Geopolitical events have taken a turn for the worse recently, particularly given the conflict in the Middle East. However, when it comes to the global economy, from an investment perspective there are reasons to believe the time is right for a small global equity overweight (compared to long-term targets) in Nutmeg's managed portfolios. This includes the Fully managed, Socially responsible, and Thematic investing styles.

How have markets reacted to events in the Middle East?

Markets have understandably been volatile in recent weeks because of the conflict. At the close of October, global equities had fallen just over 8% in local currency terms since the end of July, their peak for the year so far. Higher crude oil prices were one cause of this decline. Indeed, before the onset of the Middle Eastern conflict, oil prices had fallen significantly, and equities had begun to recover.

Meanwhile, global investors continue to be nervous about risk assets, such as equities, with a major survey of portfolio managers showing high cash allocations*, which historically has preceded an equity rally. The thinking here is that portfolio managers have plenty of cash reserves to support a rally if it begins. So what are the prospects of a rise in equity markets?

From the start of the conflict on 7 October to the end of the month, equity markets fell 2.5%. The US dollar, which is normally finely tuned in reacting to global risk, has barely changed value in the same period.

Oil prices did initially respond by rising from $85 to $90 per barrel, but have since fallen back again due to other global factors, such as potential weakened demand in China.

Reasons for market optimism

Despite the caution exhibited in equity markets, there is growing evidence that the global manufacturing, investment and trade cycles may be turning positive, following improvements already recorded this year in household consumption. Let's look at the trends in more detail.

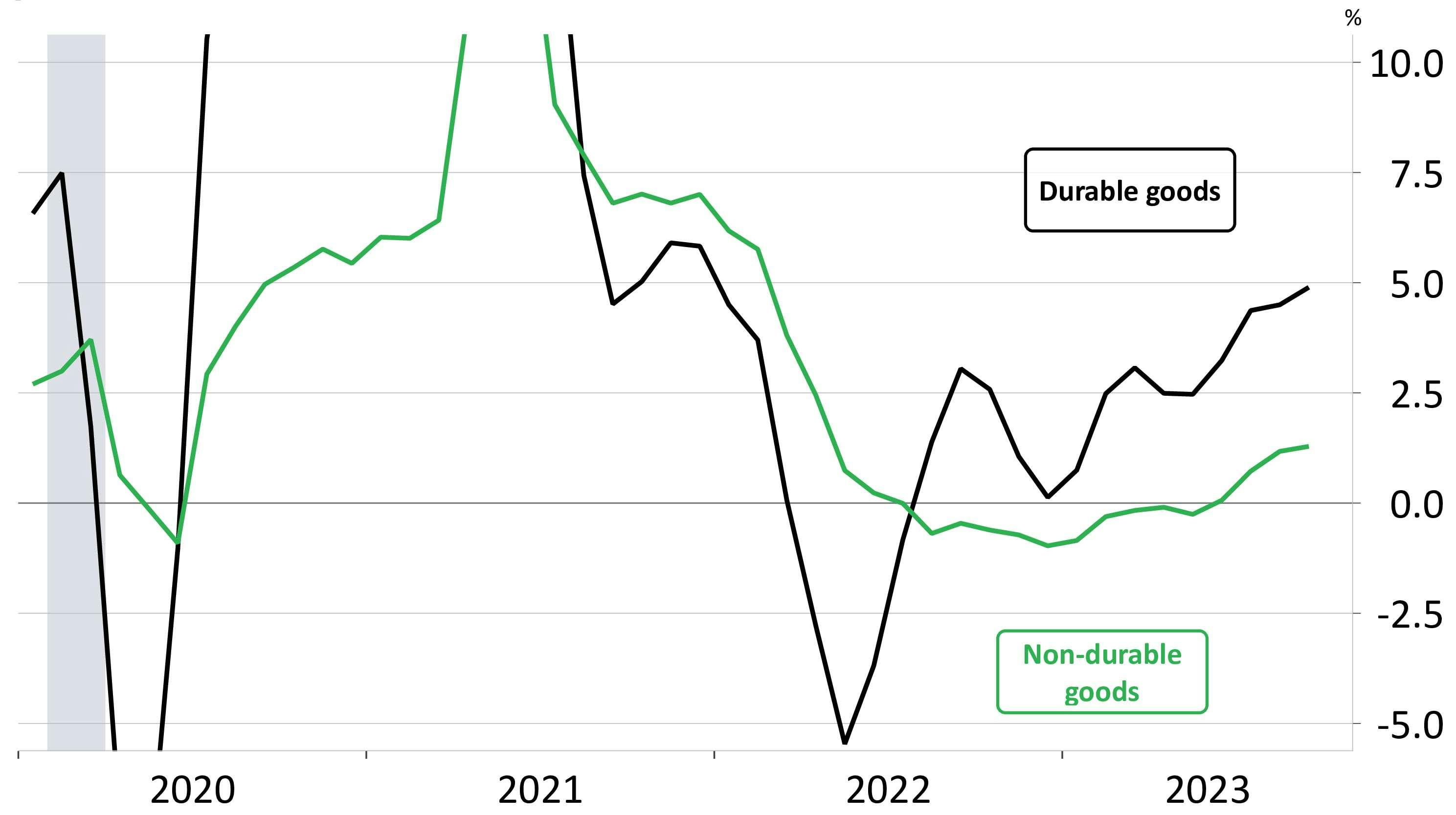

Chart 1: Personal consumption expenditure volumes 2020-23 %

Source: Nutmeg, Marcobond, 3-month average over-year-ago %, shaded area represents US recession

Chart 1 shows personal consumption expenditures (PCE), also known as consumer spending, which is a measure of the spending on goods and services, in this case by people in the US. The more people spend, the more this should benefit businesses and economies globally.

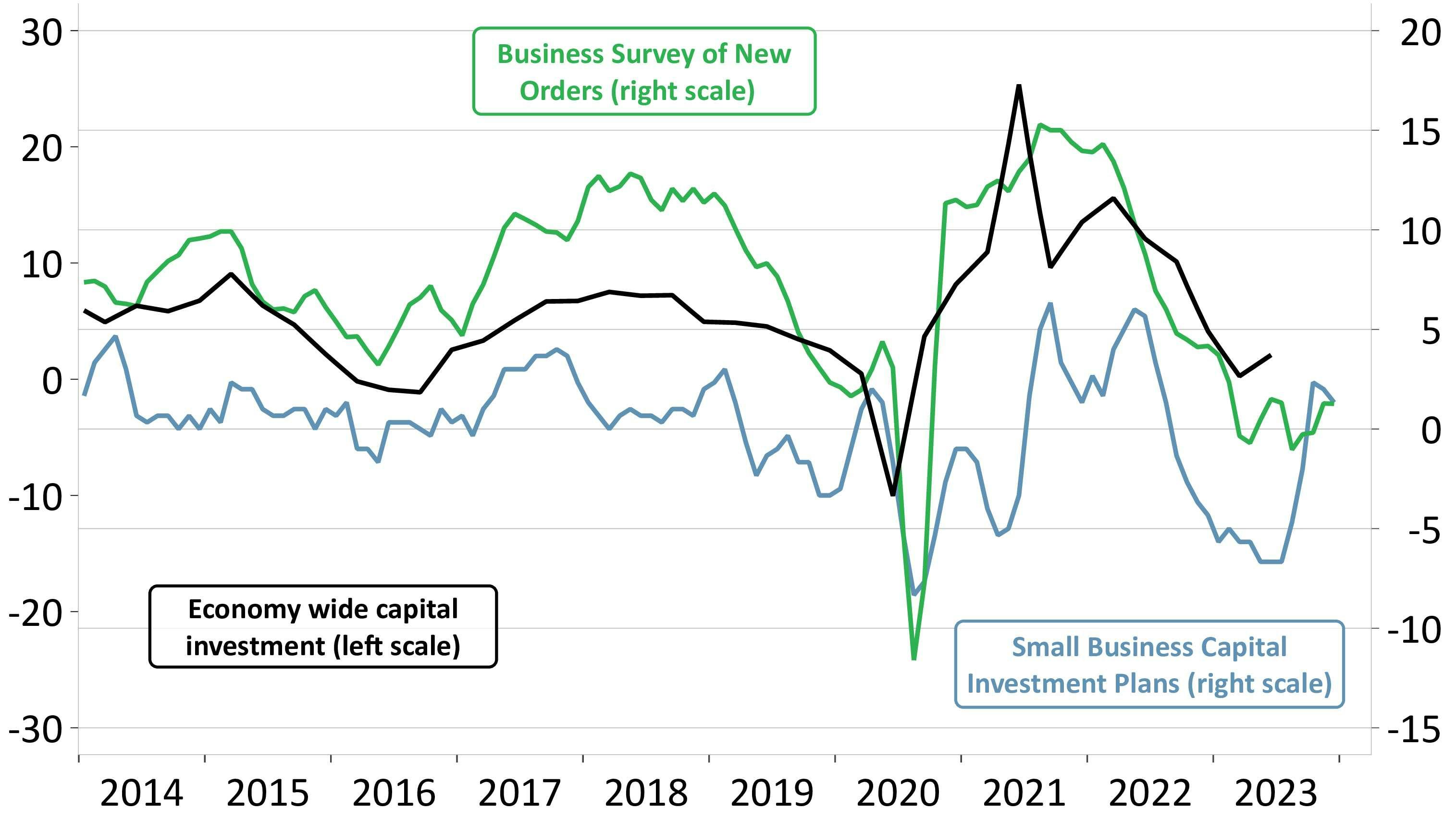

Chart 2: Capital expenditure 2014-23 %

Source: Nutmeg, Marcobond, over-year-ago %, change survey over last year, advanced 3 months

Chart 2 demonstrates that the fixed-capital investment cycle, which is spending on things needed to start and conduct business - such as buildings and equipment - is improving.

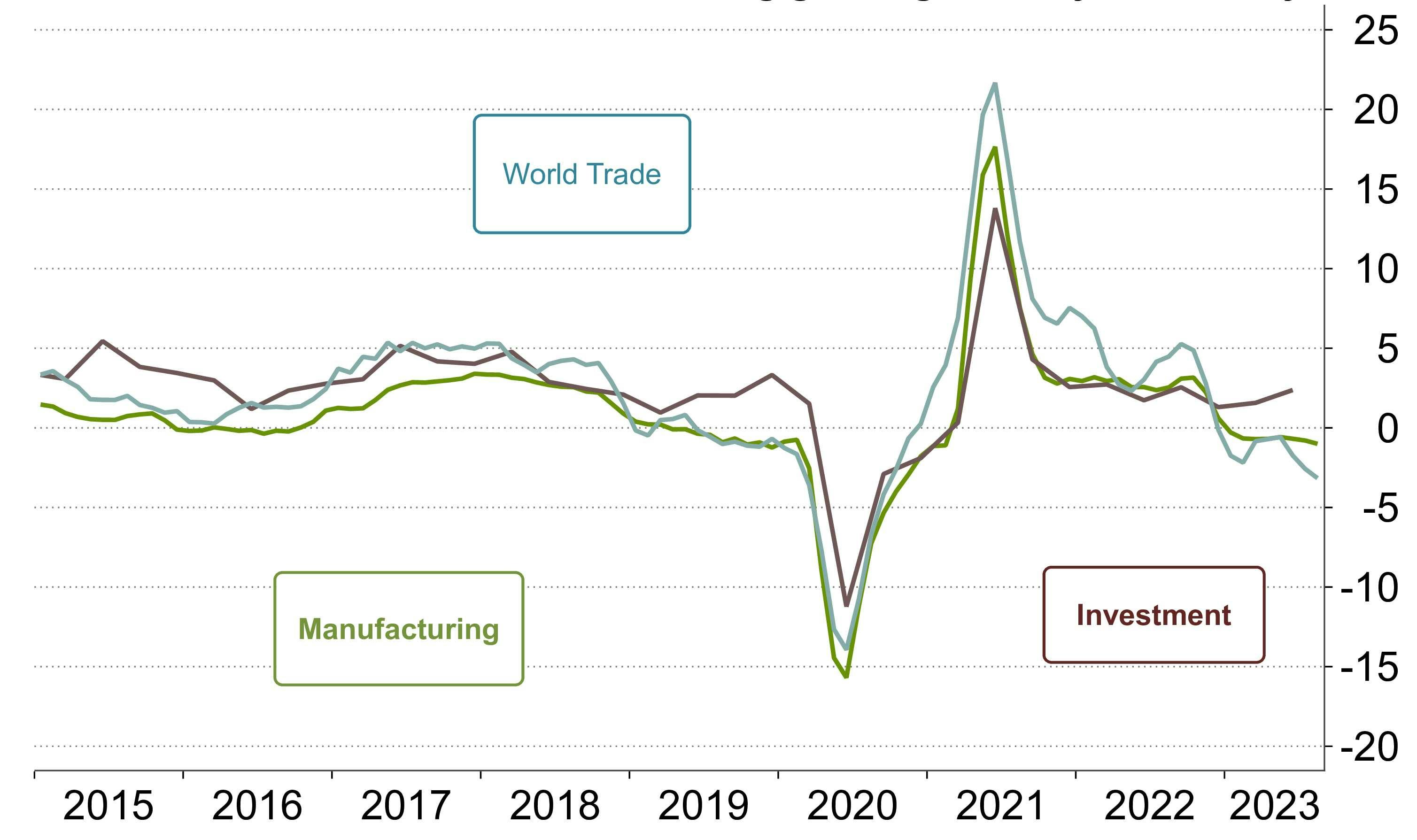

With this, we expect the manufacturing and global trade cycles to improve in the months ahead. This is because the trade, manufacturing and investment cycles all measure the same global growth dynamic (Chart 3). Note, the dramatic fall and spike in 2020-21 represents the profound impact of Covid-enforced lockdowns and reopening.

Chart 3: Measure of global growth dynamic 2015-23 %

Source: CPD, Nutmeg, Marcobond, over-year-ago %

Why improving global growth should be good for equities

It's still early days, but solid employment and soundness of private sector balance sheets suggest that a consumer recovery is under way in the US and UK. This should in turn sustain an improvement in global manufacturing, investment and trade.

It's clear that higher interest rates are a drag on growth, limiting the contribution expected from the home-building sector, for example, as the cost of borrowing rises. Even in housing though, the data has not weakened to the extent many had feared.

Another major sector of interest, especially when looking at the US, is automotives - car sales and manufacturing - which is performing better than might have been anticipated in a period of hiking interest rates. This is also due, in part, to the financial health of the private sector. But it’s also due to the slow but transformational switch to low-carbon engines.

2023 has been a year, like 2022, of shocks. It started with a bank panic that, thankfully, did not stretch beyond a few poorly managed banks. It has continued with the dreadful events in Israel and Gaza, as well as the ongoing conflict in Ukraine.

There are always geopolitical factors, but signs of a strengthening global production cycle should provide a positive backdrop for risk assets.

We will continue to monitor global events, including geopolitics, as well as the policy decisions made by central banks. But for now, a modest overweight in global equities is held in our Fully managed, Socially responsible, and Thematic investing portfolios.

Sources: *Global Fund Manager Survey, Band of America, 17th October 2023. Survey period 6 to 12 Oct 2023. A total of 295 panelists with $736bn AUM participated in the October survey.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance.