“I’m getting old, and I need something to rely on”

These lyrics from the beautifully melodic Keane classic (Somewhere Only We Know, 2004) speak directly to the problem of the modern-day investor. Even if UK pop/rock isn’t to your musical taste, we can agree with the sentiment. Just what can investors rely on as they build their future financial security?

Here are a few simple rules of thumb that investors of any age – and musical taste – can rely on.

1. Inflation is not your friend

Most of us have an estranged relationship with inflation. We pick up sporadic news of how it’s doing via monthly reports on government statistics. We get a sense it wears down our spending power from year to year. And if interest rates rise with inflation, it hurts us through higher mortgage and loan payments.

However, many of us fail to grasp the serious damage inflicted on our long-term wealth by inflation. Unless financial returns are greater than inflation in the long term, your financial strategy could be making the purchasing power of your wealth diminish.

Inflation will erode your wealth, and large cash holdings over the long term are rarely wise unless investors need that liquidity for a particular purpose.

Chart 1: Bank of England base rate, less inflation (%)

Chart 1 shows the official rate underpinning all UK bank retail deposit rates, after the effect of inflation. In other words, cash in a current account at the bank at the standard rate has lost value in real terms over the past 20 years.

Hypothetically, if you were to take out a 5% annuity yield on a pension portfolio of £500,000 – with no other contributions – it would offer an income of £25,000 per year.

If you were to leave that £500,000 pension pot for 20 years – again, with no other contributions – at the current negative real interest rate of -2% (the average of the last decade), the value of the pot in today’s terms would fall to £333,804 using monthly accumulation.

Using the same 5% annuity rate on that pot would offer an annuity of £16,690, which is a 33% loss of real purchasing power i.e. a one-third reduction in real wealth. So, inflation really isn’t your friend when it comes to cash.

2. Volatility is your friend

It may feel painful when the value of an investment drops, but diversified investing is all about putting your capital at risk across different markets and geographies in order to obtain a good return.

The rule of thumb is: no risk, no return. And if you’re comfortable taking a higher risk with your investments, you might expect higher returns in the long term. However, there are three caveats to bear in mind:

- Financial market volatility means that assets lose value as well as appreciate in value. Capital is at risk.

- Past performance is no guarantee of future returns. So that means, for example, you can’t expect a return over the past 12 months to be repeated in the next 12 months.

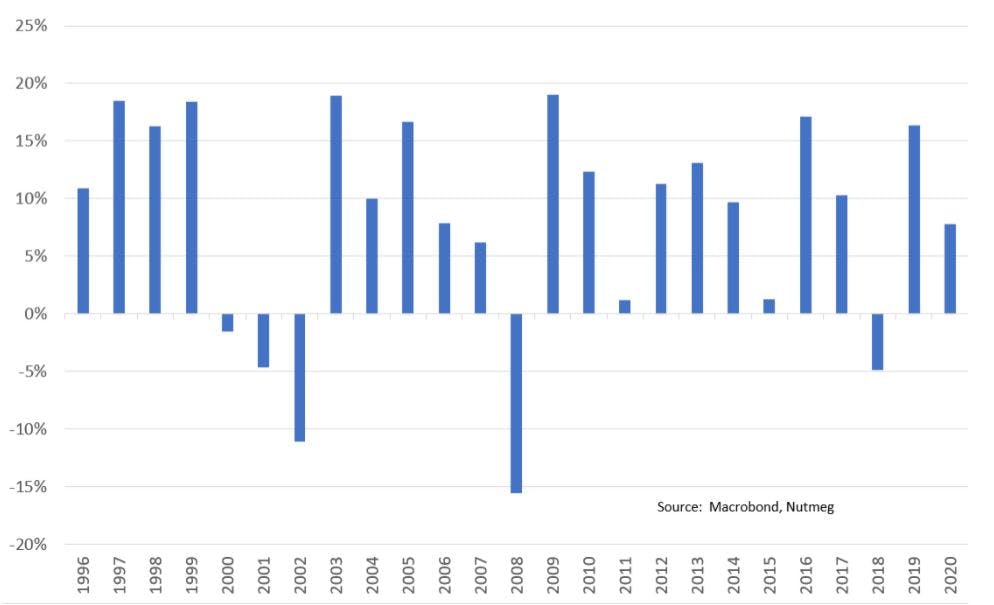

Chart 2 shows simulated calendar year returns for Nutmeg’s Fixed Allocation Portfolio C, aligning with the mid-risk options within Nutmeg’s portfolio range. These are simulated historic returns for demonstration purposes only. We have used fixed allocation of underlying equity and bonds weights to demonstrate returns without the impact of intervention of our investment experts. As the chart shows, there can be a high degree of variance in annual returns from year to year.

Chart 2: Calendar year returns – Fixed Allocation Portfolio C

- Time Diversification. The longer you’re prepared to wait, the more you would hope to get paid for taking risk. In other words, volatility is a friend who sticks by you over the long term. At least, that’s the theory. But as the next chart shows, it very much depends on what period you’re looking at.

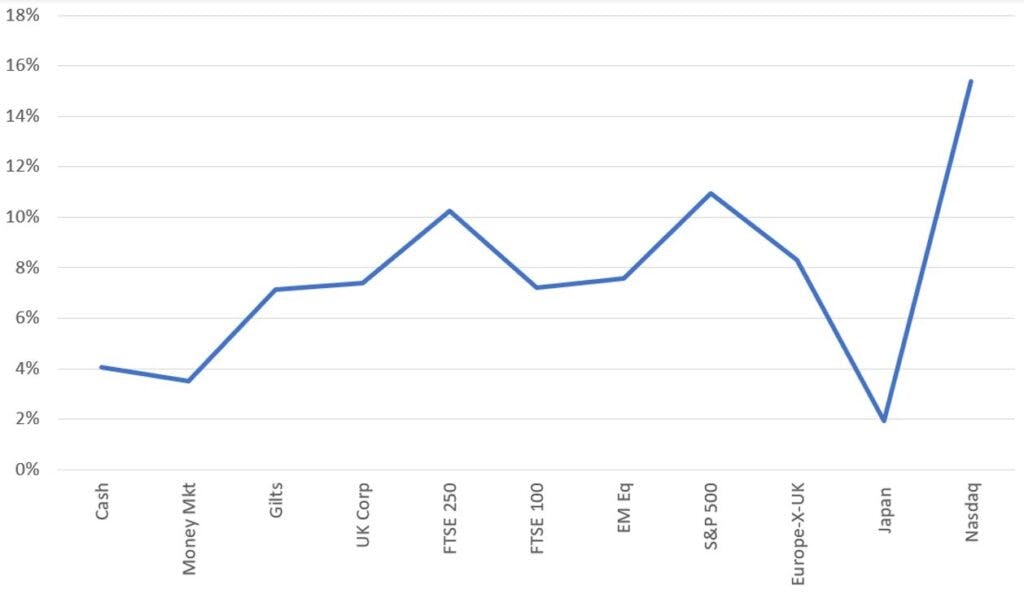

Chart 3 orders assets, left-to-right, by their average volatility between 1990 and November 2021 (this volatility data is not included here). The blue line represents returns. As you can see, the Nasdaq US technology index passes the time-diversification test. It has the highest volatility and the highest returns.

However it’s clear there is a lot of idiosyncratic risk still impacting the risk-return behaviour of other equity markets: FTSE 100, emerging market equities, Europe ex-UK and Japan.

Chart 3: Asset returns (%) – ordered by 1990-2021 volatility

Source: Macrobond, Nutmeg, Jun 90 to Nov 21. All are equity markets except cash, money market, gilts and UK corporate bonds

3. Asset diversification is your friend

Holding a mixture of income-bearing assets and growth-related assets across geographies and asset types helps mitigate risk and could help to improve the trade-off between risk (volatility) and return.

