How long-term investors can benefit from developments in technology, the household names that dominate the sector today, and tomorrow's key themes.

At a glance:

- The technology sector houses some of the world's largest companies, many of which are household names

- The growth of artificial intelligence has boosted the sector in recent years, both companies that market AI tools and the chipmakers that produce the hardware

- US equities are leading the way, sparking fears of a 'bubble' in the sector, though the earnings picture is very different from the Dotcom boom and bust of the late 1990s and early 2000s

- A long-term thematic approach to technology may suit investors who want exposure to growing areas such as cybersecurity and robotics, while remaining diversified

Why is the technology sector so important to investors today?

The technology sector dominates investors' portfolios like no other, and it is no surprise that technology related costs are becoming a growing part of consumer and business expenses. Tech's tentacles spread wide - from the way we communicate to the way we travel, shop, and entertain ourselves. From a business perspective, it is more visible throughout supply chains, through the use of robotics and automation, cloud computing, cybersecurity, and of course artificial intelligence.

At Nutmeg, our globally diversified portfolios have technology exposure at different levels, depending upon your chosen investment style and risk level. The style with the most exposure is our Technological innovation portfolio, part of our Thematic investing offering that focusses on long-term technological trends. However, thematic investing is only available for investors at risk level five and above.

Here we'll discuss some of the technology trends we've identified, key tech companies, and whether the sector has some bubble-like characteristics.

What are the key technology companies for investors?

The most obvious place to start is the so-called 'magnificent seven' - Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla - which dominate the US equity market. While not all strictly technology businesses (with Alphabet and Tesla classified as Consumer Discretionary and Amazon and Meta as Communication Services), they are often grouped as such and together represent just over one-third of the S&P 500 index. They are all, or were recently all, in the top-10 of index constituents.

Table1: S&P 500 top 10 companies by market weight

Source: Nutmeg, Bloomberg, as at 26 July 2024

While it's understandable today that these household names hold such a huge share of the market, this is not a new phenomenon. Chart 1 below illustrates that the 'magnificent seven' has made up more than 20% of the S&P 500 for the past four years, showing how established these brands have truly become.

Chart 1: 'Magnificent seven' % total of S&P 5000 since 2014

Apple, Amazon, Meta, Nvidia, Microsoft, Alphabet and Tesla

Source: Nutmeg, Macrobond, as at 30 June 2024

The depth of the technology sector is illustrated by almost half (13) of the top-30 stocks in the US being directly technology related. The likes of Advanced Micro Devices, Netflix, and Adobe sit alongside more traditional titans like Eli Lilly (pharmaceuticals), J.P. Morgan Chase (financials), Exon Mobile (energy), and Proctor & Gamble (consumer staples).

How can investors best capture the success of technological innovation?

While some individual technology companies have performed exceptionally recently, investing in individual stocks still carries significant risk. One of the best ways to maximise your chances of capturing possible future success in the technology sector is through tracking an index via an ETF. This approach offers diversification across companies, sectors, and both long-established and newer technology trends. An emphasis on diversification remains key to avoid concentration in highly speculative technology that could be very volatile.

With all investing it is recommended to take a long-term view of at least five years. Technology can give us some of the best examples of how patience can pay off - Apple wasn’t in the top-20 US stocks in the S&P 500 when it first launched its iPhone in 2007, with a market capitalisation of less than £200 billion. By July 2023 it had become the first company to have a market capitalisation of $3 trillion.

How does Nutmeg invest in technology?

Our globally diversified portfolios hold technology stocks across multiple markets, for example semi-conductor suppliers TSMC in Asia and ASML in Europe. However, the US remains by far the largest and best-placed market to access this sector and its associated themes. The Nasdaq index has a particular focus on technology, and this is the market that we have a direct allocation to in our higher-risk portfolios.

