This year may well be defined by its elections, but how are investors impacted by who sits in 10 Downing Street or The White House?

At a glance:

- Elections are important dates in the geopolitical calendar, however there is no clear correlation between a governing party and market performance in the long term.

- Rather it is the changes in economic policy that governments introduce that can have a big impact on markets.

- Government spending pledges, and the direction of taxes, are key considerations for investors during election campaigns.

- Elections are just one of many events that impact financial markets in any given year. Market performance across equities, bonds, and currencies in the months following elections is not significantly different from the general volatility in these asset classes.

- In the UK, the Labour party is predicted to win the next general election. However, the high level of UK national debt means there's not much room for significant difference between the Conservatives and Labour on economic policy.

- It's a closer call in the US to pick a winner from the Democrats and Republicans, though both parties share similar economic policy.

With a UK general election announced for 4th July, and the US presidential election set for 5th November, political campaigning will dominate much of the second half of 2024. But what does this mean for investors?

Here we look at history to get an idea of how elections have impacted investment markets, as well as cover the specifics of what’s to come both in the UK and the US.

What do elections mean for investors?

It’s natural for investors to scrutinise the policies of the leading parties. Economic and foreign policy is central to election campaigns, and candidates regularly proclaim that their policies will drive market performance.

According to J.P. Morgan Asset Management’s Market Insights team, it's the fiscal promises of the successful party that are often key to how markets react, namely those related to government revenue and taxes.

An example is the tax cuts enacted by President Trump in 2017, which fuelled a strong rally in the stock market given the wave of earnings upgrades that followed. However, while big policy changes do temporarily move markets, there are not necessarily clear trends in market performance in the 12 months following an election versus non-election years, as we shall explore later.

As it stands, it will be difficult for any party to deliver new tax cuts or major spending programmes in the US or the UK, given how indebted both countries remain.

The team said: "With interest costs rising and deficits already more than 6% and 4% of GDP in the US and UK respectively, the economic differentiation between right- and left-leaning parties looks set to be smaller than normal.”

Can investors do anything to prepare for an election?

Not really. Recent years have proven how difficult it is to predict the outcomes of elections, particularly in the US.

Polling companies have been criticised for high-profile miscalculations, such as in 2016 when various headlines suggested that Democratic nominee Hillary Clinton had a 91% chance of beating the eventual winner, Republican Donald Trump.