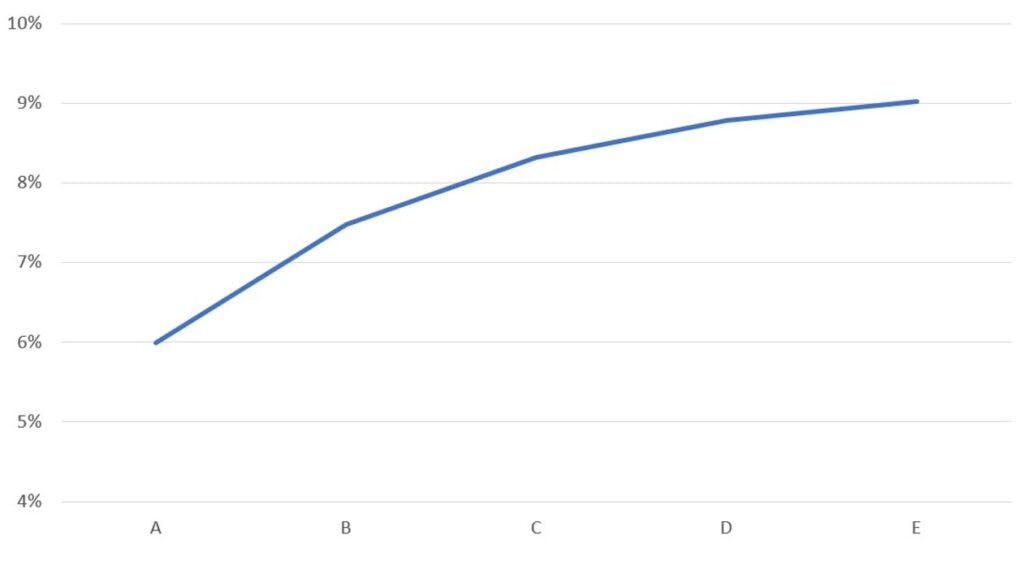

- Chart 4 below shows annualised long-term simulated returns for equity and bond portfolios similar in nature to Nutmeg’s Fixed Allocation portfolio range (A to E). As we move up the risk spectrum (say, from C to D), long term returns rise. This result was not consistently achieved in the separate asset returns (Chart 3), so part of the story here is that asset-diversification is boosting confidence in that rule of thumb: higher risk, higher return.

Chart 4: Simulated historical returns of Fixed Allocation Risk Spectrum

Source: Nutmeg, Jun 94 to Nov 21

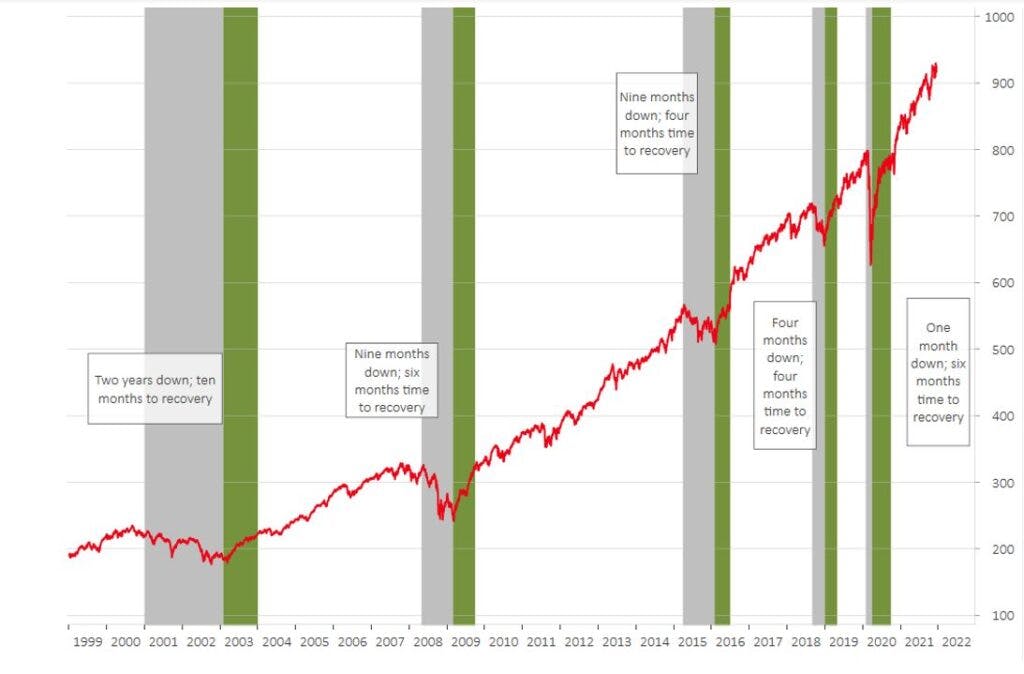

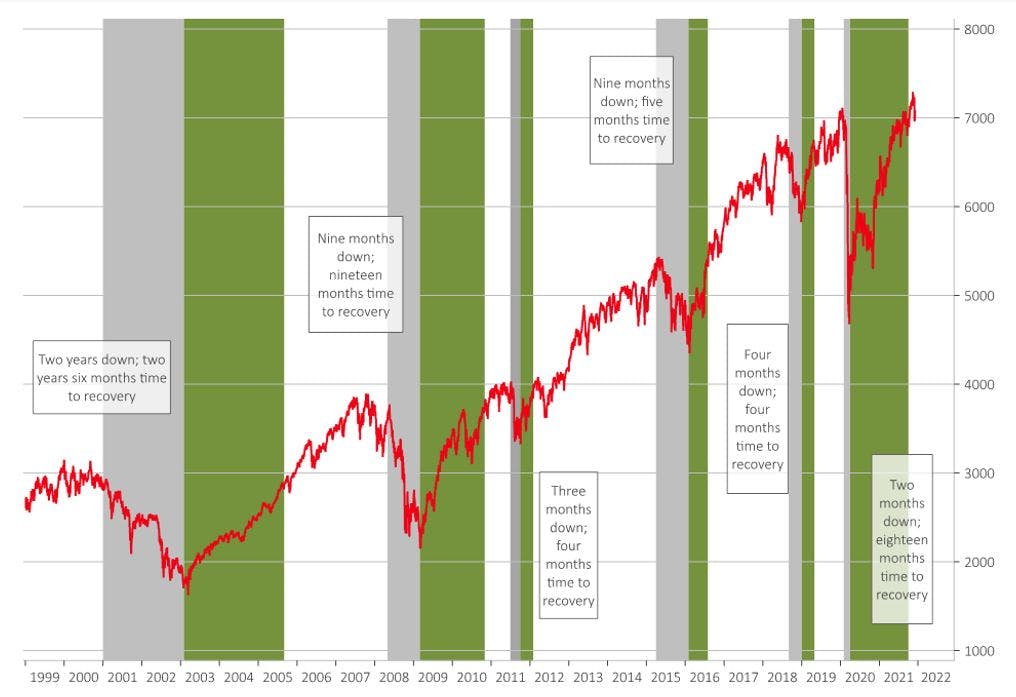

- In addition to potentially improving the risk-reward trade-off, asset-diversified portfolios also seem to help shorten the time to recovery after an adverse move in portfolio value.

The next two charts show a generally shorter down-move and recovery time for a globally diversified multi-asset portfolio compared to those for large UK companies (FTSE 100). Chart 5 is, again, a simulated return index based on Nutmeg’s Fixed Allocation Portfolio C; a mid-risk portfolio comprising 60% global equities and 40% bonds. The Covid-induced panic of first-quarter 2020 took the FTSE 100 one and a half years to recover. The diversified portfolio recovered in six months. Patience seems to be as strong a virtue as diversification.

Chart 5: Nutmeg Fixed Allocation Portfolio C; time to recovery

Source Nutmeg. Red line represents Portfolio C

Chart 6: FTSE 100

Source: Macrobond, Nutmeg. Red line represents FTSE 100 Total Return Index GBP

4. Active management can be your friend

If idiosyncratic factors are so prevalent in individual assets, then having a professional investment manager taking these factors into consideration when constructing a portfolio can help the risk/return profile. Fixed Allocation portfolios are backward-looking in their construction. Active management can look forward and detect structural shocks (e.g. Brexit, China-US trade or geopolitics) and react to this idiosyncratic risk accordingly.

So, in conclusion, there are four things investors can rely on…

Inflation is not your friend and is wealth-destructive if capital is not receiving an above-inflation net return. Substantial cash holdings over the long term are rarely wise unless individuals need that liquidity for a particular purpose or they are not willing/able to accept any degree of risk to their capital.

Volatility can be your friend if you’re invested in a globally diversified portfolio which minimises the idiosyncratic risks for individual asset classes. The more diversified risk you take, the higher your longer-term returns could be.

Active management can be your friend. It can help cope with idiosyncratic risk through forward-looking judgements and asset allocation changes. Investors with a very long-term horizon who are comfortable with market fluctuations may not need the comfort of active management. But many investors prefer the assurance that someone is looking over their portfolios, taking comfort from the fact that changes will be made when the manager feels idiosyncratic risk is not being rewarded.

Patience is your friend. We have seen that in well-diversified multi-asset portfolios, recovery times are shorter than in single asset values. Patient investors, who don’t cash-in their investments after a slide in value, have in the past seen their portfolio value recover in a time period usually shorter than the period of decline.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Simulated past performance and forecasts are not reliable indicators of future performance.