The Bank of England (BoE) has cut interest rates for the first time since the start of the Covid pandemic, ending a year at 5.25% with a new rate of 5%. We explore what this means for the UK economy and investors, and how Nutmeg portfolios are positioned to deal with the change.

On August 1st, the Bank of England's Monetary Policy Committee (MPC) voted 5 votes to 4 in favour of cutting interest rates, bringing the base rate down to 5%. The rate had been held at 5.25% since August 2023, which was a 16-year high.

Ahead of Thursday's meeting, financial markets were uncertain which way the MPC's decision would fall, with economic data proving inconclusive. Allan Monks, Chief U.K. Economist at J.P. Morgan, said that an August cut "would feel like it's coming despite, rather than because of, data developments since May."

With the US Federal Reserve opting to hold rates at 5.5% the night before, the odds were shifting towards the BoE following suit and holding out until the autumn.

After a year of rate holds, why has the Bank of England made its move now?

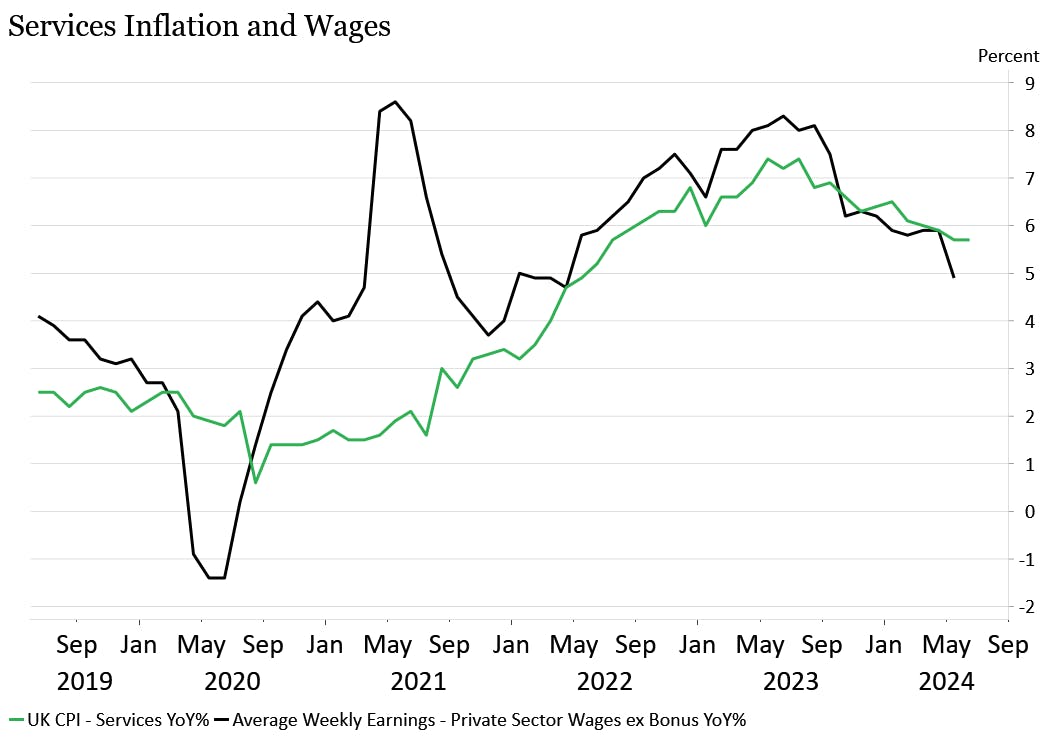

Back in June, the MPC wanted "more evidence of diminishing inflation persistence" before cutting interest rates, with core inflation and service price inflation in particular as sticking points. Goods prices have eased since the last MPC meeting, however both core and service price inflation remained stagnant in June (at 3.5% and 5.7% respectively) leading many market commentators to believe a rate hold was more likely.

Despite this, the two consecutive months of Consumer Prices Index (CPI) data coming in at the bank's target of 2% (in the 12 months to May and 12 months to June), were evidently enough to clear the inflation hurdle.

Other measures factored into the MPC's decision include wages growth, which has seen some cooling as the unemployment rate has jumped from� 3.8% in December 2023, to 4.4% in May. Rachel Reeves' recent announcement of wage increases in the public sector may have added complexity, but the decision to cut rates seems to indicate the BoE is confident that this would not tip the labour market in the wrong direction.

Chart 1: Services Inflation and Wages

Source: Nutmeg Calculations, Macrobond.

The UK's economic performance in recent months was stronger than anticipated, which also led many to believe that the MPC would not see a rate cut as necessary for economic recovery. Economic growth can increase demand for goods and services, which can in turn drive price increases and higher wages. The MPC, however, clearly believed there was wiggle-room, and that the risk of over-stimulating the economy was low after only a few quarters of growth. Even with lower rates, the International Monetary Fund expects year on year growth of the UK economy to stay at 1.5% for 2025.

With a mixed bag of evidence, the BoE has likely acted now so that the British economy does not get left behind. Economic data had to be weighed against the increasing pressure on household finances – particularly those who are feeling the effects of higher variable rate mortgages or are facing the prospect of rolling off a fixed term deal and needing to remortgage.

What does the Bank of England hope to achieve with rate cuts?

Rate cuts aim to stimulate the economy by reducing the cost of credit, leading to an increase in borrowing and investment activity. A 25 basis points (0.25%) cut is modest, but it should help to alleviate some financial pressure on households, as well as encouraging consumer and business confidence.

With lower rates, consumers can afford to take on more debt - from spending a little more on their credit cards, to taking on mortgages and loans to fund personal projects. Rate cuts should also encourage businesses to invest in growth, allowing them to borrow to fund the big capital expenditure projects that they may have put on ice for the last 12 months.

Beyond increased spending, a cut in interest rates should also incentivise consumers to invest their savings in markets, as the potential for investing returns to exceed the interest rates on their savings accounts increases.

However, cutting rates should be done with caution, as policymakers don't wish to spark further inflation. While the MPC's decision to set the new base rate at 5.0% does indicate a policy shift away from inflation control towards stimulating controlled economic growth, it is still a relatively restrictive interest rate and should not tip the balance too far.

What will this mean for financial markets in the short and medium term?

The BoE's August announcement won't shock markets, as rate cuts have been well signposted by policymakers and anticipated for a long time. In fact, markets had previously expected more rate cuts this year than what has materialised, and had started to reflect this in prices already.

Equities:

History tells us that equity markets respond well to easing of monetary policy. As businesses announce their growth plans (enabled by the ability to borrow at lower rates) expectations of future profits will drive demand. This leads to stock price increases. While the most ambitious companies might see this more acutely, other players in their supply chain will also benefit from increased demand.

In theory this should be good for the FTSE 100, however at present the FTSE 100 is trading close to its all-time high. It's therefore likely that optimism around rate cuts has been 'front-loaded' into prices, and that a cut of 0.25% will not move markets materially.

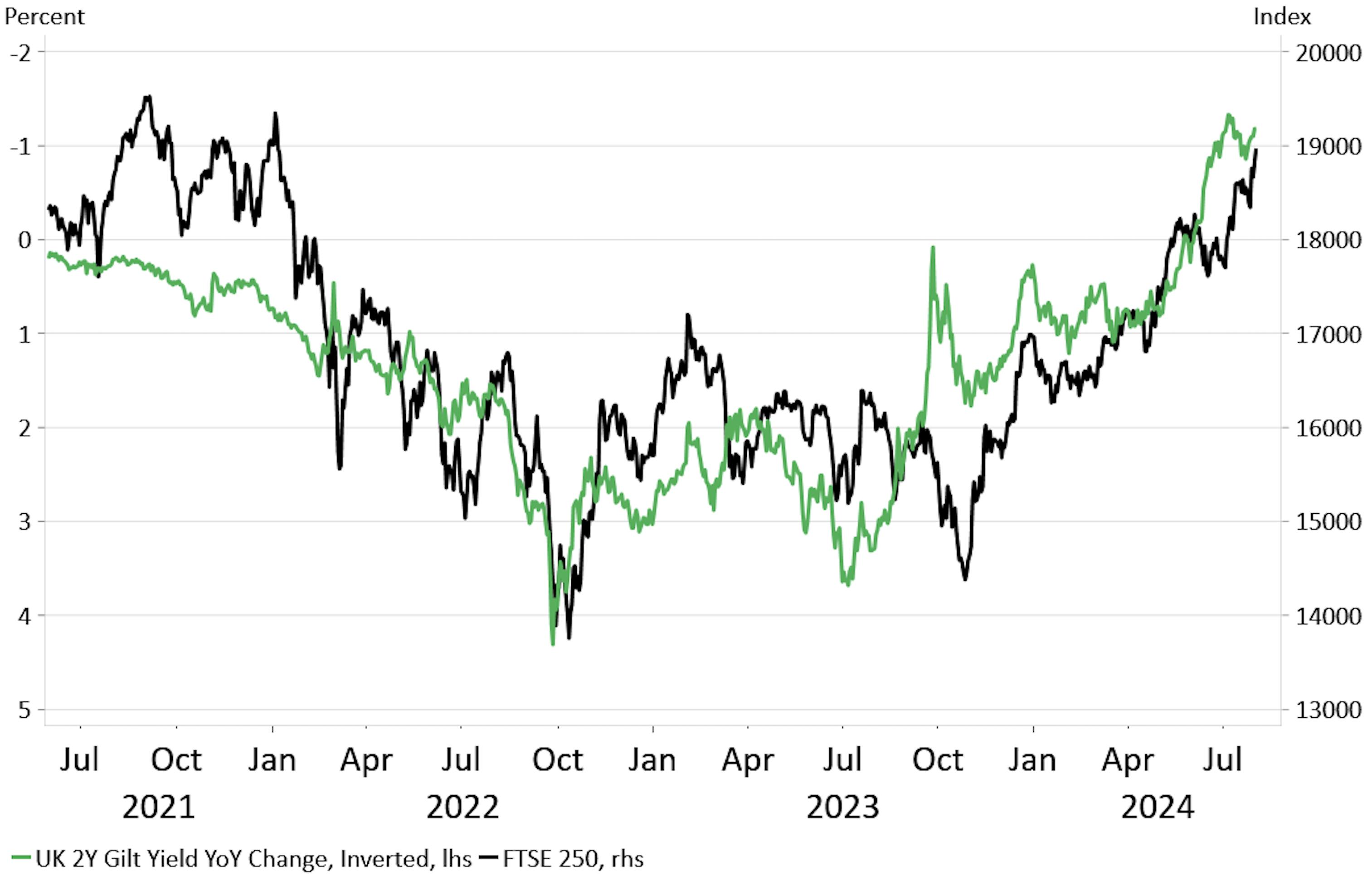

The FTSE 250, which comprises mid and small-cap stocks in the UK, is more likely to benefit from a rate cut, given smaller businesses are more sensitive to the domestic interest rate environment.

Chart 2: FTSE 250 Performs Better in Falling Interest Rate Environment

Source: Nutmeg Calculations, Macrobond. These figures refer to past performance, which is not a reliable indicator of future performance.

Bonds:

Generally, when interest rates fall, they take government bond yields down with them, while the price of outstanding bonds tends to rise.

Shorter duration bonds are more impacted by central bank decisions. Longer duration bonds are also impacted, but more influenced by longer term growth and inflation dynamics.

Bond markets have been pricing in an interest rate cut from the Bank of England for the better part of 12 months, with expectations often shifting due to the persistence of inflation.

Overall, we expect some positive reaction to the rate change from gilts and corporate bonds. The question the market is now facing is how many cuts the bank will do during this easing cycle. This will ultimately depend on how the BoE is interpreting the inflation data which in some instances (services) is still proving to be sticky.

How has Nutmeg been adjusting portfolios in line with rate cuts and expected cuts?

The Nutmeg investment team is constantly monitoring the economic data that informs interest rate decisions.

We’re positioning our portfolios to tilt towards equities compared to our long-term average, specifically in sectors and markets that should benefit from a strengthening economic recovery, and continued growth leadership from technology-oriented businesses.

Ahead of the ECB's rate cut on June 6th, Nutmeg held a preference for European industrial stocks, given the path of recovery that we were seeing in the global trade cycle.

Domestically, we have been running a small underweight to the FTSE 250 against the FTSE 100 through the year, waiting for confirmation of a UK recovery and a pivot in Bank of England policy. We regularly review this position, together with our wider portfolio. We also took the decision to swap our US treasury exposure into gilts, given our expectation that the BoE would cut rates before the Federal Reserve, a prediction which has played out.

While the Federal Reserve held on July 31st, markets seem confident that a rate cut is imminent in September. Nutmeg portfolios are presently overweight US equities, a conviction which we have strengthened with an additional small holding in the NASDAQ in May.

In fixed income, despite the positive news regarding rate cuts, we remain neutral on the outlook for government bonds. We prefer taking our risk where we can in corporate debt, carrying an additional premium to Government Bonds, which should also benefit from the interest rate cuts.

What should investors do in times of interest rate uncertainty?

While this first BoE rate cut is promising, it is hard to predict how far and fast central banks will move. The ECB held rates at 4.25% in July after moving first, meanwhile the Fed held off, but there has been some market speculation that September-December cuts may be more aggressive than 0.25%.

The general trend points downwards, which should give investors confidence. In this environment, investors should be investing according to their risk tolerance and time frame. If you need information about different investment products, you can book a free call with one of our experts to discuss your options.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not a reliable indicator of future performance.