In our Technological innovation thematic portfolio range, we also have exposure to long-term technology themes, which makes up between 10 and 20% of the overall portfolio, depending on the portfolio risk level chosen. Within this, we have identified a number of technology focus areas:

- Artificial intelligence (AI) - The application of and investment in AI and machine learning is only going to accelerate across different elements of business and our daily lives over the years to come.

- Cloud computing - Essential to the digital economy, cloud technologies enable businesses to grow, scale, innovate, and evolve.

- Cybersecurity - This is in high demand now, and the market is set to increase in the years ahead as our technologies (and cyber criminals) become increasingly sophisticated.

- Robotics and automation - Already essential on vehicle production lines, robotics is expanding into other areas of manufacturing as well as the service sector.

- Semiconductors - These are the computer chips that store and process information. This sector is set to become more important in the decades ahead, particularly with the growth of artificial intelligence which requires huge amounts of data.

We access these areas in a number of different ways. This includes sector-specific ETFs (such as VanEck Semiconductors and iShares Automation & Robotics), while we are also careful to avoid overlap by remaining as diversified as we can.

Given the all-encompassing reach of technology we are also keeping a close eye on how other industries can potentially benefit from radical shifts in innovation. For example, the energy sector is adapting rapidly to meet the data centre cooling needs of firms that use AI in a more efficient and sustainable way, while real estate firms are increasingly using technology for data centre construction and management.

Are we in a new tech 'bubble'?

Not likely. Given the scale and growth of a handful of US technology companies, it's understandable why some will draw parallels to the Dotcom bubble of the late 1990s and its subsequent bursting in the early 2000s. However, we believe this comparison is not entirely relevant as the circumstances are very different.

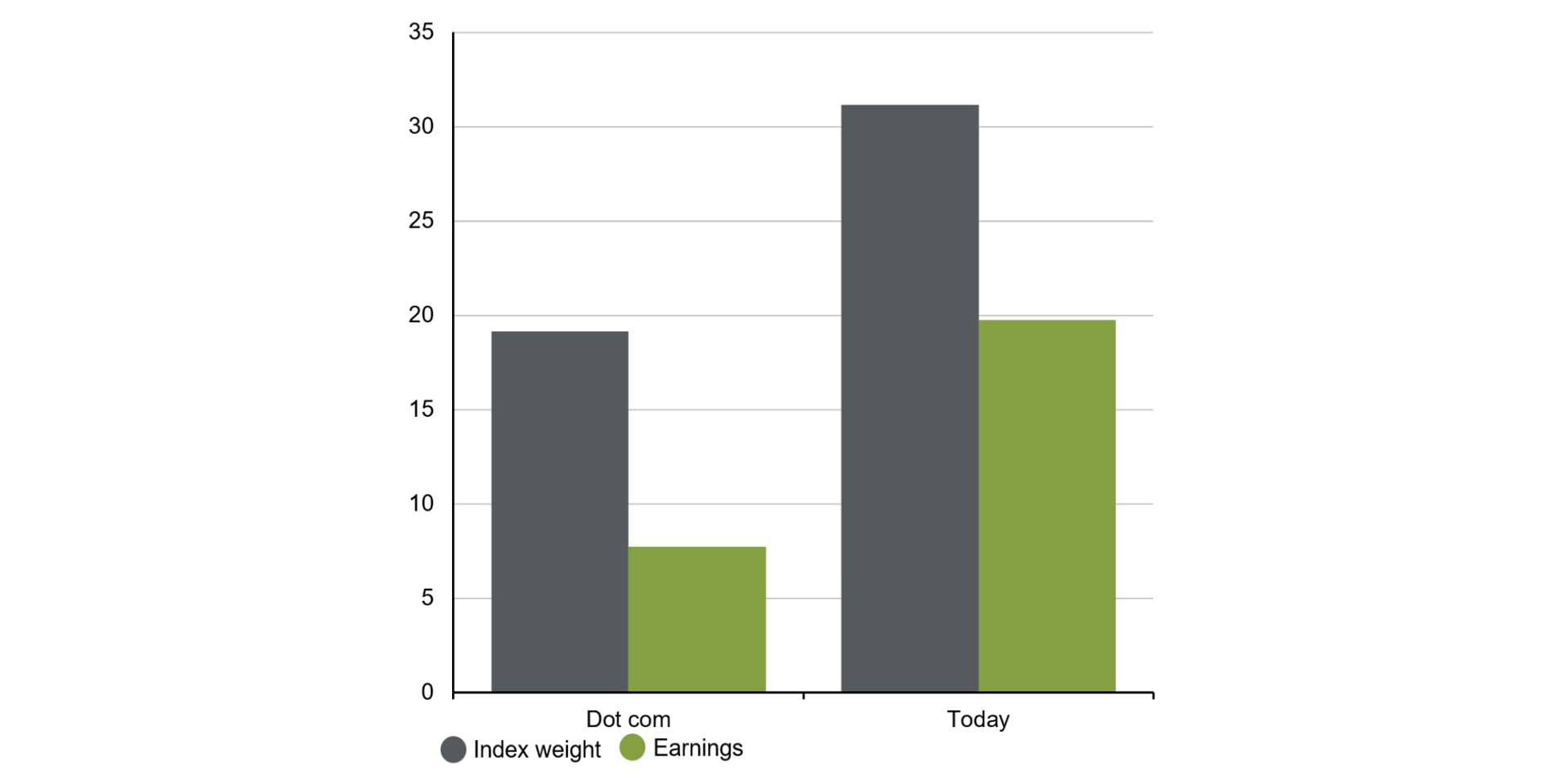

At that time, the top seven US companies (Microsoft, GE, Cisco, Walmart, Exxon, Intel, and Citigroup) had a much lower rate of growth. They were unlikely to ever deliver the kind of acceleration that we've seen from the likes of Alphabet, Nvidia or Meta, given the speed of innovation in recent years. While commentators were right about the vast potential of the internet to change how we live and spend money, that potential was not realised fully until years later. Today the sector has a greater level of maturity, with phenomenal growth and profitability. Developments in AI have been contributing to formidable company earnings, which was not the case before.

For Karen Ward, Chief Market Strategist for EMEA at J.P. Morgan Asset Management, it is comforting that today's technology companies are delivering these solid earnings, compared to the Dotcom boom.

She explained: "It’s not simply that we are excited about the technology that we hope one day will be monetised...the earnings of the magnificent seven are up 168% since 2019" (LSEG Datastream, J.P. Morgan Asset Management, 30 June 2024).

"That contrasts to what we saw in the early 2000s. Back then index concentration was also very high but actually they weren’t necessarily producing the earnings at the time."

Chart 2: 'Magnificent seven' % contribution to S&P 500 market cap and trailing earnings

Source: IBES, LSEG Datastream, S&P Global, J.P. Morgan Asset Management. Dot com represents the largest seven tech or tech-related firms in the S&P 500 by market cap, as of March 2000. We then show the same metrics for the ‘Today’ bars for the current largest seven tech or tech-related firms by market cap.

However, this does not mean investors should be complacent, and it would be unrealistic to assume these technology giants can continue to deliver record-breaking numbers perpetually. This is why Nutmeg is upfront about our principles of investing, including understanding the trade-off between risk and return and diversifying across different companies and sectors.

Conclusion

Equity investors can today, with relative ease, access technology companies at the forefront of our increasingly digital global economy. We believe that long-term investing can both harness the scale and growth of established names, while also embracing ever-evolving sub-sector themes that can help tomorrow's winners realise their potential.

Visit our dedicated webpage to see if Nutmeg Thematic investing portfolios could be suitable for you. If you need information about different investment products, you can book a free call with one of our experts to discuss your options.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not a reliable indicator of future performance. Thematic investing carries specific risks and is not for everyone. There is no guarantee that development of the trend will contribute to positive investment outcome. All Nutmeg themes, including Resource transformation, should not be considered as incorporating ESG considerations. We do not provide investment advice in this article. Always do your own research.