Since the pandemic there has been a lot of talk about the road to economic recovery and the importance of economic stimulus. But what exactly is stimulus in this sense, how is it coming about and what does it mean for you, the private investor?

What is stimulus?

We can break down economic stimulus into two fields: monetary and fiscal.

Monetary policy stimulus is an attempt to provide liquidity where banks have stepped back. Famously, we saw this following the global financial crisis (GFC). At that time, 2007-8, banks were scared of losing money and felt very exposed to bad assets and debt. The central banks such as the UK’s Bank of England, The Federal Reserve in the USA, the European Central Bank and the Bank of Japan, all took on the role of liquidity providers with huge quantitative easing programs.

Fiscal stimulus is a more direct injection into the real economy and can have a more immediate impact than monetary stimulus, especially in the US and UK where savings rates are lower. Targeting the fiscal “giveaways” to people who will spend them and put the benefit back into the real economy is key. Often, we see this in a tax break to encourage a certain business sector to grow and thereby pay more in corporation tax down the line. In 2020 and 2021 we saw this with the furlough employment support scheme in the UK and the support given to households below a certain income in the US.

What’s going on today?

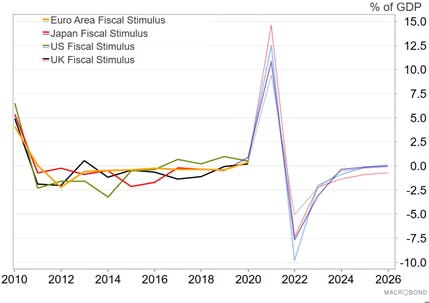

Primary budget of G4 economies change on yearly average

From the chart above we can see that three of the world’s major governments and the Euro Area have undertaken major fiscal stimulus programmes. Central banks have accommodated this by buying government bonds in the secondary bond market. Such monetary and fiscal policy coordination has allowed governments to dramatically increase their budgets. As the chart shows, this equates to between 9%-15% of respective GDPs in 2020/21: stimulus needed because of the extraordinary economic contraction caused by the global Covid pandemic and to help governments pay for fighting the pandemic. In March Joe Biden signed a further Covid relief bill worth .9 trillion for the US economy.

What does this mean for markets?

Financial stimulus is typically welcomed by markets and there is often correlation between stimulus announcements and market performance. When businesses, banks and investors are confident that policy makers are lending support to the economy, that confidence can keep markets buoyant.

As was reported earlier this year, US stimulus worth almost trillion powered a 70% gain in US equities from the lows when the pandemic first hit in March 2020. That support, later combined with vaccine rollouts and clear agendas to move economies beyond the pandemic, all helped markets recover.

But…

A common criticism of economic stimulus is that it represents irresponsible money printing that can make government debt unsustainable and cause inflation. While few would argue against the need for fiscal stimulus to help households and to buy vaccines during the pandemic, some economists have raised concerns about the level of monetary stimulus (quantitative easing) that has built up over the last 13 years since the GFC.

One fear is that too much cheap money in the system can make prices rise, leading to inflation which is often paired with rising interest rates. This can be a problem for governments who have taken on a lot of debt to pay for the stimulus as this can lead to a rise in government bond yields, as was seen recently in both the UK and the US. Another fear is that the economy may grow addicted to excessive government assistance.

What is Nutmeg doing?

The relationships between stimulus, market prices, bond yields and inflation are watched closely by the Nutmeg investment team. Nutmeg fully managed portfolios are positioned to take advantage of price rises following stimulus and to potentially defend them against inflation. Continued diversification is key, along with asset allocation adjustments within appropriate risk levels, to maximise potential returns.

This means we currently hold small overweights in equities to enjoy growth from government stimulus. To prepare for the possibility of higher inflation and rising interest rates, our allocations to bonds are designed to offer specific inflation hedges. We also hold gold which is seen as an inflation hedge.

Economic stimulus has proved critical in nurturing the global economy back to a growth through the worst economic shock in living memory. We will continue to see the effects of such stimulus on the global economy for some time and as these impacts appear, our investment team will be able to react and adjust accordingly to maximise the opportunities for portfolio growth.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance and forecasts are not reliable indicators of future performance.