The 2024 US presidential election is now over and Donald Trump is set for a second term as US President. We explain what markets are saying about the election, and why history suggests the election outcome is unlikely to change very much for investors' long-term plans.

At a glance:

- The initial market reaction to Trump's election win saw the US equity market open higher, and US Treasury bonds dip, likely due to expectations of higher inflation and of a slower pace of rate cuts from the Federal Reserve

- Markets have been unsettled for several weeks, but it is not all to do with the US presidential election

- There is no clear evidence of election outcomes having a significant long-term impact on markets

For the last few weeks, the US presidential election race looked too close to call. In the end, the result was clear cut. US voters have elected former President Trump to serve another term.

It is a momentous event. Speculation on what could happen will now turn to months-long speculation over what the result means. Adding to the US election noise and the uncertainty, this year 40% of the world’s population either have headed or will head to the polls to vote for national leaders in 2024.

This backing track of feverish journalistic typing has been difficult for investors to tune out. And when investors are unsettled or worried, it can prompt them to make choices that may not be in their best interests.

Here we ask our investment team how markets have been responding to election movements, and what it might mean for investment portfolios.

What is the market telling us about the US election?

Markets have been showing some signs that the US election has had an unsettling effect. The “volatility index” or “VIX”, also known as the “Fear Index”, is often cited as a reflection of how unsettled investors are, and it has been on an upward trend since July.

Market commentators have drawn a dotted line between the US election and the VIX index's rise. However, there have also been much more prominent spikes in the index in recent months that show the market reaction to a number of other significant events.

For example, August saw a brief market panic when a weaker-than-expected US jobs report caused some investors to call into question the strength of the US economy. This - in addition to a rate rise from the Bank of Japan - triggered the rapid unravelling of the so-called "Yen carry trade". Stock markets around the world had a rough start to the month before quickly recouping the losses, and more. In September, China rummaged through its bag of policy tricks in an attempt to stabilise the economy and deal with the effects of the Chinese housing bubble. Meanwhile, war continues in Ukraine and the Middle East appears to be on the edge of a broader regional conflict. These active events have all had a more significant, albeit short-lived, impact on markets.

The election was more up in the air, so there was less concrete information for the market to act on. Real Clear Polling showed the race to be close to 50:50, and indeed Trump and Harris exchanged the lead.

At the time of writing, the ink is still wet on the headlines confirming Trump's win. Much will likely change in the coming days. The initial reaction from financial markets is that equities in the US have risen, and Treasuries have fallen.

What does this initial reaction say about what investors expect from another term for Trump? Is there anything investors should do now that the election is over?

Not quite chalk and cheese, not quite apples with apples

Ideologically, yes, Harris and Trump are worlds apart.

Economically speaking? They are probably closer than they might like to admit.

Both candidates made promises to spend significantly. Economists broadly agreed that the plans of both would add materially to US national debt. Both targeted Chinese imports.

Trump's policies are, however, more aggressive than Harris'. Trump has mooted a 60% tariff on all Chinese imports into the US. Economists also seem agreed that while both of the candidates would have likely added trillions to the fiscal deficit, Trump's agenda is likely to add more.

This is where we believe there is more solid evidence of a market reaction.

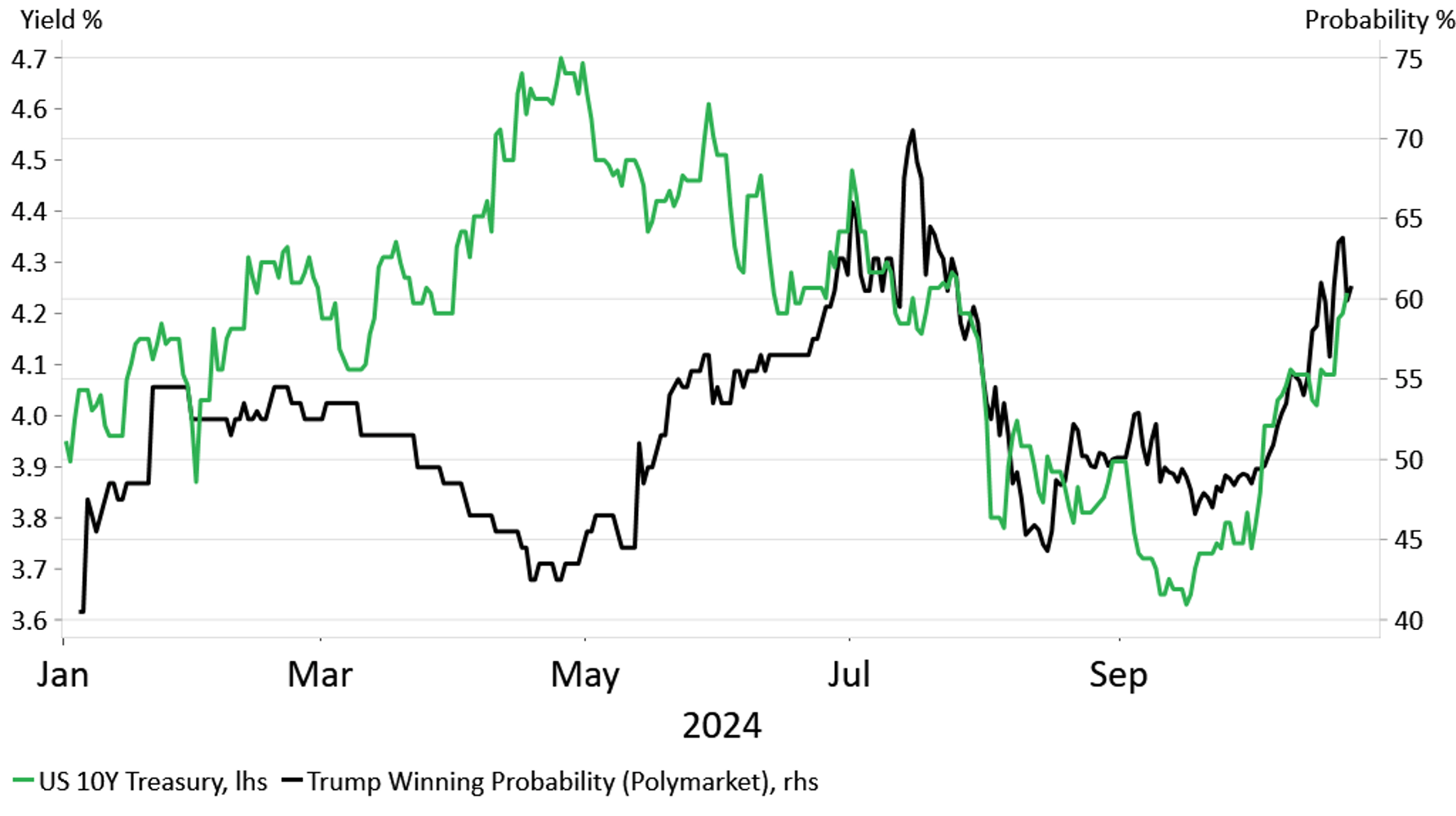

The 10-year US Treasury yield has risen and fallen, since June 2024, in line with market expectations of a Trump win. This relationship continued following the announcement of his win, Treasury yields have climbed again sharply (when yields rise, prices fall). Why?

Chart 1: Trump Win Probability in Election Lead-up vs 10-Year US Treasury Yield to October 2024

Source: Nutmeg, Polymarket, Macrobond, October 2024

This may be due to Trump's talk about tariffs and the impact their implementation may have on inflation, and consequently on bond yields. Taking a look at the tariff discussion first, while Harris proposed targeting specific sectors and rivals, with an emphasis on national security, Trump proposed a blanket 60% tariff on Chinese imported goods. Portfolio Manager, Bola Onifade, explains why Trump's tariffs, if passed, might add to inflationary pressures.

"Where Harris and Trump differed the most is the introduction of even more tariffs under Trump. Tariffs under Trump could easily prove to be inflationary where there aren't cheaper American-made substitutes for Chinese goods. A resultant spike in the cost of finished goods could act as an impediment to the continuation of the rate cutting cycle that has just begun."

Trump has also called the autonomy of the Federal Reserve (Fed) into question, which could potentially end more than 70 years of the US central bank setting policy without political pressure from the Federal Government. Changing this could have a destabilising effect, especially for bond markets. But there is important context to this point too, as Nutmeg's Head of Portfolio Management, Pacome Breton, explains:

"Trump already tried to put some pressure on the Fed in 2018, with limited success. A re-elected Trump could be more aggressive this time around but, as often with the former president, it is difficult to segregate talk from real future action."

In combination, the bond market does seem to be reflecting more uncertainty, and possibly a view that a Trump win would push inflation up further.

What about the past? How have election winners impacted markets?

Our investment team's analysis suggests there's no clear evidence of elections having a significant long-term impact on markets.

The key thing for investors to remember is that economic events and cycles tend to have more of an impact on the average returns under different governments than the governments themselves.

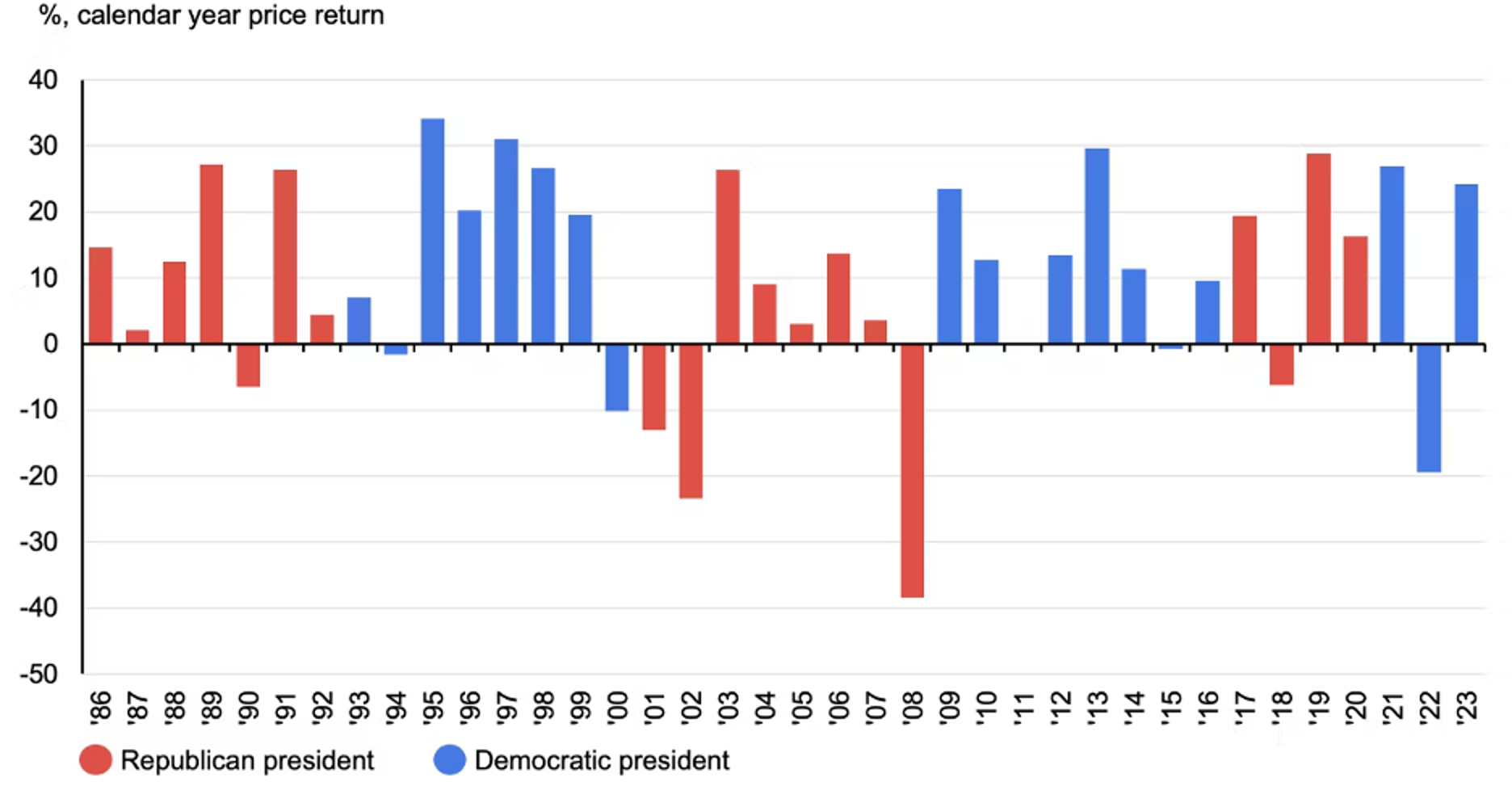

In the chart below you will see who was in power for the majority of each year – Republican or Democrat in the US.

Neither major party can claim to have had that much sway in market performance. It is instead external economic events (for example, the Global Financial Crisis of 2007-08) that appear to have had more of an impact.

Chart 2: US Equity Returns 1986-2023

Source: LSEG Datastream, S&P Global, J.P. Morgan Asset Management - Market Insights. Chart shading represents which party's president was in power for the majority of each year. Data as of 30 October 2024.

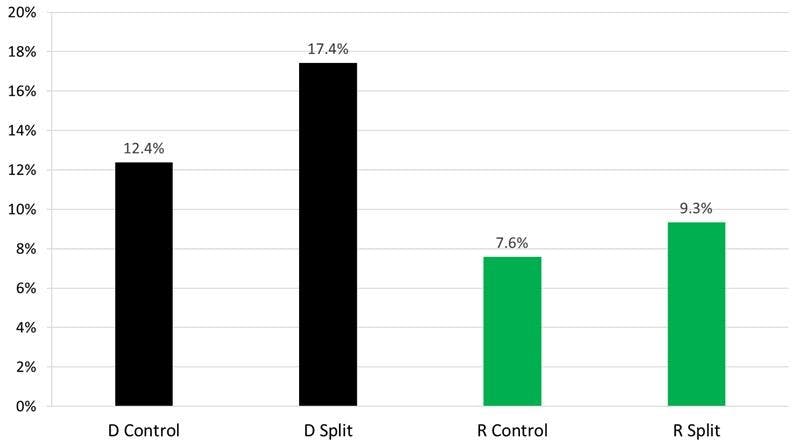

The below chart shows what has happened when one party holds both the presidency and control of the House and the Senate (the two parts of Congress), or holds the presidency but the House and Senate are split between parties. Opinion is divided on why (or indeed if) a split Congress can be said to affect equity market returns. One suggestion is that the split forces beneficial compromise, another is that it acts as a speed bump to fulfillment of an agenda. However, a look at equity market returns from 1950 to 2023 under Republican and Democrat governments shows that positive returns have been achieved over the long-term, under both Democrat and Republican administrations.

Chart 3: S&P 500 Annualised Returns President and Congressional Regimes

Source: Nutmeg, Macrobond, US House of Representatives, October 2024

Stick to the plan

US presidential elections haven't usually been a strong driver with respect to performance in the past.

This election, while extremely polarising on societal topics, might not result in dramatic economic divergence.

Trump's suggestion of high tariffs on Chinese goods, if implemented, could have a more significant impact on some areas like inflation and as discussed, the bond market is potentially reflecting this already (bond yields tend to rise with higher inflation expectations). More broadly, both candidates had economic policies designed to support growth. Even if this means adding to national debt, this has the potential to support riskier assets like equities.

Dr. David Kelly, Chief Global Strategist at J.P. Morgan Asset Management, agrees, but says recent market strength means it might also be a prudent moment to assess portfolio diversification.

"This is a time to really broaden portfolios and think carefully about your exposure to the US. While I'm an optimist on where the [US] economy is going right now - it’s on the right path - there's a lot of positivity built into valuations. If something goes wrong...I think there is significant potential for a correction. I’d want to make sure I was well diversified."

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.

Past performance and forecasts are not a reliable indicator of future performance. We do not provide investment advice in this article. Always do your own research.