Volatility is a term frequently used when talking about investments, but what exactly is it? How can it be managed? And what can investors do during times of market turbulence such as the one we are experiencing now?

Update on recent market volatility

Equity markets have experienced a volatile run into Spring, as investors have digested the various developments around the US tariffs first announced on 2 April. In the weeks since 'Liberation Day', we have seen a number of twists and turns, including:

- A 90-day pause on higher tariffs for US trading partners other than China

- China raising its tariffs on US goods

- The US granting exclusions from the tariffs announced on 2 April for smartphones, computers and select electronics, including from China.

President Trump has a track record of changing policy settings after they have been announced, with his negotiating tactics typically involving the use of uncertainty. This is something we have seen play out in recent weeks. For markets, this has all led to heightened uncertainty, which has caused asset prices to move around sharply, in both equity and bond markets.

The initial 2 April announcement was accompanied by a significant drop in prices across many asset classes as investors grappled with the wide-ranging implications. Since this initial sharp fall, we have seen some tariff reversals and some initial signs of softening relations between the US and China accompanied by a broad recovery in asset prices. Markets may be regaining a sense of stability, however, the "end-game" is still to play out and is subject to uncertainty.

Our view

In the near term, we are focused on managing portfolio risks around the unknown policy direction. Our investment team has been keeping abreast of developments as they arise and assessing the implications for portfolios.

We were running a small equity overweight this year – holding modestly higher equity exposure than our long-term benchmark, but removed this position in early April, retaining the proceeds in cash, because of the threat to economic activity from the developing situation.

Retaining perspective

Depending on the nature of the volatility and the factors influencing it, periods of market turbulence can vary in length. The extent of the tariffs has had serious consequences for markets, with the wide-ranging impacts being felt around the globe.

Periods of heightened market volatility do happen, and it can be useful to refer to past events to try to retain a broader perspective. The onset of Covid-19, and what happened in markets, is an event that newer and more experienced investors alike will recall. When the pandemic first hit, global equities suffered significantly. The S&P 500, which tracks the performance of the largest 500 companies in the US, lost around 34% of its value in just over a month between the middle of February and late March 2020. For investors, this was jarring.

However, it didn’t take long for prices to start their recovery. By the end of 2020, the index not only recovered its losses but made gains of 16% for the full 12-month period. Extending the time period further, index gains totaled 82% for the five years from the start of 2020 to the end of 2024.

What you can do

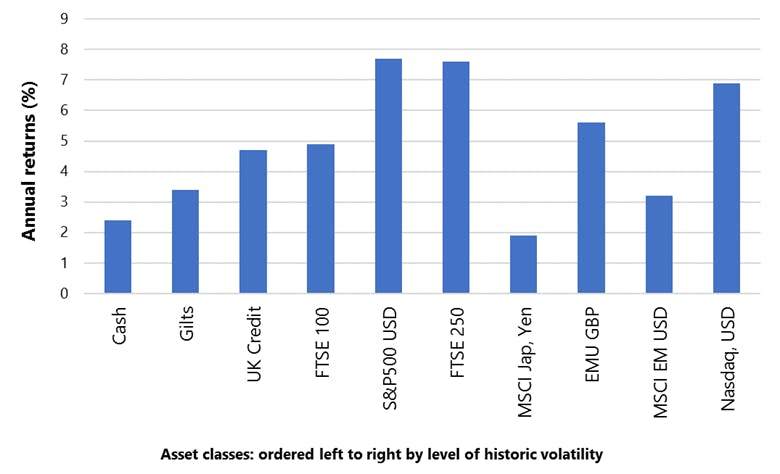

Whilst each period of volatility is different, market turbulence and fluctuations in portfolio values can be uncomfortable. Trying to remain focused on the long term can be difficult. However, our analysis shows that over the long term, investors in a wide variety of equity and bond markets outperform cash savers. Chart 2 shows this in full detail. It should be noted that while historic data can be a useful reference point, when investing nothing is guaranteed and capital is at risk. Past performance is not a reliable indicator of future performance.

While none of us can control the news, or the reactions of other investors around you, you can control the impulse to make hasty decisions. Many of our seasoned investors already know this, because in the past the vast majority of our investors have ridden out these market storms without changing their portfolios*. However, if you’re feeling nervous about how recent financial market performance could affect your investment goals, our team is here to talk.

What is market volatility and what causes it?

Volatility is a measure of the change in value of an asset. When volatility is high, it is an indication that values are changing more sharply and quickly than usual. The value of all financial markets changes over time, with many asset classes such as equities and bonds (which make up Nutmeg ETFs) changing in value throughout the day as parts of the intertwining cogs of the wider financial system.

Markets can be moved by a wide swathe of influences, such as: political and economic factors, speeches and new policy announcements from politicians or central banks, or wider geopolitical factors like war or energy shortages.

Any of these variables can cause changes in how confident investors are about the prospects for different types of investments, often referred to as ‘investor sentiment’. If a policy change is announced that many investors deem negative for the prospects of an asset class, investor sentiment for those assets can fall quickly and sharply. If a large number of investors are trying to reduce their holdings in an asset class at the same time, it will have a bigger negative effect on the price. This is because for every seller, there needs to be a buyer on the other side of the trade. If sentiment is worse, the price of the asset must find the level at which it becomes attractive to another investor, which is likely to be lower than normal.

How can volatility affect me?

For any investor, it’s natural to be disappointed and potentially feel some anxiety if you see that the value of your portfolio has fallen. While it can be difficult to retain sight of the big picture, it is important to remember that very few investors will have only ever seen a one-way upwards journey.

For investors with long-term goals

It may be easier to ignore some short-term disruption if you are investing for your retirement which may be a long way off, or for a target you expect to be on the distant horizon. The probability of your portfolio increasing in value typically increases the longer your time horizon is. You have longer to benefit from any returns compounding and there is time for any periods of market turbulence to settle.

For investors with more immediate goals

If you have been planning to cash in your investments for an upcoming property purchase, to help fund your imminent retirement, or for any other more pressing circumstance, we understand that a sustained period of volatility may impact you more. You may have concerns about your portfolio, and how your financial goals may be impacted by the recent market turbulence. If your circumstances have changed since you first set up your portfolios, or you would like to speak to us about any concerns you may have, we encourage you to book a call with our team to get free financial guidance.

Should I sell when markets are volatile?

If your portfolio is down today, remember that a loss is only crystallised when an investment is sold. Although an investor may see their portfolio value move around more quickly than normal during a period of heightened market volatility, that same portfolio may not be down in value in a month’s time, or by the end of the year, for example.

"Rather than focusing on what has happened recently in markets, the risk level that may be right for you should be based on your individual circumstances such as your investing time horizon, capacity to take on risk and risk tolerance. Nutmeg uses a risk questionnaire with clients to help them determine their appropriate risk level, so they can be confident their portfolio is being invested in a way that is consistent with their individual circumstances. It is disconcerting seeing investments fall but changing risk levels based on market movements involves selling or buying, and effectively timing the market which is notoriously difficult.

We’ve seen historically that those investors who invest for the long term, with an appropriate risk level, have had greater success than those trying to time the market in the short term. Our overall belief can be summed up that time in the market is more important than timing the market."

Paul Hillis, Wealth Services Practice Manager

When you choose to sell your investments depends on your own personal circumstances. However, if you have set a timescale and risk level that you are comfortable with, and these still apply to your current goals, then you have made sensible steps towards your financial future.

If you have been investing in financial markets for a long time, you will likely have experienced different periods of market stress and come out of the other side with some experience of what to expect.

For those who are relatively new to investing in a globally diversified portfolio, making your way through the first period of market turbulence can be daunting. Your first year as an investor can be especially stressful because those first 12 months in isolation are more likely to show losses than when you have been invested over a longer time frame. It’s completely understandable that volatility can cause stress, especially if you aren’t used to seeing negative figures when dealing with your finances.

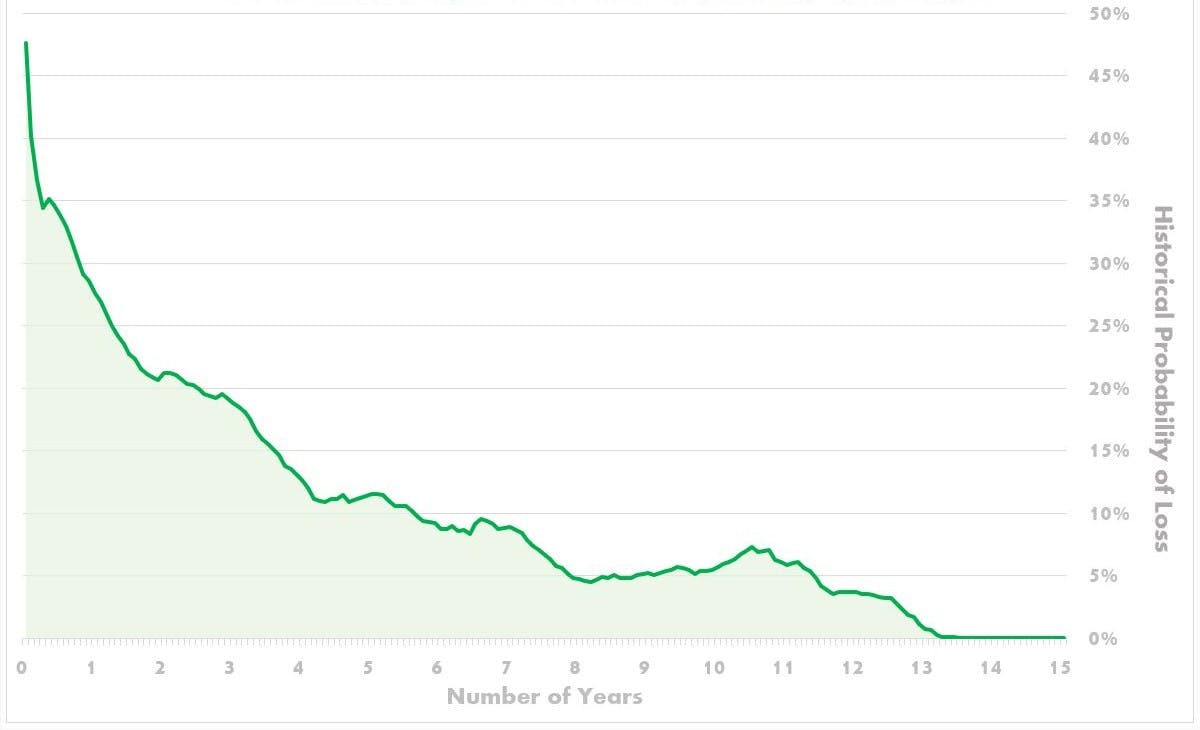

However, as the chart below shows, the likelihood of making a loss should go down over time, and so too can those feelings of anxiety. What might seem like a big movement over a shorter time frame may be put into perspective when viewed over several years, though historical performance does not predict future returns.

Chart 1: Historical probability of loss decreases by holding investments longer

MSCI World Equity Mid and Large Cap probability of loss (average from Jan 1972 to April 2025, by number of years invested)

Source: Macrobond, MSCI World Equity Mid and Large Cap Total Return in GBP, 4th Jan 1972 to 21 April 2025. Chart produced April 2025.

How Nutmeg manages portfolio risk

Our investment experts closely monitor and analyse financial market data, economic data, and developments in the global policy landscape that can impact investments. For our Fully Managed, SRI and Thematic portfolios this means making strategic adjustments to your portfolio’s mix of investments as and when the team believes it is most appropriate, ensuring your portfolio remains aligned to long-term objectives.

This involves daily risk monitoring, ensuring that portfolios are well-diversified across asset classes, investing in ETFs that have been rigorously researched and selected to meet our standards for size, trading volume, and liquidity.

For the Fixed Allocation investment style, rebalancing is done once a year. The Smart Alpha portfolios are powered by J.P. Morgan Asset Management and are actively monitored by the J.P. Morgan Asset Management team who advises the Nutmeg investment team on changes to portfolios based on market conditions, leveraging their deep research-driven insights.

We understand that appetite for risk can be highly personal. At Nutmeg we aim to understand your tolerance for risk, and ensure your portfolio is invested appropriately. If your financial circumstances have changed and you would like to discuss your portfolio with our team, please book a call for free financial guidance.

How different risk levels work

For the Fully Managed portfolios, for example, the risk scale of 1 to 10 primarily reflects the split, often called asset allocation, between perceived higher-risk assets (equities) and the bond market that has traditionally exhibited less volatility. Historically, equities have displayed greater price volatility than bonds, but also have demonstrated better returns over the long term.

For the lowest risk level 1, most of your money will be invested across developed market government bonds, the money market, or in corporate bonds. The vast majority of any equity exposure will be in developed markets, such as the US, UK, Europe, or Japan. Moving all the way to the highest-risk level 10, most exposure will be to equities, including emerging markets such as China and Brazil. Exposure to bonds will be more limited.

While equities tend to be higher risk and bonds tend to be lower risk, asset classes do not always perform to type. For example, 2022 was a particularly bad year for bonds as the world’s major central banks raised interest rates in a bid to control inflation. This is something to keep in mind when assessing your portfolio: that when investing, nothing is completely certain.

Can I avoid volatility?

If you are investing in financial markets, it is impossible to avoid volatility altogether. However, our investment team has risk management at the heart of our investment process to manage portfolios’ exposure to volatility as effectively as possible.

While past performance is no guarantee of future returns, history has shown us that volatility can be your friend should you take a long-term approach to investing. Chart 2 below orders asset classes, left-to-right, by their average volatility between 2000 and 2025. The bars show investment returns for a variety of asset classes. Although the relationship between risk and reward is not completely linear, as in not all those with higher volatility make higher returns, all equity and bond markets except for Japanese equities outperform holding cash by a significant margin over the 25-year period.

Chart 2: Asset class returns between 2000 – 2025, ordered by volatility

Source: Macrobond, Nutmeg, 1 January 2020 to 1 March 2025. All are equity markets except cash, money market, gilts and UK corporate bonds. Chart produced April 2025

A fresh perspective

Once you get to grips with volatility as a natural part of investing, with the understanding that the longer you invest, the less likely you are to see losses, this can help to ease some of the anxiety you may have about investing.

No investment is ever guaranteed to deliver returns, but a measured approach over a sensible time horizon can help to maximise your chances of reaching your financial goals.

If you do feel you would like to discuss your financial goals further, you can book a free call with one of our experts.

Footnotes

*In 2022, we looked at seven events going back to 2012 to see if Nutmeg customers changed their behaviour in response to market volatility. An average of 97.8% of Nutmeg customers did nothing out of the ordinary.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance. Thematic investing carries specific risks and is not for everyone. We do not provide investment advice in this article. Always do your own research.