Diversification – investing across a range of different asset classes, regions, sectors, and styles – is the bedrock of multi-asset investing. It helps you to spread risk and can improve your chances of higher returns. The popularity and performance of different asset classes will always ebb and flow, but diversification is timeless. Let’s remind ourselves of this core principle of portfolio construction.

What do we mean by portfolio diversification?

Diversification is, in simple terms, defined as investing in multiple assets so that your exposure to each one is limited. If individual investments perform poorly, the impact on the whole portfolio is moderated and, vice versa, standout stocks will contribute to performance rather than drive it entirely.

Portfolio diversification was once described as the “only free lunch” in investing by Nobel Prize laureate Harry Markowitz – alluding to the fact that it may reduce risk without a corresponding reduction in return. Although, if not quite ‘free’, then you can at least think of the lunch as a buffet; you’re less likely to be stuck with one bad taste in your mouth if there’s more variety on your plate.

Why diversification is a good strategy

Going ‘all-in’ on one sector or asset class can be an incredibly risky approach. If, for example, you had invested everything in the travel and leisure sector, which bottomed out during the Covid lockdowns, then a bulk of your investment could have gone with it.

It is, in fact, very easy for investors to get carried away with outperformance at a sector level. A good example was the clamour for technology stocks in the late 1990s as people began to speculate on the burgeoning potential of the internet and a new digital world.

The Nasdaq – still home to many tech companies today – climbed quickly with money pouring into start-ups from venture capitalists and other investors looking to profit from opportunity. However, an unprecedented rise in valuations of these companies was not sustainable, thus leading to the infamous dotcom bust of 2000, as shown by the chart below.

Chart 1: Historical outperformance of US technology stocks 1990-2000

Source: Nutmeg, MacroBond (X axis = years, Y axis = total return %)

An investment strategy that tempers losses

A better strategy might be to spread your investment across several sectors including, say, financials, energy, consumer stocks, healthcare and utilities companies. We believe a wiser strategy would be to also invest across geographies, from the UK and US, to Europe, Japan, Asia, and emerging markets. Even better still would be to invest not only in equities, but also bonds, both government and corporate debt, and currencies, as we do at Nutmeg.

That’s where a good multi-asset strategy can really deliver. A wealth manager, such as Nutmeg, can do the work for you by allocating across these different markets and changing the amounts, or asset allocation, to each as different market conditions dictate.

Diversification and portfolio risk

The foundations of any well-diversified multi-asset portfolio will comprise growth-related assets, such as equities, and income-bearing investments, usually bonds. Risks can and will vary across these different categories, but in general terms equities – the archetypal ‘risk asset’ – have shown over time to deliver greater potential for growth (and losses) than lower-risk, yielding assets such as government bonds.

However, as we’ve seen more recently with the poor performance of bonds, there are no guarantees that they will conform to risk assumptions in the short to medium-term.

In risk-managed portfolios, such as those offered by Nutmeg, wealth managers are able to adjust the percentage amounts held in each of the buckets in order to cater for clients’ preferences. Equities can be – though are not always – lowly correlated to bonds, which have historically been seen as ‘safe-haven’ assets. That means that when one performs badly, the other should perform well.

