Harry Markowitz, the celebrated creator of Modern Portfolio Theory, died recently aged 95. In tribute, here are some of his lessons in diversification that all investors can take heed of, preceded by quotes from the man himself.

“Modern Portfolio Theory recommends that you diversify with a balance of stocks and bonds and cash that’s suitable to your risk tolerance.”

Modern Portfolio Theory (MPT) has its roots in Markowitz’s paper Portfolio Selection published in the Journal of Finance in 1952, work which later earned him a Nobel Prize.

In practice, MPT is a mathematical framework used to select investments in order to maximise their overall returns, but within an acceptable level of risk. We’ll skirt over the maths here, but this foundational idea remains the basis of diversification still used by wealth managers like Nutmeg today when investing for our clients.

In simple terms, at the core of MPT is the impact of asset correlation in improving portfolio diversification and potentially reducing the risk you need to take for a given target return. The prime example of this is a portfolio made up of equities (traditionally a high-risk asset class) and bonds.

Markowitz argued that any given investment's characteristics should not be viewed alone but should instead be evaluated by how it affects an overall portfolio's risk and return. In other words, in prioritising their client’s risk tolerance a wealth manager can then build an adequately risk weighted portfolio that optimises the risk/reward split between higher and lower risk assets.

However, remember there’s no silver bullet for investing, and no returns are guaranteed.

The efficient frontier

“Perhaps the most important job of a financial advisor (sic) is to get their clients in the right place on the efficient frontier in their portfolios.”

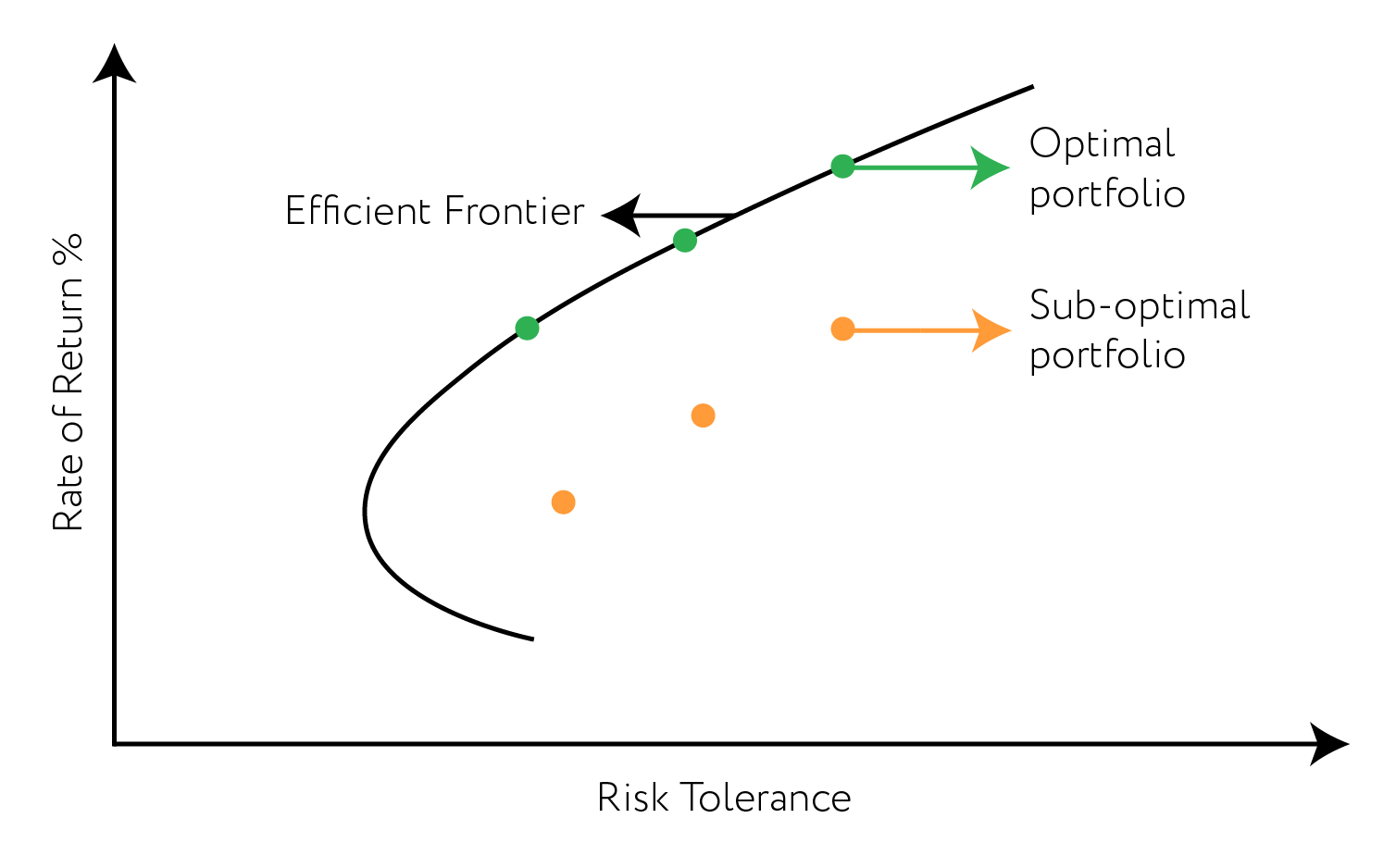

A key tenet of Markowitz work with MPT is the efficient frontier. Bearing in mind the ideas we’ve just outlined, this is best demonstrated through a chart that plots the best possible returns investors can expect from a portfolio, given the level of volatility they are willing to accept. The most ‘efficient’ or optimal portfolios are those with a mix of assets that offer the highest returns for a given amount of risk.

The efficient frontier is visualised in the chart below, with the different dots representing different portfolios. This plots several potential returns versus the risk taken (often measured through standard deviation or portfolio volatility). The maximum returns you can achieve are on the top right of the chart, consisting entirely of one riskier asset class (say, 100% in equities), whereas as moving down the risk scale to the left would add in less risky asset classes to the mix, for example adding in a certain percentage of government bonds.

Chart: Markowitz’s efficient frontier

Source: Nutmeg.

The important point, as recognised by Markowitz and generations of investors after him, is that for a given level of risk one can design portfolios with different expected returns. Inversely, for a given expected return one can design portfolios with lower risk levels than others. Optimal portfolios situated on the sweet spot of the efficient frontier tend to have a higher degree of diversification than the sub-optimal ones, which are typically less diversified.

Diversification in action

“Diversification is the only free lunch in investing.”

Diversification is a core principle in how we manage portfolios at Nutmeg, with each portfolio along our risk levels and benchmarks made up of the major asset classes, equities and bonds, and the sub-asset classes within each of these.

There are plenty of moving parts – for example, emerging market equities are historically seen as riskier than, say, UK or US equities, while corporate bonds have more of a risk of default than government bonds.

Nutmeg’s strategic allocation framework uses over 25 years of historical data to examine the contributions of each individual asset class to overall portfolio efficiency. Clients can see the full breakdown of the asset classes in each of our portfolio styles via the ‘Past Performance and asset allocation’ section of our investment portfolio pages on the Nutmeg website (choose the ‘Asset allocation’ tab).

Our blog, Investor Essentials: What is diversification? explores our process as well as examples of where a more concentrated approach has failed for other investors in the past. Those looking for further commentary on the current environment for major asset classes, may want to read our latest blog exploring the correlation between equities and bonds today.

It’s thanks to pioneers like Harry Markowitz that investors have benefitted from years of improved research on portfolio management. Nutmeg, like all good wealth managers, puts diversification at the core of our investment process, giving clients the best possible chances of investment success over a long-term horizon.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest.