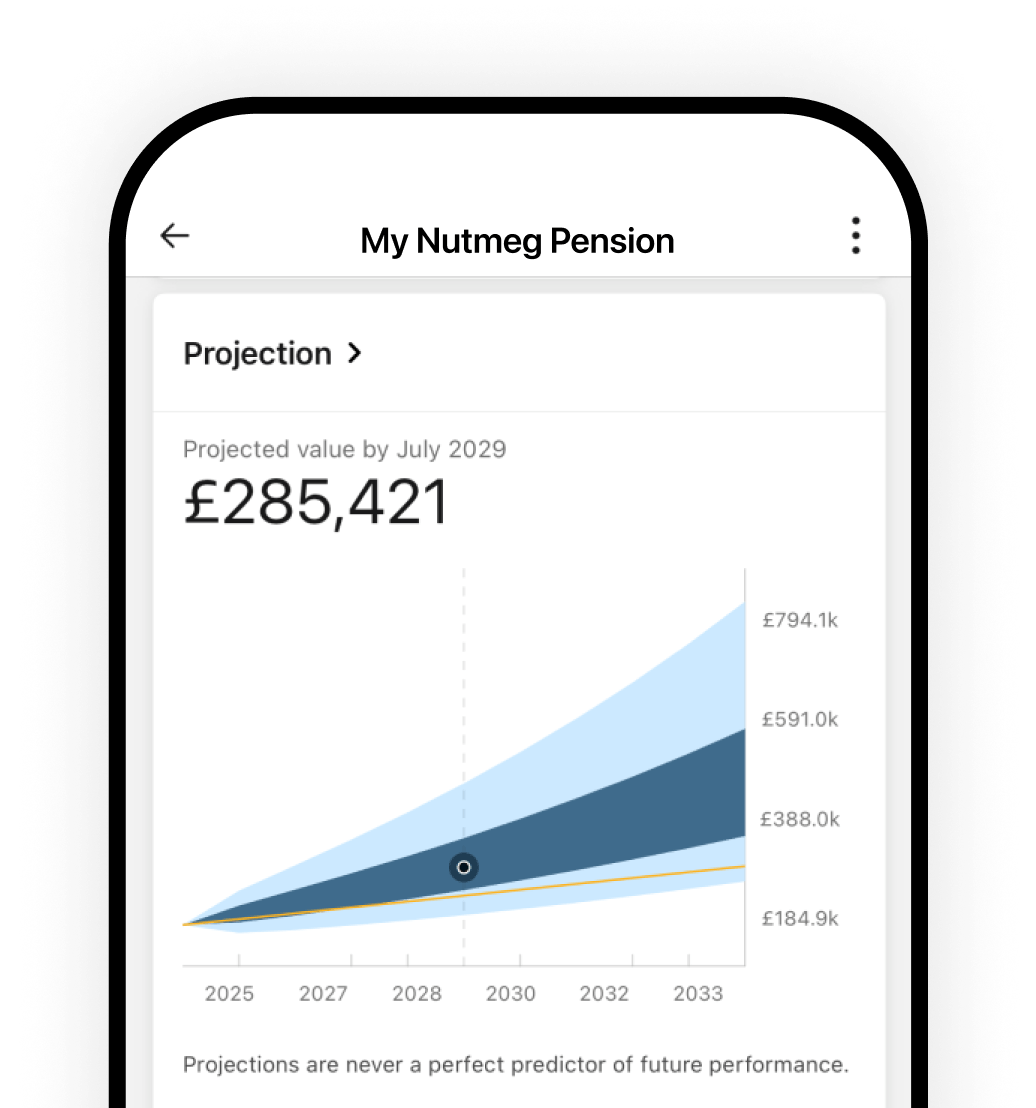

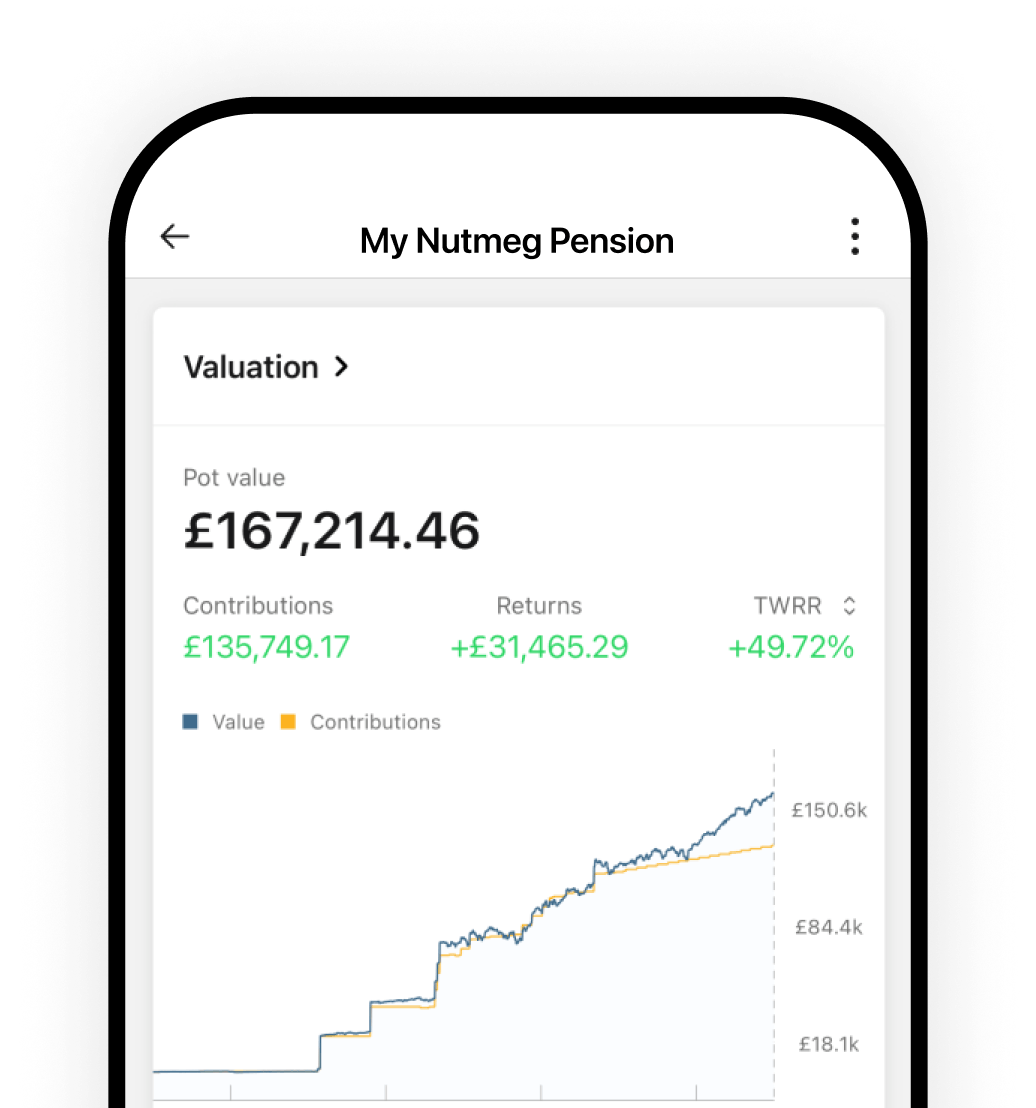

See how much your investments could be worth, and exactly where you're invested with our easy-to-use tools.

Trust the experts

Our expert team will manage your investments for you and keep you updated.

How much could your pension be worth?

Want to see how much your money could grow over time? No one can predict the future, but our calculator can help you work out what your money could potentially turn into if you invested in a pension with us.

Try our calculatorRead our financial advice articles

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax rules vary by individual status and may change. If you are unsure if a pension is right for you, please seek financial advice.