We take a look at the latest round of corporate reporting, what kind of picture it paints for investors, and dive into why earnings season matters so much in the first place.

At a glance:

- Earnings season is one of the many indicators of corporate and economic health that our investment team uses to inform the allocation of assets in Nutmeg portfolios

- Earnings season occurs four times a year and offers a glimpse behind the scenes of publicly listed companies

- Most companies performed better than expected this quarter

- Q3 earnings season saw a more optimistic take on future earnings growth from professional analysts

Listed company profits are the bedrock of global equity markets. As US companies represent 70% of advanced country equities, quarterly US company profit reporting or “earnings season” is the centrepiece of this. That said, listed firms across the UK, Europe and other major markets generally release earnings at the same time.

What happened in the Q3 2024 earnings season?

The Q3 earnings season was, overall, positive. Most S&P 500 companies that reported beat consensus analyst estimates (explained below).

Analyst expectations are important, because the trajectory of earnings in the future can be different from today. A company could have endured a difficult period, but prospects for future earnings releases might look more positive. Similarly, a company might have produced a long string of strong earnings at a pace investors may feel they cannot sustain.

Let us explain what that means.

Expectations of future earnings growth improved with Q3 results

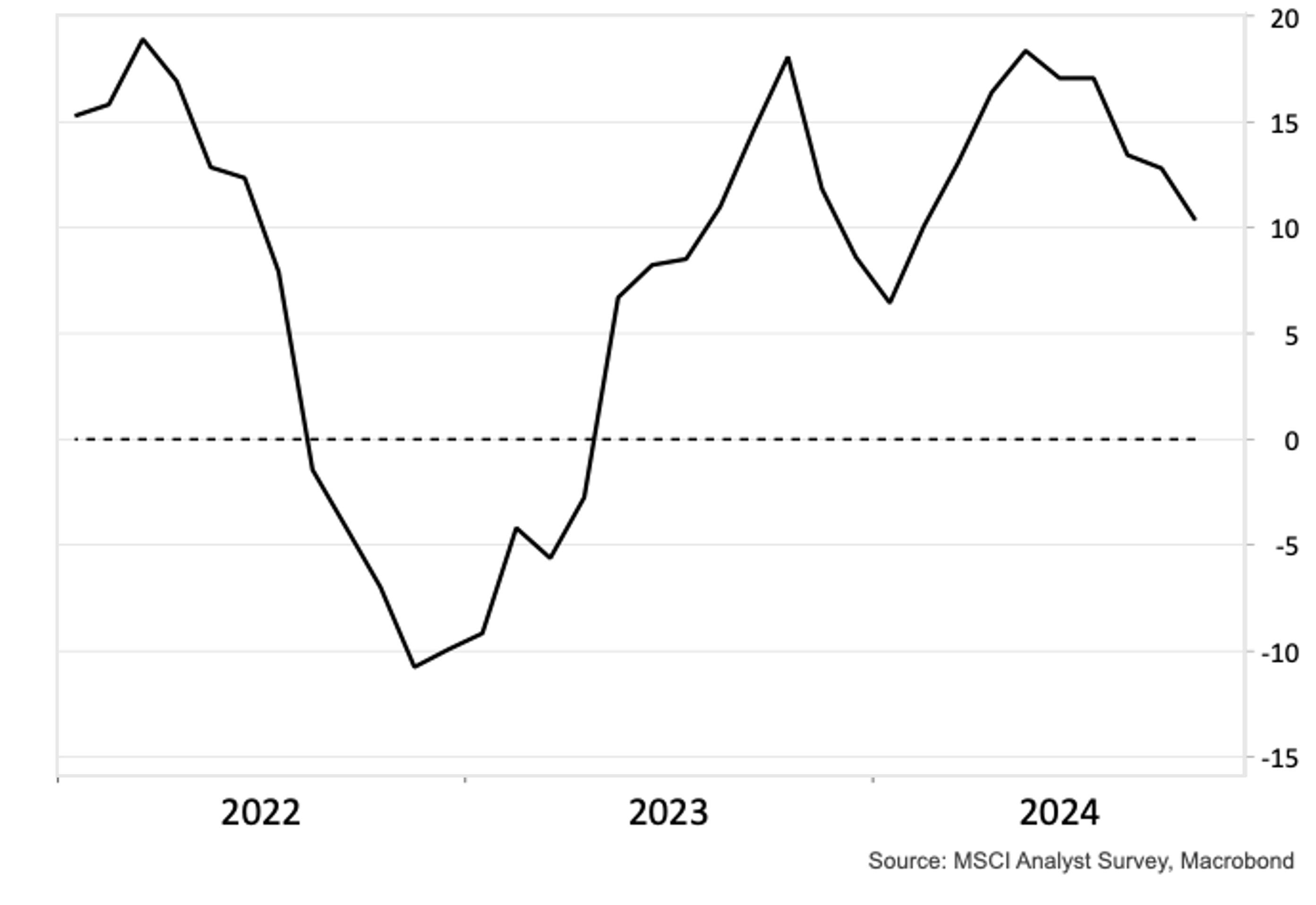

The first chart (US Profit Chart) shows expectations for profit growth looking one year ahead, based on analyst forecasts made from 2022 to October 2024. Expectations going into Q3 results had been for 10% growth in the next year.

Chart 1: Expected US-listed company profit growth in one year's time

Source: Nutmeg, MacroBond, MSCI Analyst forecasts. Data to end October 2024.

As you can also see from the chart, expectations for future growth had been trending downwards for most of 2024. Analysts had been getting progressively less optimistic about what companies would earn.

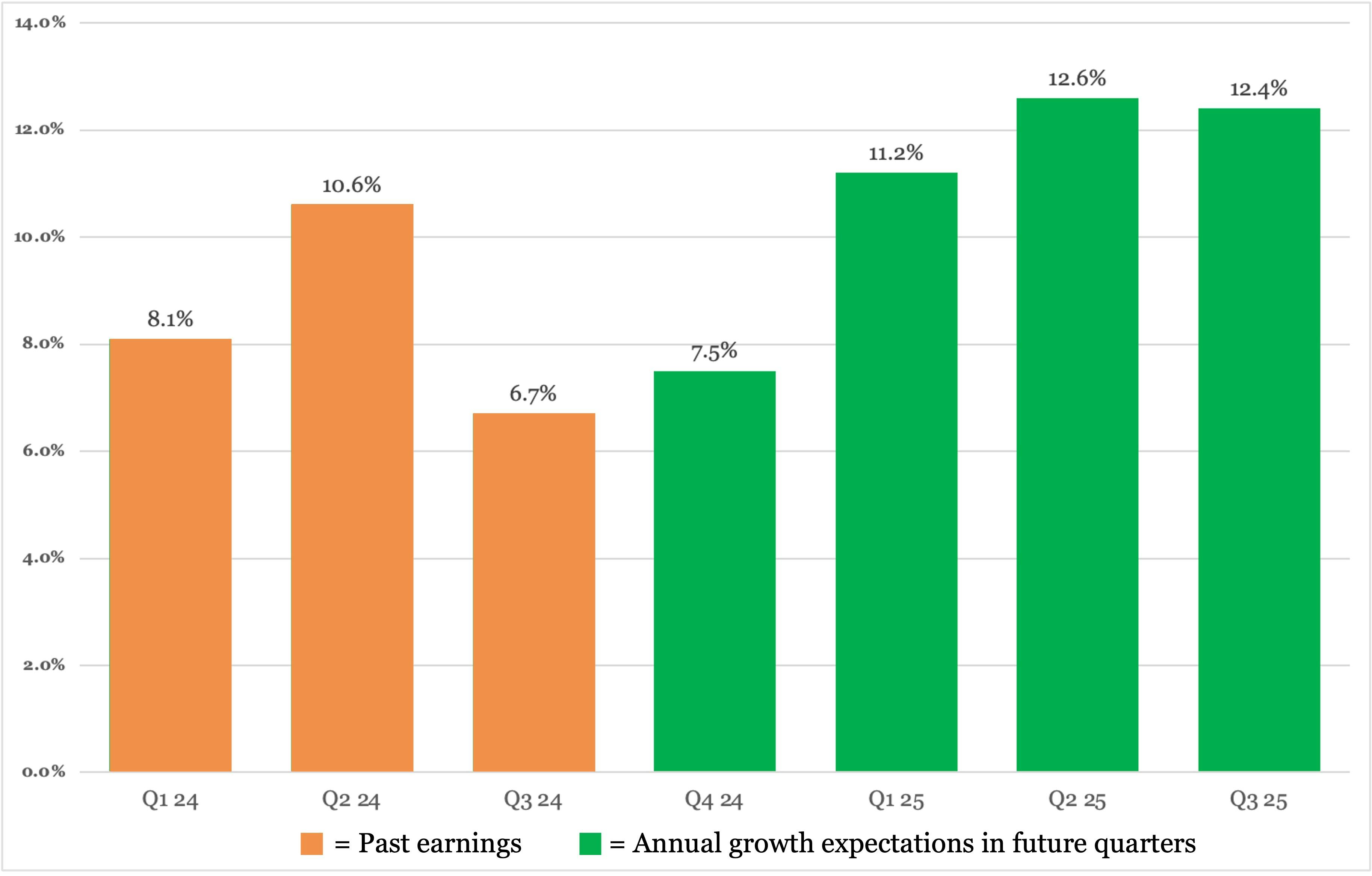

The second chart shows the impact of the most recent reporting season (Q3). It shows that many of these same analysts are re-thinking the profit outlook.

They now expect it will grow faster - around 12%.

Chart 2: Annual growth expectations in future quarters

Source: Nutmeg, MacroBond, November 2024

Earnings results were supportive for equity markets during the bulk of the reporting period (throughout October to 3rd of November) in advance of the election, before the result helped push US equity markets to new highs.

But how and why do earnings actually make a difference to markets?

What are earnings?

The strength of corporate earnings is an important indicator of company health, or of corporate health overall.

Equity earnings are very closely watched by investment professionals for good reason. Long-term, equity earnings growth tends to correlate strongly with positive equity market returns.

What is earnings season?

Earnings season refers to the times of year that many listed companies update the market on how they are performing. It usually spans a couple of weeks after quarter's end, falling in January (covering Q4 previous year), April (covering Q1), July (covering Q2) and October (covering Q3). Because US companies represent such a large portion of developed equity markets, what happens in US earnings influences global markets a lot. That said, firms across the UK, Europe and other major markets, generally release earnings at the same time.

Earnings season provides a window for investors to see how a company is performing. The information they learn can cause big moves in share prices, especially if investors are surprised by the figures.

Most companies that are traded on stock exchanges are required to report earnings on a regular basis, as a condition of listing. Usually, stock exchange rules state that companies must report earnings at least annually. In reality it would be quite unusual for a company to report less frequently than every six months. Quarterly reporting is very common, even if it is just a pared back summary of important events called an interim management statement (IMS).

Why is earnings season important?

Earnings season is when analysts and other investors can update their valuations and expectations for the companies they follow using the most up-to-date information. It’s therefore no exaggeration to say earnings season is fundamental to the creation of efficiently functioning financial markets.

Earnings season is important for individual companies, but it can also move the share prices of companies in the same (even similar/related) sectors, if they face similar challenges.

Take for example, the so-called “Magnificent 7” stocks: Apple, Amazon, Meta, Alphabet (Google), Microsoft, Nvidia and Tesla. It is not unusual that when one or more of these companies faces difficulties, the market infers that it will affect some – or all – of the others. For example, if Nvidia hypothetically were to face supply chain issues in sourcing semiconductor components, Microsoft and Google would likely face the same issues as they also use semiconductors in their AI applications (example is illustrative only).

How does earnings season actually move markets?

Analysts in the investment industry spend a lot of time trying to work out what companies – and therefore their shares – are worth. Usually, analysts will specialise in a specific sector and research all the companies in it.

Ahead of an earnings report, analysts will make their own estimates of how a company is performing and input them into “models”.

Analyst models are detailed spreadsheets that break down company reports and track key numbers to determine what they think the company is worth. Analysts will use past information, updates from the company itself (and any guidance it gives), as well as their own forecasts to build a picture of whether company earnings will grow or shrink, and how fast.

If the analyst thinks the company share price does not reflect enough earnings growth, they may issue a “buy” rating on a stock. Similarly if they think the company share price looks too optimistic on earnings growth they might issue a “sell” recommendation.

If company earnings come as a big surprise to analysts, it can trigger buying or selling activity that can move markets.

What is “consensus” and why does it matter?

Consensus is an average of what analysts expect for a company’s earnings report. If the actual earnings reported by a company are better in one or more important ways from consensus, the share price will often rise. The opposite is true if the earnings surprise is a bad one.

What are bellwether companies?

Bellwether companies are those that are believed to reflect the fortunes of a market or a market segment. If a bellwether company releases positive results, investors might also anticipate better news elsewhere, and vice-versa. An example might be a company that produces construction equipment being used as a bellwether because its products are so important to the development of new building projects. One company that has been perceived as a bellwether is Caterpillar, with which you might be familiar through its manufacture of heavy construction vehicles and machines.

Earnings season and investment decisions

Earnings are vital to creating accurate valuations, and for investors to understand how a company is performing. More regular reporting has been shown to improve accuracy of valuations by analysts. In fact, when rule changes in the UK allowed companies to report less often, the vast majority continued to produce reports quarterly. That said, one of the most important elements of regular earnings reporting is to create a detailed picture of how a company is performing over time.

Earnings seasons can impact markets in the short term, but it is in this longer-term picture that the value really lies.

The brighter tone of the latest earnings season helps to reinforce our investment team's decision to hold more equities than our benchmark. We will however continue to keep an eye on earnings – among many other indicators of corporate and economic health – should this position change.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance. We do not provide investment advice in this article. Always do your own research.