The Republican administration in the US has kept investors guessing with a constantly shifting dialogue on tariff implementation. Now that sweeping tariffs have landed, what can investors expect?

At a glance

- The wholesale nature of the tariff regime announced is more than almost all expectations, posing increased downside risks to economic and global trade activity.

- In the US, goods imports only account for a small portion of spending, but a lower dollar could potentially add to the inflationary impact of higher tariff charges.

- Confidence shocks are likely negative in the near-term so we are now looking at a slightly lower growth and slightly higher inflation outlook than widely expected.

- There remains unpredictability about future US policy announcements; with even a reversal possible as negotiations progress. This, along with the confidence shocks, raises challenges for businesses' decision-making.

- The Nutmeg team has reduced risk exposure in managed portfolios.

In recent weeks, global financial markets have experienced heightened volatility, driven by a storm of economic uncertainties and geopolitical tensions that has US tariffs at its centre. Investors are grappling with rapid fluctuations in asset prices, prompting a re-evaluation of risk management strategies and portfolio allocations. We have little doubt our investors have questions.

Our investment team has been keeping abreast of developments as they arise and assessing the implications for portfolios.

These are the facts as we see them, as things stand.

We have seen a small correction in US equity markets this year, reflecting the risks to growth and revised earnings expectations introduced by the tariff regime. Broader global stock markets have also been volatile in the wake of the tariffs announcement. We expect as the tariff negotiations evolve, including possible retaliation, financial market assets will remain volatile.

We have been running a small equity overweight this year – modestly higher equity exposure than our long-term benchmark – on the basis of improving global growth and trade. This week’s policy announcement has added extra uncertainty around this, and so we have removed this overweight position selling a small amount of US large company equity exposure, retaining the proceeds in cash.

Nutmeg multi-asset portfolios are built with global asset diversification at their core. In all but our highest risk managed portfolios, we have also been maintaining extra bond exposure that benefits when bond yields fall – as they have done. We have made these changes to manage the risks around unknown policy direction in the near term. Ultimately though, equity market performance revolves around the medium- to long-term prospects for the economy and its profitability.

At the current time, we do not expect a recession in the US economy in 2025 as a base case, and we expect earnings growth to remain relatively strong for US companies, albeit weaker than expectations at the turn of the year given the above factors. Indeed, despite trimming US stocks, our portfolios remain more exposed to the US equity market than other markets because we continue to expect the US economy to outperform others in the long term.

We continue to monitor the volatile policy landscape and stand ready to alter the shape of our Fully Managed, SRI and Thematic portfolios as events unfold. Fixed allocation portfolios are adjusted once a year. The Smart Alpha portfolios are powered by J.P. Morgan Asset Management and are actively monitored by the J.P. Morgan Asset Management team who advises the Nutmeg investment team on changes to portfolios based on market conditions, leveraging their deep research-driven insights.

What are tariffs intended to do?

The data suggests that tariff implementation is not the main game for the Republican administration. Sure, the threat – and now reality – of tariff increases is intended to extract better deals from trading partners. But the main aim is likely to be to reshore as much production to the US as possible.

Amongst a lot of geopolitical noise, on 11 March the president implied that tariffs were just a stepping stone.

“The biggest win is not the tariff – that big win is a lot of money – but the biggest win is if they move into the country and produce jobs”.