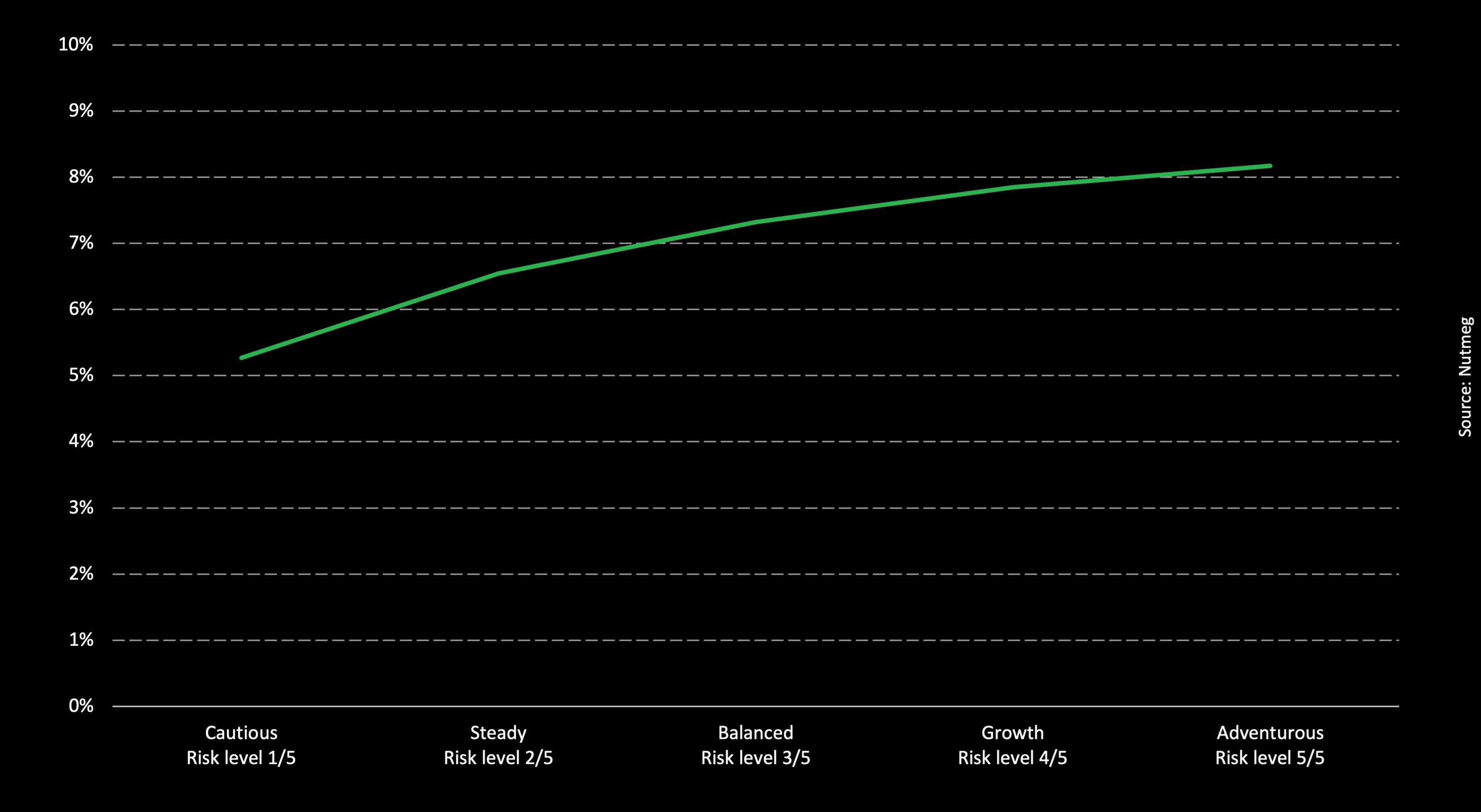

The chart below shows annualised long-term simulated returns (1990 – 2023) for equity and bond portfolios similar in nature to Nutmeg’s Fixed Allocation portfolio range . As we move up the risk spectrum, long-term returns rise.

Chart 2: Simulated historical returns of fixed allocation risk spectrum (1990-2023)

Nutmeg Internal Data from 01/06/1990 – 28/02/2023

Investing in the riskiest assets individually may have delivered a better return over the long-term, but the volatile nature of equities means it could also have lost you a fair amount too. Choosing to diversify across asset classes should give a smoother journey and could make for a clearer path to achieving your investment goals.

Are ETFs well diversified?

Rather than invest directly in stocks, Nutmeg invests in exchange-traded funds (ETFs). Created to track an index or market ‘passively’ they offer a cost-effective route to diversification, in that the ETF will invest across a large pool of investments without having to buy each one individually. For example, an ETF tracking the S&P 500 US equities index is comparable to buying a small part, in the appropriate proportion, of each of the index’s 500 companies.

ETFs are the perfect diversification tool for wealth managers today – Nutmeg’s universe of available ETFs spans over 1,800 strategies, with the average Nutmeg Fully Managed portfolio containing over 8,000 underlying securities, diversified across global equity, bond and commodities markets.

How a wealth manager like Nutmeg can help

Diversified portfolios come in many different types, including fixed allocation strategies where the portfolio is automatically rebalanced across asset classes, and assets reviewed yearly; to fully managed where investment managers take a more hands on approach on a day-to-day level. In both instances, diversification is paramount to achieving clients’ investment goals across different risk levels, while professional investment managers also have the leverage to make use of information, and some funds, that would simply not be accessible to individual investors.

While investment trends will come and go, the principle of diversification remains constant; make sure you don’t lose out on its benefits.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not a reliable indicators of future performance.