We explore how an expanding population and rising living standards are driving an increase in demand for resources, and how new technologies are rising to the challenge.

At a glance:

- As the global population expands and living standards improve, the demand for energy and other resources is ever increasing.

- Technology plays a key role in this increasing demand. The mass manufacture and use of computers, smartphones, televisions, and other consumer electronics requires vast amounts of energy, as well as lithium and other precious metals.

- Society is becoming increasingly focussed on how we continue to meet this rising demand, and so we're beginning to see more investment from governments and institutions in finding innovative ways to power our lifestyles.

What is 'Resource Transformation' and why is it important?

Our thematic investing portfolios are designed to capture the long-term productivity, population and resource trends that are shaping our futures across the globe. The Resource Transformation theme looks at the increasing demand for energy, materials and water - resources which converge to produce the goods and services we consume and to power life as we know it.

While the Resource Transformation theme focusses on our evolving demand for resources, it should not be confused with our Socially Responsible Investing (SRI) portfolios. Intensifying demand for more resources will not always be met in a sustainable way, and the Resource Transformation portfolios do not factor ESG considerations into the allocation of assets.

For Resource Transformation clients, around 20% of equity exposure is thematically invested - capturing both the trends outlined in this article as well as more traditional players in the resources space. The rest of the Resource Transformation portfolio will invest in a globally diversified range of ETFs that are not specific to the theme.

In this article we delve into the water, energy and materials trends that we're investing in on behalf of our Resource Transformation clients.

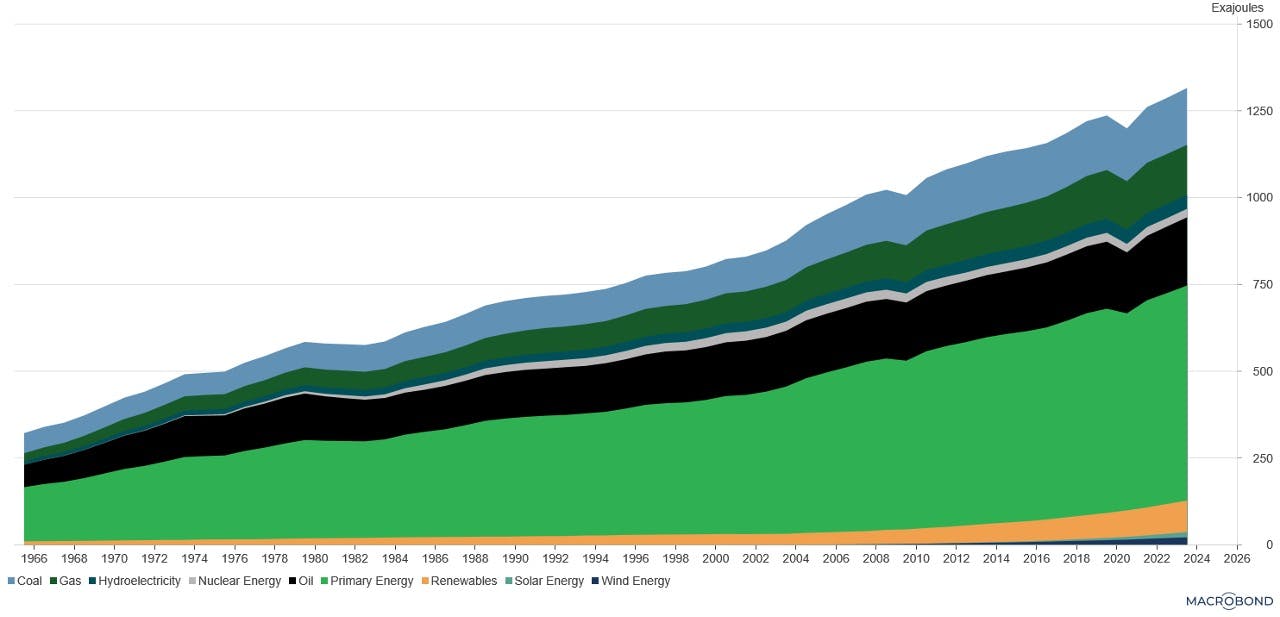

Energy

Global energy consumption has increased nearly every year for over half a century. Consumption continues to grow at a rate of 1-2% per year, and while this might sound negligible, it does stack up quickly over the decades (Source 1). This growth in consumption, combined with a push towards greater energy efficiency, is creating an urgent need for new methods of energy production, storage and consumption.

To store and consume our rising energy output more effectively, governments and institutions are starting to invest in more efficient batteries, fuel cells, and smart-grid technologies, among other innovations.

Chart 1: Global Energy Consumption

Source: Energy Institute, Statistical Review of World Energy, Macrobond, August 2024

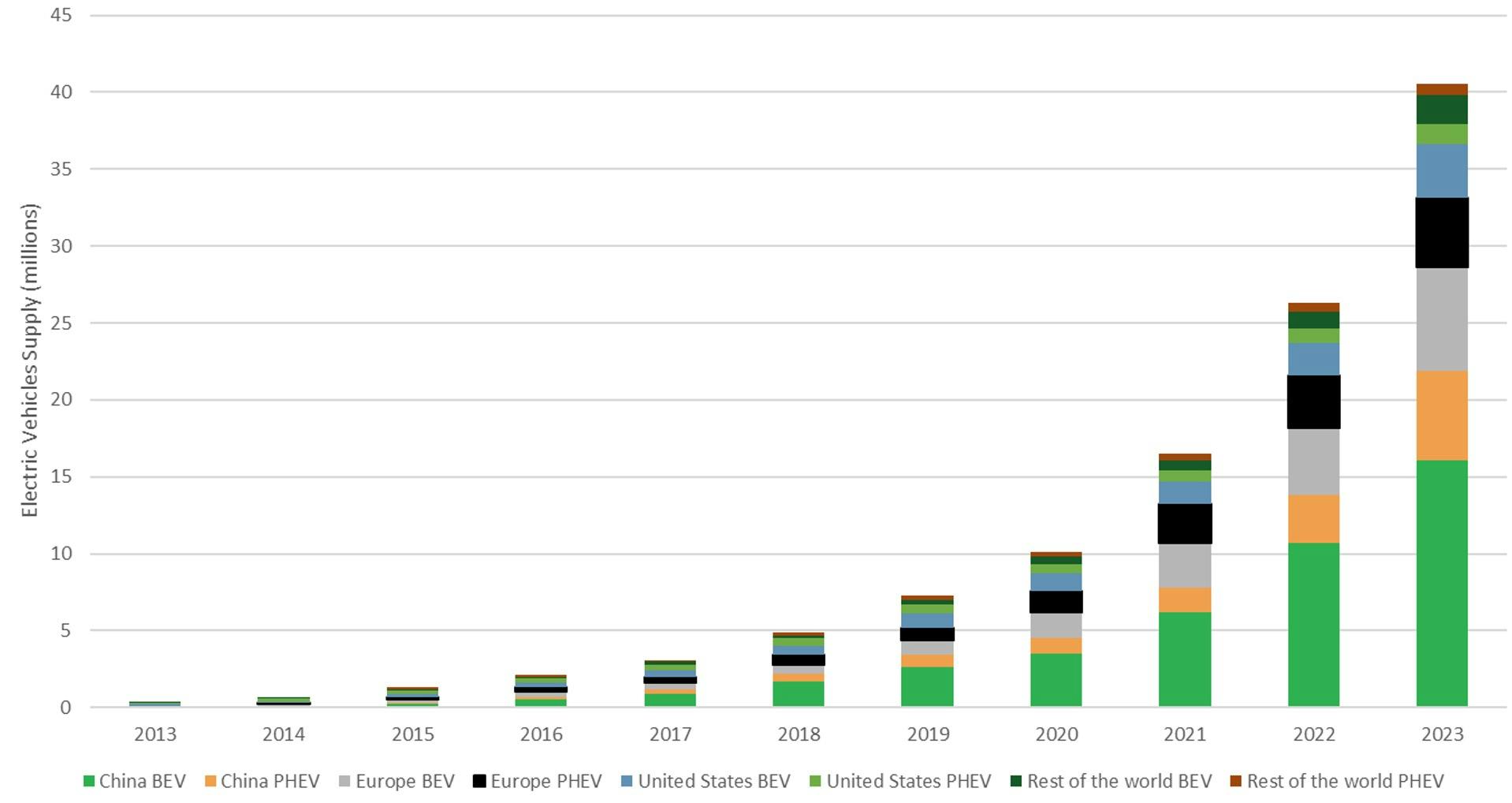

The lithium battery has become almost ubiquitous, but new improvements are always being made. Efforts are ongoing to commercialise more efficient types of lithium with vastly more energy density than that of a traditional lithium-ion battery. This has important implications for the future of mobility and transport - especially as electric cars become more prevalent.

Chart 2: Global Supply of Battery Electric Vehicles and Plug-in Hybrid Vehicles

Source: IEA, Global EV Outlook 2024. Total Supply of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs).

The transition to a more energy-efficient world also requires innovation in other emergent energy sources including hydrogen and uranium, the latter resource to which we recently gained exposure for the first time via the Global X Uranium UCITS ETF.

Despite the ongoing electrification of transport, fuels are still seen as irreplaceable in certain sectors such as long-haul transport, chemicals and steel. Of all the alternative fuel sources available, hydrogen is one of the most promising.

Hydrogen is already used as an alternative fuel in many parts of the world, especially China, although the vast majority of it is captured from the burning of coal and natural gas, which both emit greenhouse gases. More research is needed into the manufacture of hydrogen using renewable inputs and a process called electrolysis to create almost zero pollutants.

Given the complexity of this process, the technology may not be totally viable as a mass market fuel source. Despite this, advancements are always being made, which is why we seek exposure to these sorts of technologies through the iShares Global Clean Energy UCITS ETF. This ETF includes stocks of firms pioneering new methods of energy production and consumption, including the potential application of hydrogen as a source of fuel for the aviation industry.

Materials

Demand for materials is also rising constantly, with no sign of slowing down anytime soon. Across the consumer market, demand for digital services, devices and electric cars is on the rise. In the industrial market, technologies like quantum computing and robotics are also improving in leaps and bounds, and all of these developments are highly resource-intensive. In both the developed world and emerging markets, increasing volumes of raw materials are required to sustain the digitalisation of daily life and commerce - such as copper, silver, nickel and lithium.

Copper, for example, was used by humans for thousands of years to make coin, jewellery, and bronze alloys. Today it is more commonly used as a conductor of both heat and electricity, and because it has great antimicrobial and corrosion-resistant properties - which helps reduce bacterial spread and increase the durability of goods. As more EV charging points and heat pumps are installed in homes, and as the industrial sector increasingly uses copper in machinery, the demand for this metal is likely to continue to increase in decades to come. By 2040, demand is expected to be 36,379 kilotons, which is a 41% increase on the estimated demand in 2023. On the supply side, new investment in mines, refinement and recycling is required just to keep up. We look for exposure in this sector by investing in funds such as the VanEck Global Mining ETF – which primarily focus on organisations within the metal and mineral extraction industries.

Water

Living in the United Kingdom, the supply of water on earth may seem plentiful - but this is not the global experience. And while it's easy to think of fresh or distilled water usage mainly in the context of individual and household consumption, a significant amount of water is also used in the agricultural and industrial sectors. In fact, only about 12% of global freshwater consumption is domestic, whereas agriculture accounts for around 70%.

Access to clean water is of universal importance across geographies and industries, requiring progress in digital water management, advanced filtration, flood prevention, wastewater processing, and desalination. The latter is becoming an ever more crucial tool in the fight to provide clean water to populations living in hot and arid climates, especially in close proximity to the coastline. In the United Arab Emirates for example, around 42% of drinking water originates from desalination plants.

We look for exposure to this sector by investing in funds such as the iShares Global Water UCITS ETF – which primarily focus on the largest names in fresh water production, treatment, transportation, and distribution technology.

How are we investing to harness the opportunities in our long-term resource challenges?

When investing in resource and energy technologies, we look to capture the entire value chain in our portfolio. For example, our investments in solar technology are intended to capture every step of the product lifecycle from the initial mining of lithium and other components, through to the manufacture, distribution and maintenance of panels.

The resource investment space is growing rapidly in order to meet demand, but there are many areas that are still quite young and require further development before they meet our investment standards. Investment in uranium previously fell into this category, however in April of this year, an ETF became available that fit our size and liquidity requirements and provided the exposure we desired.

Is investing in the Resource Transformation theme right for me?

Structural change can take time to fully embed and can require significant capital. Nutmeg's thematic investing portfolios, including Resource Transformation, are centred on trends that are entering or currently within their growth phase. Therefore, investing in Resource Transformation, and our other thematic portfolios, is more appropriate for those with long-term investing goals. Our investment team has carefully selected themes based on more established trends that are only likely to reach full adoption in the next 10 to 20 years.

It can be a challenge to invest in rapidly evolving spaces, which is why a globally diversified approach that accesses these themes through future-focused ETFs can help to balance the risk. The option to invest in the Resource Transformation thematic portfolio is only available to Nutmeg investors with a risk level of 5 or above.

Risk Warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Thematic investing carries specific risks and is not for everyone. There is no guarantee that development of the trend will contribute to positive investment outcome. All Nutmeg themes, including Resource transformation, should not be considered as incorporating ESG considerations. The Resource Transformation theme will likely have exposure to a variety of renewable and non-renewable materials and energy sources.

Past performance and forecasts are not a reliable indicator of future performance. We do not provide investment advice in this article. Always do your own research.

Sources

- Hannah Ritchie, Pablo Rosado and Max Roser (2020) - “Energy Production and Consumption” Published online at OurWorldInData.org. Retrieved from: 'https://ourworldindata.org/energy-production-consumption' [Online Resource]