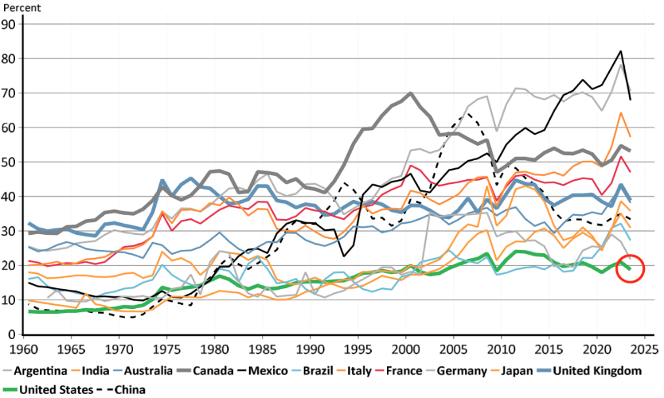

The structure of the US economy suggests that potential tariff 'wins' may be limited. The US economy is one of the most closed economies in the developed world. Its limited international trade means total traded goods crossing its border comprise around 18% of GDP. The US is the green line below, compared with the UK, in blue, in the middle of the pack. Imports comprise around 11% of GDP, and of this, imports from Canada, Mexico and China account for around 5% (almost half).

Chart 1: Imports plus exports as percent of GDP – developed markets

Source: Nutmeg, Macrobond. March 2025

'Bad actors'

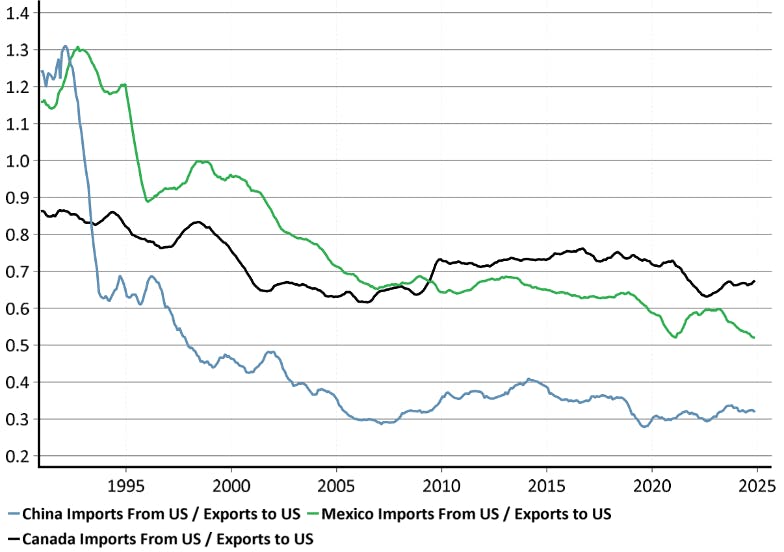

The Republican administration has identified a so-called “Dirty 15”, a list of countries with whom they say the US runs big trade deficits. Of Canada, China and Mexico in the chart below however, only China is really what the Nutmeg team might call a ‘bad actor’ (acting badly in terms of trade). China’s imports from the US total only around 30% of its exports to the US. The ratio for Mexico has also deteriorated in the last decade, but it still does not match China. The chart shows that the US has been in a fairly stable trade deficit with these three nations in the last 20 years.

Chart 2: Ratio of US goods imported from, versus goods exported to, US (a figure below 1 shows a deficit)

Source: Nutmeg, Macrobond. March 2025.

If this is a 'trade war' are US multinational companies now 'behind enemy lines'?

This bad actor argument is far from the whole story though. Looking only at goods exported by US-based companies to overseas markets hugely underplays the impact that US companies, overall, have on the world.

Chart 3: US company activity in the world

Source: Nutmeg, Macrobond. March 2025

In the chart above, the dotted line shows exports from the US to other countries, as a percentage of total US GDP. The solid black line shows the total sales of multinational US companies, operating overseas, as a percentage of US GDP.

Multinational enterprises (MNEs) are companies that – by definition – have production facilities in multiple countries, and in a few cases, all around the world. The goods captured by this sales figure don’t leave the US as exports, but they are still sales by US-owned firms operating overseas.

The chart indicates that these US MNEs sell three times more goods and services than their domestic cousins. When the sales from US-owned, overseas-based production facilities are considered, the impact of US companies in the world is already considerably bigger than the exports figure suggests.

You will notice the lengthy time lag on this officially-reported MNE data; the last update is 2022. Despite this, the chart shows how important good business relations between the US and the rest of the world are.

Ironically, almost half of MNE sales by US-owned companies are European sales. The new Republican administration must know all this, and may adjust its deal-making strategy accordingly. Negotiations have been well and truly opened by the US move. European Commission President, Ursula von der Leyen, has indicated a response is imminent.

"We are already finalising a first package of countermeasures in response to tariffs on steel. And we are now preparing for further countermeasures, to protect our interests and our businesses if negotiations fail."

How will financial markets react to increased US tariffs?

We remain of the view that the US economy is currently strong and that riskier assets like equities have medium-term (generally meaning a year or more) support. That being said, investors may not be out of the woods, and some more bouts of volatility seem likely.

The seemingly haphazard way in which tariff threats are being thrown around is unsettling investors everywhere. It’s unwelcome uncertainty in a world where the “status quo” – a sense of normalcy – is so important for long-term investing.

Threats by trading partners to reciprocate with tariffs on US goods will likely have macroeconomic, market and geopolitical implications over the short- to medium-term.

Macroeconomic impact

The scope of tariffs to impact – specifically to increase – inflation, is limited by two factors.

First, any tariffs would need to be introduced over the long-term/permanently to have an inflationary impact. This is not the model being shown by the US president. So far, they have been used to extract better trade deals. Second, because the level of imports into the US is small, the extent to which tariff increases reach the economy should be limited.

Tariffs are a ‘supply shock’. Supply shocks are usually inflationary as they normally adversely impact productivity and wealth creation. Supply shocks refer to any period where the supply of goods and services is restricted artificially (such as by tariffs) or by natural disaster (COVID shutdowns). Prices can rise as more people chase fewer goods and services.

For the US, this adverse productivity shock may be offset by growth-positive factors in the form of reshored supply chains, as some manufacturing returns to the US. Time will tell. There is also some hope that AI may have a game-changing impact on productivity.

For Europe, there are a few encouraging dynamics unfolding that we believe can add to growth, especially the expected rise in defence spending. The ‘peace dividend’ following the early signs of a resolution in Ukraine should help Europe through three channels – lower energy costs, reconstruction work, and higher confidence.

Market impact

The uncertainty has already made things tricky for the policymakers at the Federal Reserve (Fed). The Fed had been in the process of gradually reducing interest rates, typically supportive for economic growth. However, they might have to cut that short – or pause to assess how things play out – in light of the muddied outlook for US inflation.

As we have highlighted, multinational US companies are actively involved in global economies. Many of these are globe-trotting listed companies – the ones you will find in the S&P 500. We see the global economy continuing to grow at a moderate pace, which will support US and global stock markets.

Geopolitical impact

The US is already in a tech trade war with China. Since around 2017, the US has sought to reduce its dependency on China as a producer of vital technology enabling components like semi-conductors. As a consequence, the US needs as many countries to align with its own technology as possible.

For as long as the US is using threats or the implementation of tariffs as part of its political vision, it provides a platform for China to draw more countries into its technology orbit. With this, the US cedes economic as well as geopolitical power.

Investment portfolio impact

Overall, the Nutmeg investment team is confident that globally diversified investors will find growth opportunities. The investment team continues to actively manage portfolios for its Fully Managed, Socially Responsible Investing and Thematics clients. The Smart Alpha portfolios – as stated above – are actively monitored by the J.P. Morgan Asset Management team who advises the Nutmeg investment team on changes to portfolios based on market conditions, leveraging their deep research-driven insights. For Fixed Allocation clients, portfolios are adapted once a year. Long-term investing rewards attention to economic and business fundamentals, which are more long-lasting than political cycles.

However, investment returns never come without a risk warning; markets go down as well as up. Nutmeg’s investment team currently think the positives outweigh the negatives.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance. Thematic investing carries specific risks and is not for everyone. We do not provide investment advice in this article. Always do your own research.