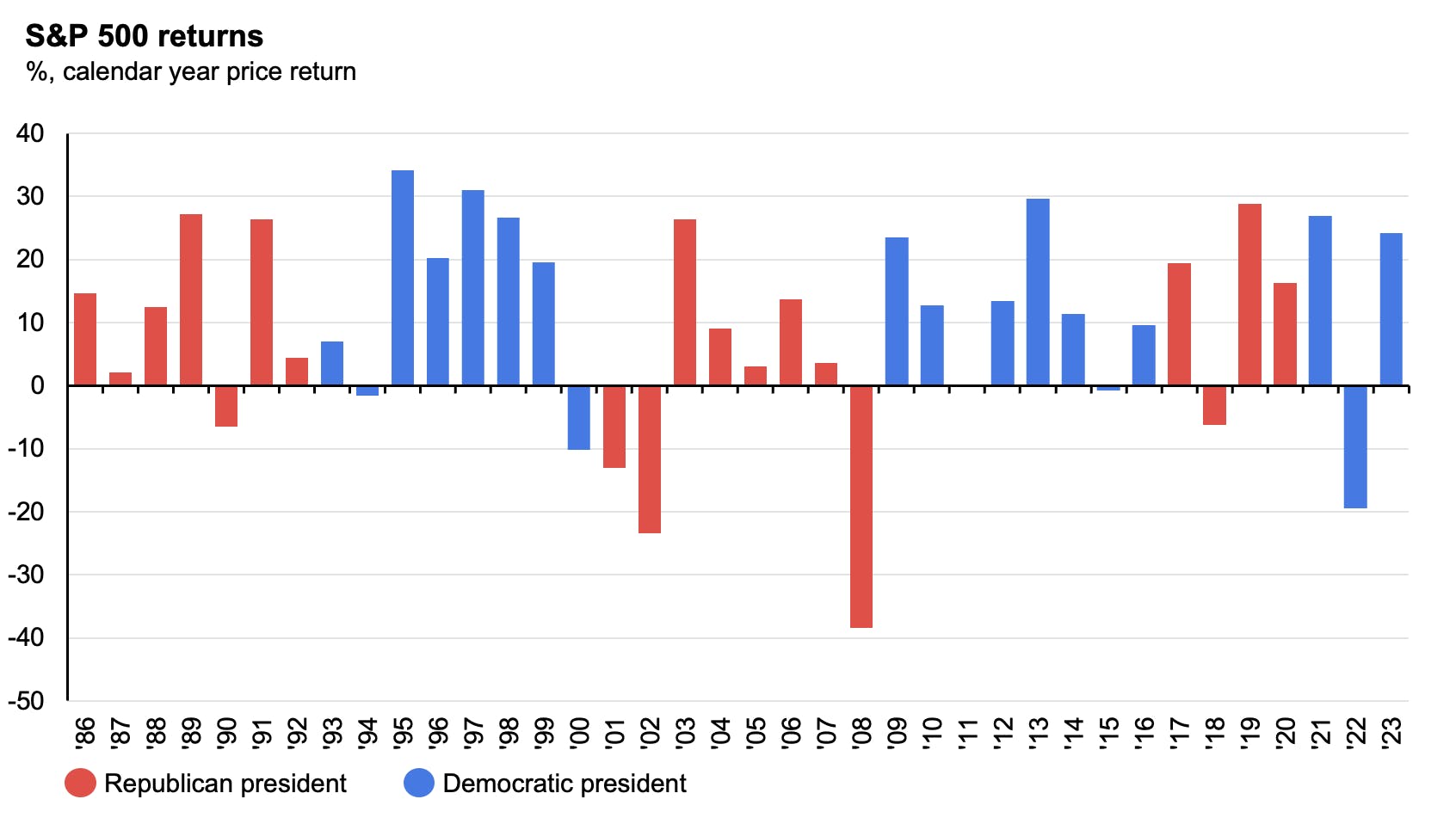

Even if we could predict an election result, who wins generally seems to have little overall impact on market performance, historically (Charts 1 and 2). While markets typically hate uncertainty and surprise, even a dramatic unexpected result is not going to necessarily have a negative impact.

For example, a predicted Wall Street sell-off failed to materialise after President Trump surprisingly won the US presidential election in 2016, with markets actually rising.

How do different election winners impact markets?

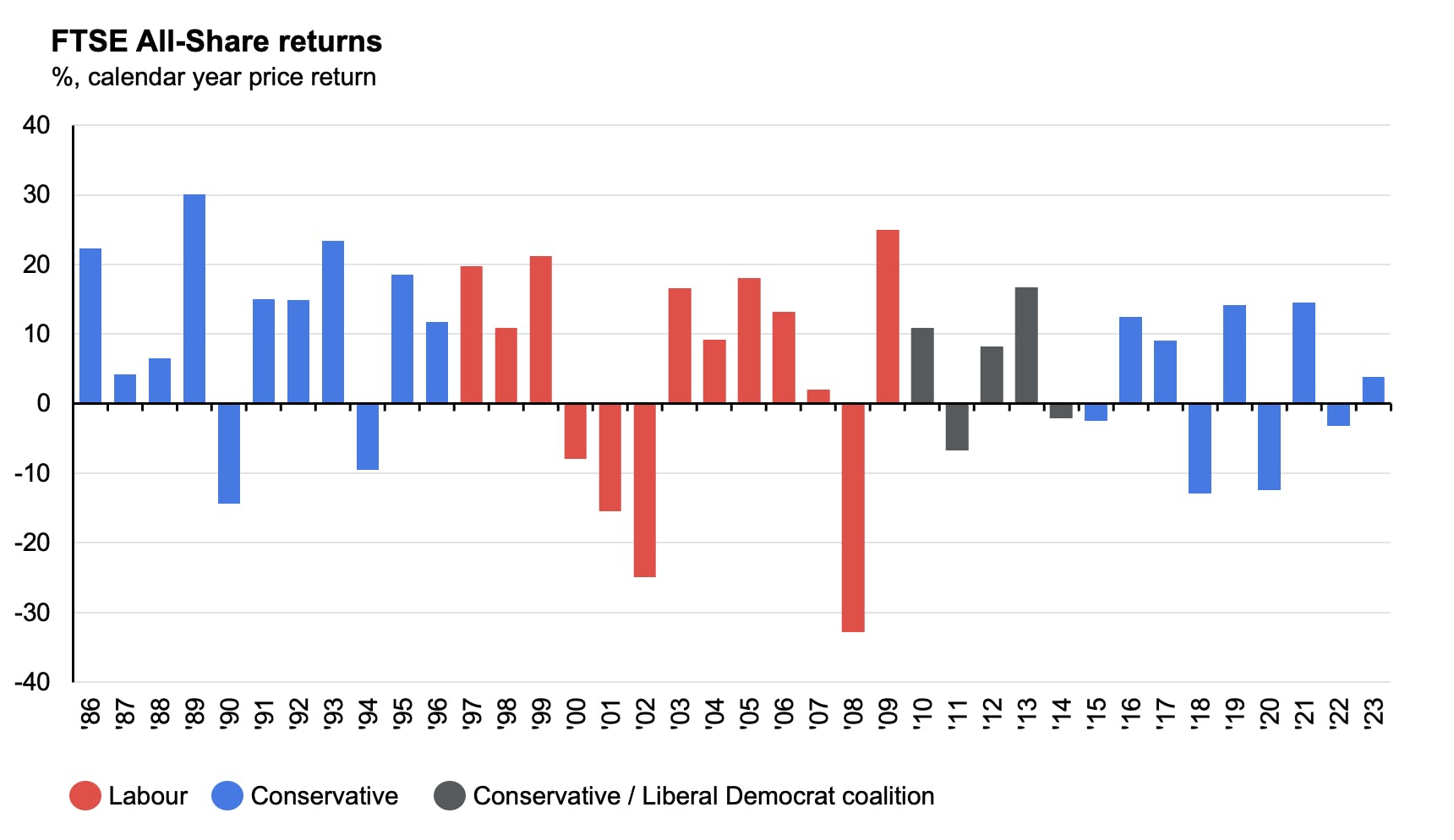

As mentioned, market data suggests that there are no clear patterns or relationships between who is in power and market performance - neither in the UK nor the US.

Rather, it is key events in the economy – such as the global financial crisis of 2007-08 – that tend to have more of an impact on the average returns under different governments than the governments do themselves.

This is illustrated in the charts below from the performance of both the S&P 500 in the US and the FTSE All-Share in the UK.

The shading represents who was in power for the majority of each year – Republican or Democrat in the US, and Labour or Conservative (or in one case a Conservative/Liberal Democrat coalition) in the UK. No major party can claim to have had that much of a sway in market performance, beyond external economic events.

Chart 1: US equities returns 1986-2023 (%)

Source: LSEG Datastream, S&P Global, J.P. Morgan Asset Management - Market Insights. Chart shading represents which party's president was in power for the majority of each year. Data as of 15 May 2024.

Chart 2: UK equities returns 1986-2023 (%)

Source: FTSE, LSEG Datastream, J.P. Morgan Asset Management - Market Insights. Chart shading represents which party was in power for the majority of each year. Data as of 15 May 2024.

How do markets perform during election years?

Just as it is difficult making assumptions about different election winners' impact on markets, it is also hard to draw clear conclusions about how elections themselves will benefit or hinder investors.

At any point in time, both equity and bond markets will be preoccupied with a myriad of global influences that will span much further than the politics of one single country. However, there is still value in looking at the average total equity returns, bond yields, and currency performance in the year following an election. It is also worth comparing this with the longer-term performance and volatility of these asset classes.

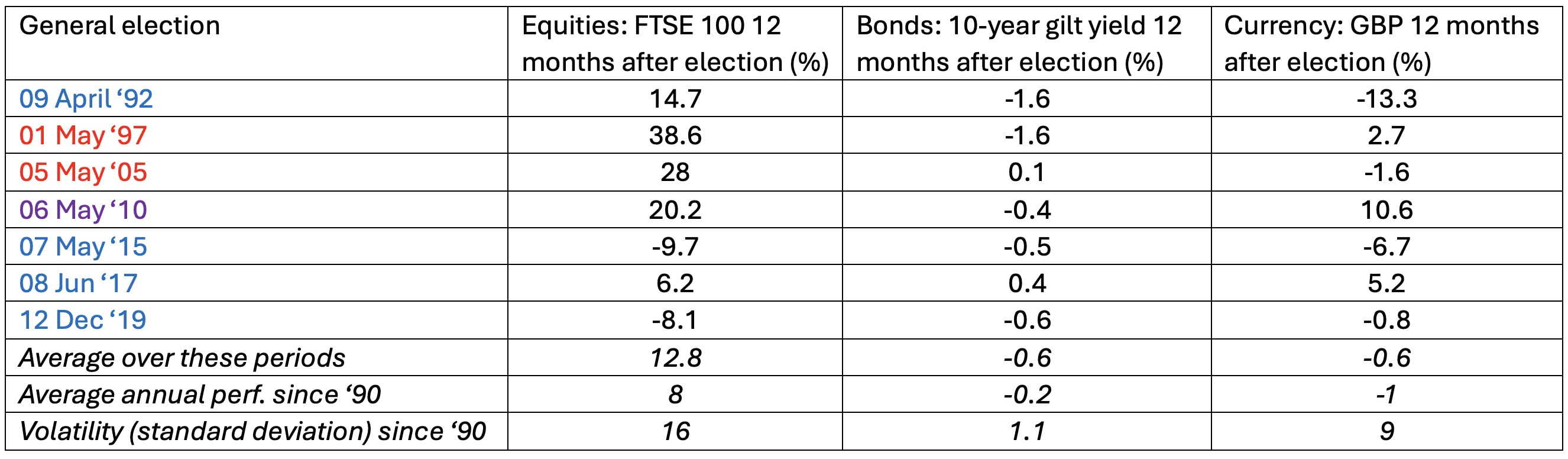

How have UK markets performed during election years?

Table 1: Markets' performance following last seven general elections (since 1990)

Source: Nutmeg, Macrobond. Winners: Conservative in blue, Labour in red, Conservative-led coalition in purple

Table 1 shows the performance of the UK's main equity index, the FTSE 100, in the 12 months after the seven general elections since the turn of the '90s. This is compared with performance of 10-year gilt yields - a good measure of investor confidence - and pound sterling (measured against the dollar), again in the 12 months after an election.

Key findings:

- The average total equity return for the FTSE 100 in the 12 months following an election was 12.8%. This is higher than the 8% average annual growth of the index in the 34 years since 1990. This may be explained by new governments trying to 'front-load' popular policies to take advantage of whatever honeymoon period they enjoy. However, Nutmeg data also shows that markets since 1990 have been quite volatile - measured as a standard deviation of 16% across election and non-election years - so it's hard to draw any solid conclusions about overall performance with other factors likely moving markets.

- Ten-year UK government gilt yields fell 0.6% on average after elections, compared to an average annual fall of 0.2% across the whole period. The Nutmeg investment team does not see this as overly significant in the context of average annual volatility in yields since 1990, which was 1.1%.

- Pound sterling fell on average 0.6% after elections, versus the dollar. The average decline in the UK currency over the 34 years has been around 1% per year, so again there is not a significant trend at show here. While it's tempting to look for trends in instances of a change in government versus a continuation of the same government, as we saw in Chart 2 who is in power ultimately is secondary to other economic and market factors.

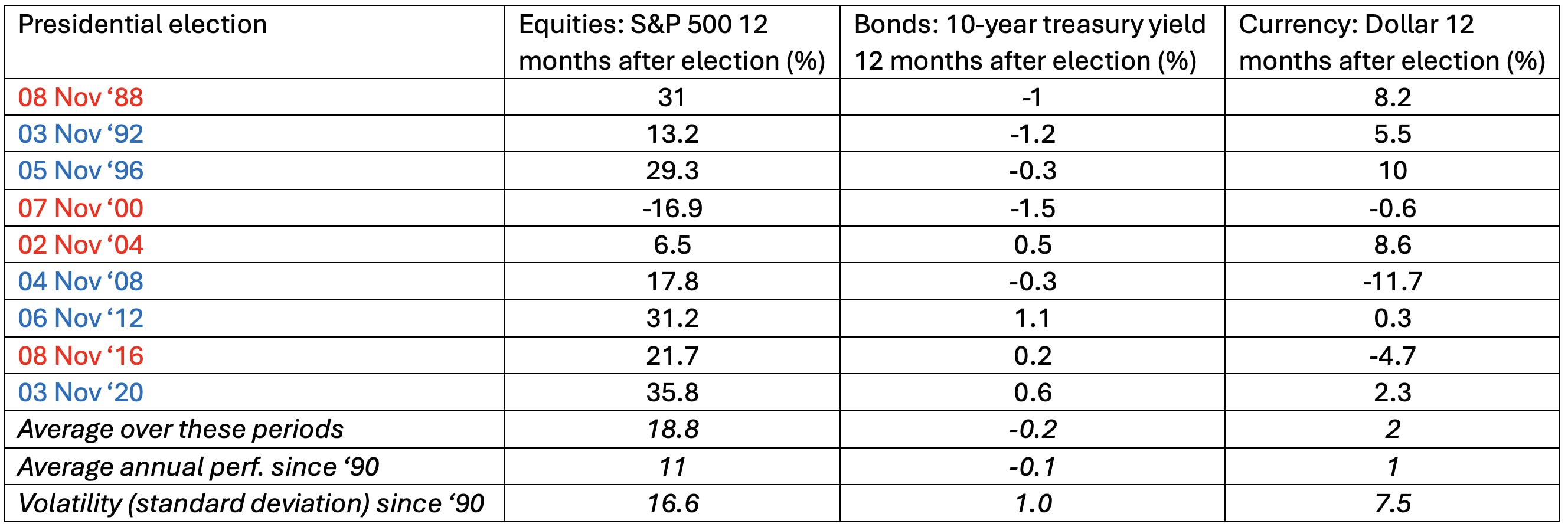

How have US markets performed during election years?

Table 2: Markets' performance following last nine presidential elections (since 1990)

Source: Nutmeg, Macrobond. Winners: Republican in red, Democrat in blue

How about in the US? How have markets been impacted by presidential elections there? We've carried out similar analysis as we did in the UK, though using the S&P 500 as the main equity index, alongside 10-year treasury yields, and the dollar (measured against a basket of major currencies).

Key findings:

- The average total equity return of the S&P 500 in the 12 months following an election was 18.8%, which compares well with the 11% average annual return over the 35 years since Ronald Reagan was president. Again, it's worth noting that markets have been quite volatile since 1990 in election and non-election years - with average annual volatility at 16.6% - which puts these double-digit returns in context.

- Ten-year treasury yields fell on average 0.2%, only slightly above the all-period average annual change of a 0.1% fall. Given the average volatility of annual changes is 1%, the difference is not significant.

- The dollar appreciated by twice as much after elections. But even this 2% versus 1% difference is insignificant compared to the 7.5% average annual volatility of the currency.

Our investment team's analysis suggests there's no clear evidence of elections having a significant impact on markets. Elections are one of many events that impact economies and financial markets, so it is no surprise to find that market performance in the wake of elections is not significantly different from the general volatility in these asset classes. However, as discussed earlier, we should also keep in mind that some of the key market events have happened during election years - such as the financial crisis in 2008, and the Covid outbreak in 2020.

Who is likely to win the UK general election?

Current polling from the Electoral Calculus, as at 21st May, suggests that Labour will win with a majority of 308 seats. While history has taught us that it's unwise to make assumptions about potential changes to government, it does appear that the UK could have a new Prime Minister in Keir Starmer by the end of the year.

What would a Labour government mean for the UK economy?

Labour is due to outline how it intends to re-align public spending. Given the UK's indebtedness the independent think tank, the Institute of Fiscal Studies, has warned that whichever party wins the election they may have to raise taxes or cut spending.

Among the Labour party’s policies is a new fiscal lock that guarantees permanent government tax and spending changes will be subject to an independent forecast.

The idea behind this is to avoid the repeat of the scenario of the Truss/Kwarteng mini-budget of 2022, when plans for unfunded tax cuts triggered a UK economic crisis. The announcement led to a dramatic rise in UK government gilt yields, accompanied by a fall in sterling to its lowest value against the dollar since 1985.

Labour has also promised to set up a new publicly owned British energy company, drawing on renewable sources, though what this would mean in practice – and the consequences for FTSE 100-listed energy giants – is yet to be determined.

What would a Conservative government mean for the UK economy?

Rishi Sunak’s recent speech warning of “dangerous years” ahead for the UK and promises of “more change in the next five years than in the last 30”, suggests a Conservative government looking to highlight challenges ahead.

Among the party's promises is a new 'triple lock' on the pension allowance. This would mean a pensioner's allowance would rise in line with either average earnings, inflation, or by 2.5% - whichever is higher - from next April. An initiative to boost economic growth is the creation of 100,000 more high-skilled apprenticeships by 2029.

At the start of 2023, the Prime Minister made five promises that he hoped would give the British public “peace of mind”. A pledge to halve inflation has seemingly come good with the Consumer Prices Index at 2.3% in the year to April 2024, compared to more than 10% at the start of 2023. His efforts to grow the economy are more difficult to gauge, though ONS figures show the UK has now officially exited recession with GDP growth of 0.6% in the first quarter of 2024.

A third economic promise to reduce national debt still needs work – in the year to March, the Government borrowed a mammoth £120.7bn. While it was lower than the previous year, it was £6.6bn more than had been predicted.

Who is likely to win the US presidential election?

It’s a close call. As at 14th May, polls suggested it is a neck-and-neck contest between President Joe Biden of the Democrats and former President Donald Trump, the Republican nominee. Trump’s early lead in the polling has been eroded since the end of January, according to RealClearPolitics’ poll tracker.

As of 31st May, Trump was at 47.6% of the vote, with Biden at 46.7%. However, as in previous elections much will depend on the results in key swing states, while it also remains to be seen how Trump's recent criminal conviction, and any appeal he may raise, will impact his chances.

How will the Democrats and Republicans differ on economic policy?

While the two major parties may disagree on some key areas, such as climate action, the war in Ukraine and the US’ relationship with its allies, they do share a similar stance when it comes to the economy. Both, for example, have shown a commitment to protect domestic manufacturing and grow the strategic rivalry with China. This is often referred to as protectionism.

J.P. Morgan Asset Management’s Market Insights team point to major fiscal packages already in place under the Biden administration, including the Inflation Reduction Act and the CHIPS and Science Act, which both aim to protect US industry and jobs via the use of subsidies and tax credits. Moreover, both parties have indicated a willingness to ramp up protectionist measures through the use of tariffs.

The Market Insights team said: “Recently, Biden has called for a tripling of tariffs on Chinese steel and aluminium exports. Trump, meanwhile, has suggested that if he were to be elected, he would implement a 60% tariff on Chinese goods entering the US, and an across-the-board levy of 10% on products from the rest of the world. While a boost to US competitiveness may appeal to many, it could also come at a cost to American consumers.”

However, the team has also suggested that the country’s large national debt may weigh on either party's ambitions to deliver further tax cuts or major spending programmes.

“With the US fiscal deficit already exceeding 6% of GDP at a time of record low unemployment, closing the deficit would typically be a top policy priority. Whether or not this happens remains to be seen."

"A decision to expand the fiscal deficit from either side would risk an unfavourable market reaction, particularly in the bond market. The latest forecasts from the Congressional Budget Office (CBO) already suggest that the fiscal deficit in the US could remain elevated at 6% of GDP in 2034, while debt could reach 116% of GDP.”

Why the positioning of Nutmeg portfolios is not changing

Political risk is just one of several factors that the Nutmeg investment team take into consideration in running our globally diversified multi-asset portfolios over a long-term period. The approach is to weigh the different risks against each other, and determine how each could impact our investors.

Given the recent history of pre-election polls continuing to misread the mood of the voting public on election day, our team will not make firm investment decisions on outcomes that are unknowable.

Despite uncertainty about who will be steering the UK and US economies going into 2025, equities have largely had a strong year so far in 2024, and the team remains overweight risk assets - that is equities - with the expectation of modest global economic growth.

While pre-election campaigning can create much excitement and market noise, long-term investors are advised to sit tight so long as the risk-profile of your portfolio remains in line with your objectives. Timing the market is not advisable given how political risk can throw up so many unexpected outcomes.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance.