We explore the recent volatility in global equity markets, how the Nutmeg team is reacting, and how to avoid the temptation to make any rash decisions.

Financial markets are experiencing a period of pronounced volatility in early August. Global equity markets have fallen sharply, while bond markets have delivered gains. Concerns about the health of the US economy, coupled with an unexpected interest rate rise in Japan, have unnerved investors. We explain what causes a market correction and what you can do to help protect your portfolio and stay on track to reach your financial goals.

What is a market correction?

A market correction is a fall in financial markets of more than 10% from its most recent peak, but can also be used to describe a short, sharp fall in the value of an asset. That may sound disconcerting, but market corrections are more common than you might think. The following chart demonstrates just how often these corrections can occur.

Here, the green bars represent the calendar year return for large cap US equities historically (using the S&P 500 index). The orange dots represent the maximum decline from the peak experienced in the market that year. In other words, investors have faced US stock market losses every year since 2000, and have faced periods of losses in even the best performing years.

Chart 1: S&P 500 Calendar Year Returns vs Intra-year Declines

Source: Macrobond, Nutmeg. Net total returns in USD, 31st Dec 1999 - 31st Dec 2023. These figures refer to past performance, which is not a reliable indicator of future performance.

What’s happening to cause this market dynamic?

Market corrections can be triggered by quick changes in data that give rise to investors questioning their current positions. The end of July saw two important examples that have led to recent market volatility.

Firstly, the Bank of Japan surprised many investors by raising interest rates to 0.25%. While a relatively small increase from 0.10%, and still low in comparison to many western banks, this has helped to strengthen the Japanese Yen which until mid-July had sat at its weakest level versus the US dollar since 1986. A weakened Yen had attracted foreign borrowers and been a source of strength for the Japanese stock market, making it cheaper for foreign companies to buy Japanese goods. Investors are now questioning how a stronger Japanese Yen will impact them.

Secondly, the US Federal Reserve last gave its perspective on the US economy on the 31st of July, indicating that reductions in interest rates could wait until at least September. Yet the release of disappointing employment and manufacturing surveys in the first days of August have led some investors to question whether the Federal Reserve is being too patient in cutting interest rates, fearing early indicators of a recession.

In addition to lingering tensions in the Middle East, these factors have combined to unnerve investors in recent days.

How is the Nutmeg investment team reacting?

Current market conditions feel unsettling because we stand in the eye of a storm. Global stock markets are rattled because of geopolitical and economic uncertainty – and if there’s one thing that markets hate, it’s uncertainty. As ever, the Nutmeg investment team is focused on proactively managing your investments through:

Focusing on the fundamentals. Recent macroeconomic data for the US has certainly disappointed against expectations, but this is not the full story. As part of our monthly investment management cycle, we sat down to review the health of the US economy last week, and what we found reassured us. The US consumer remains strong, company earnings have been robust, and despite weakness in recent employment readings, unemployment remains at historically low levels. In our opinion, near-term recession fears are overstated.

Staying focused on developments. Financial markets move faster than economic or policy changes – in both directions. So on behalf of our customers we continue to focus on events as they evolve. While our investment team continuously monitors markets and portfolios, and are active in our decision making, we don't base our analysis solely on short-term market movements, but rather longer term macroeconomic frameworks.

Focusing on diversification. We diversify and spread the risk of your portfolio across thousands of underlying securities across the globe in various currencies and industries. While we focus on medium to long-term investment outcomes, we monitor portfolios on a daily basis and stand ready to modify our portfolios as the fundamental picture evolves.

In times of volatility, remember to control your emotions and filter out the noise

Short-term losses can be emotional – no one likes to see their portfolio go down in value. However, keeping your investments in one place and resisting the temptation to tinker with your strategy or risk levels can pay off in the long run. Remember that greater risk usually equals greater returns in the long run, and if you stay diversified you will be well placed if any particular asset falls in value temporarily due to a market correction.

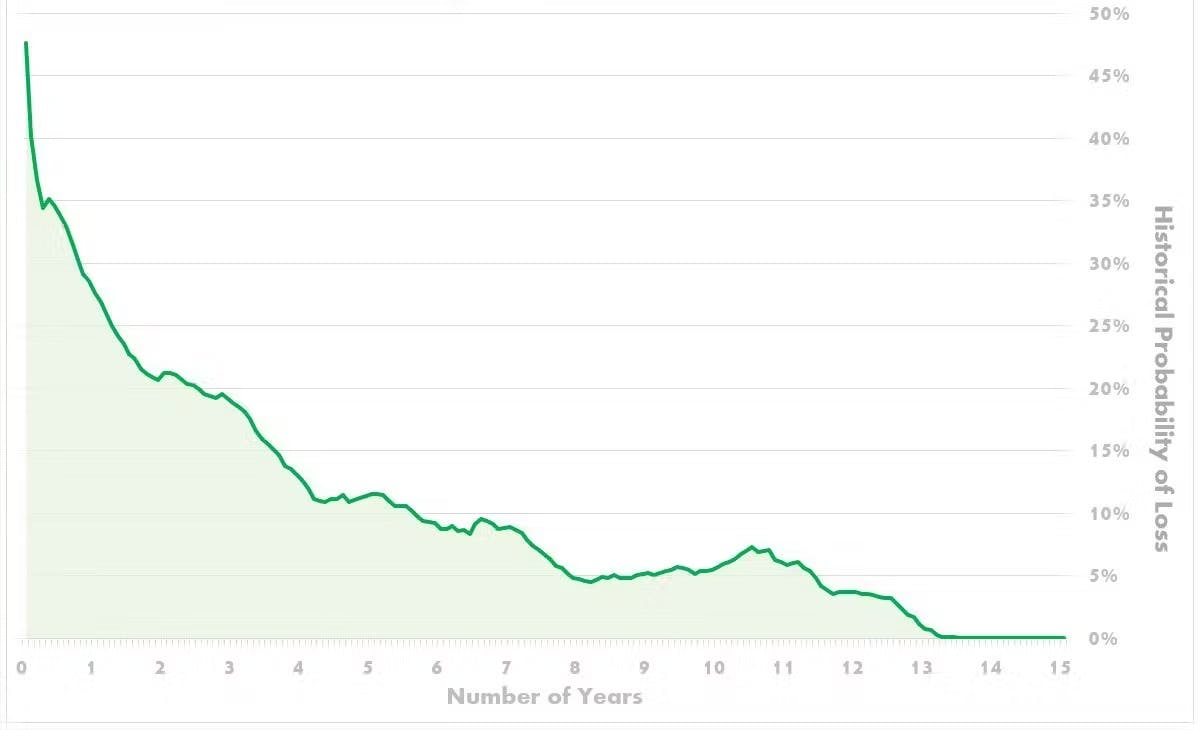

Financial markets are subject to a constant stream of commentary and speculation, especially during periods of high volatility. This can trigger emotional and rushed decision making by investors, which isn't always in their long-term interest. It's essential to filter out the noise and stay focused on why you're investing, remembering that you're in it for the long run. If you're one year into a five, 10, or 20 year investment plan, there's really no need to make any rash decisions.

Chart 2: The probability of loss decreases over time (15 years)

Source: Macrobond; MSCI World Equity Mid and MSCI Large Cap Total Return in GBP, 3 January 1972- March 2023. These figures refer to past performance, which is not a reliable indicator of future performance.

In summary, remember that investing is a marathon, not a sprint. The key to successful investing is adopting a long-term view, aligned to your risk tolerance and life goals. Generally speaking, if you alter your strategy in response to a dip in markets, your portfolio will suffer because you won't have adequate exposure when markets rebound. Timing such a rebound is incredibly hard to get right.

To learn more about navigating changing market conditions, read our articles explaining market volatility and the principles of longterm investing.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not a reliable indicator of future performance.