We explore some of our biggest population challenges and how investors can find opportunity in the long-term trends of healthcare innovation, changing demographics, digitalisation, and growing emerging market wealth.

At a glance:

- New technology is not only extending our lives, but also changing how we choose to live them.

- The 'Evolving Consumer' is one of Nutmeg's thematic investing themes, providing exposure to the long-term population trends that are paving the way for major changes in society.

- We access this trend through a selection of Exchange-Traded Funds (ETFs) that we pick based on theme purity, fund size (assets under management), and liquidity.

Society is developing at an unprecedented rate, pushed and pulled by innovative products and services which are increasing both our life expectancies and lifestyle expectations. From the careers we pursue to how we spend our money, consumer behaviours and needs are changing rapidly.

While daunting, shifting societal needs are a key driver of economic activity, presenting an opportunity for investors who choose to embrace this evolution with a long-term view.

What is the 'Evolving Consumer' and why do we believe in this investing theme?

Our thematic investing portfolios are designed to capture the various productivity, resource and population trends that are being embedded into society. The ‘Evolving Consumer' is our expression of the 'population' theme, focusing on the needs and desires of new consumer groups.

Every person who has influence over spending decisions is a consumer. Fifty years ago, this influence was much more concentrated than today. The historically wealthier 'West' is no longer monopolising global spending power, as we see an emergent middle class in the developing world. We also see people working and living longer than ever, and enjoying more active retirements. These are just some examples of how our global community, and its expectations, are changing.

As consumer attitudes and behaviours evolve, businesses must adapt their models and technology to meet consumer needs. In turn, this innovation further drives our consumption behaviours. In essence, consumer evolution is an accelerating phenomenon that won't be going away.

How exactly are these population trends embedding?

Any large-scale change must be driven by investment, and when it comes to population challenges, governments are key stakeholders.

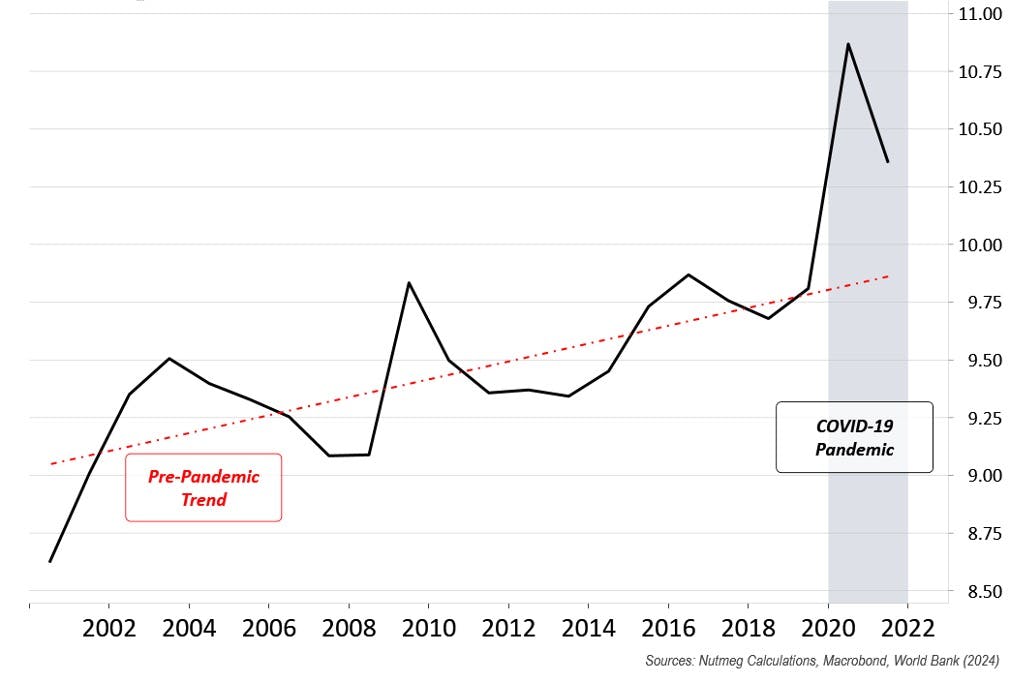

Governments across the globe are expected to continue the upwards trend in healthcare spending, which is growing at a faster rate than GDP, providing a tailwind for investment in new ideas and technologies within healthcare.

Fuelling the increased government expenditure on healthcare is the increase in life expectancy. Western economies, as well as those in Northern Asia, all have ageing populations. The UK was home to over 10 million people aged 65 or older in 2018, and this number is only set to keep rising. Populations also age as households have fewer children – with birth rates in many major economies running below replacement level. As such, many nations' spending habits will gradually shift to reflect the needs and desires of an older demographic.

Chart 1: Health Expenditure as a % of GDP

Source: Nutmeg calculations, Macrobond, World Bank (April, 2024). The black line shows a spike in healthcare during the Covid pandemic, which has since come down but remains above pre-pandemic levels. The red line indicates an upwards trend since 2002.

What is the reach of this shift in consumption patterns?

The demographic shift of the average consumer isn’t just in age, it's also in geography. While life expectancy in emerging markets is increasing, it is improved quality of life that is the main driver of change. The emerging market middle class is rising rapidly, with China and India expected to be responsible for nearly two-thirds of middle class consumption globally by 2030.

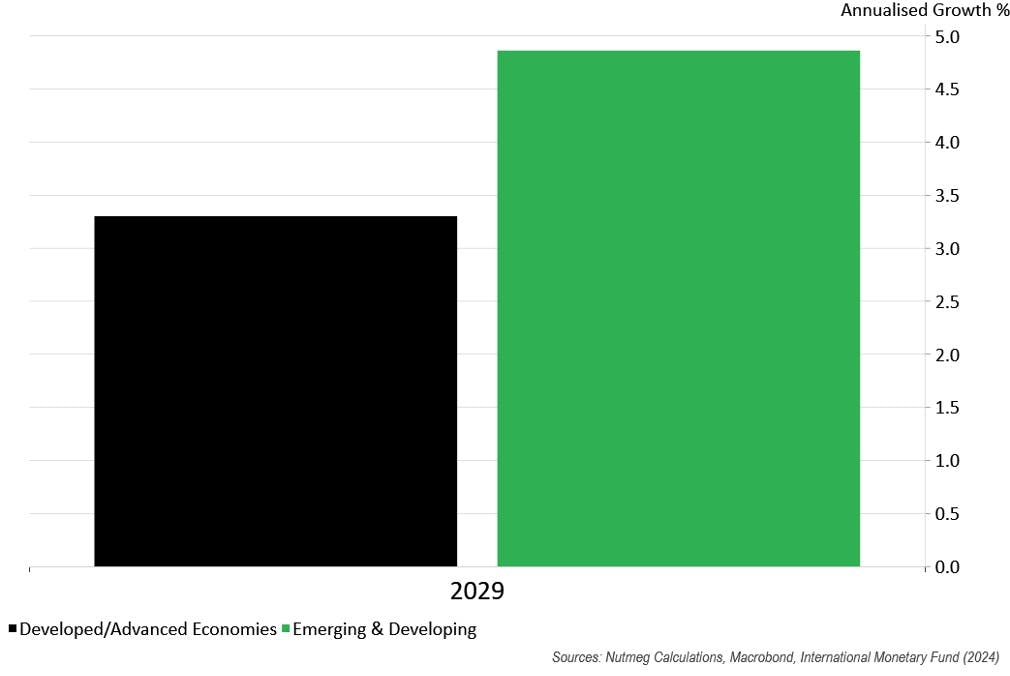

With the IMF forecasting that GDP per capita will increase by 4.8% per annum until 2029 in emerging markets, compared to just 3.3% in developed markets, emerging market consumers are becoming increasingly important for global growth in the long term.

Chart 2: IMF GDP Per Capita Five-Year Growth Forecasts

Source: Nutmeg calculations, Macrobond, International Monetary Fund (April, 2024)

There is a significant runway ahead for consumer-focused companies in emerging markets, especially for e-commerce and digital disrupters, which will continue to benefit from an increase in smartphone and mobile broadband use.

China and India have low smartphone adoption rates at 68.4% and 46.5% respectively. However, they already outweigh the number of developed market users, with a combined 1.8 billion smartphone users compared to the 276 million in the US.

The growth of smart devices and the 'Internet of Things’ has connected the emerging world with the developed world in a way we’ve never experienced before. Cultural and consumption trends are transcending geographies in the digital world, and expectations for digital goods and services are now global.

However, emerging world consumption desires are not all outwards looking. Home-grown businesses in emerging markets are also playing a major role. When looking at the largest internet-focused companies by market capitalisation, the emerging market world already had four of the top 10 spots as of August 2023 (Tencent, Alibaba, Meituan and Pinduoduo).

How do we invest in the Evolving Consumer?

Our globally diversified portfolios hold a variety of technology, healthcare and consumer-focused stocks via ETFs across multiple markets. In our Evolving Consumer thematic portfolio, where exposure to these long-term themes will differ depending on your chosen risk level, we have identified four core trends:

- Healthcare innovation

Healthcare innovation focuses on new developments within life sciences, covering everything from patient records to customised medications. Via the iShares Healthcare Innovation ETF, for example, we aim to capture the latest trends in biotechnology, medical device manufacturers, and digital healthcare providers. Examples of some key players in this field include Pfizer, Sonic Healthcare, and UnitedHealth Group. - Demographics

Demographics focuses on the challenges faced by an ageing population as a result of increases in life expectancy. Our stake in funds such as the iShares Aging Population ETF provides exposure to specialist medical care, luxury travel providers, and wealth services. These are all sectors that are experiencing a rapid increase in demand as the population ages. Some of the key players in this ETF include HCA Healthcare, Expedia, Marriott International, and JPMorgan Chase. - Emerging global wealth

This area focuses on the expansion of the middle class in emerging markets. For example, this trend is captured via the iShares EM Consumer Growth ETF which provides exposure to luxury goods and services, along with popular e-commerce platforms. One example of the type of equity found in this ETF is Louis Vuitton Moet Hennessy, which reflects a desire by affluent consumers in emerging markets to adopt luxury western brands. However, local brands are also finding success thanks to emerging market affluence, and so equities such as Hong Kong's Chow Tai Fook Jewellery Group and Brazil's Lojas Runner SA (department store) can also be found in this ETF. - Digitalisation

Digitalisation primarily focuses on providing goods and services fuelled by the growth of the smart device market, capturing trends across e-commerce, payments, communications and media. We invest through funds such as the iSharesDigitalisation ETF, which provides exposure to e-commerce platforms, connectivity providers, and digitised service platforms. Some key players found in this ETF include Amazon, Meta, Rightmove, Visa, and Shopify.

How do we pick the ETFs for this theme?

The global ETF thematic universe is vast. To select the ETFs which form Evolving Consumer and our other thematic portfolios, we look at three key criteria:

- Theme purity – how the underlying index classifies its constituents and more specifically the rules behind its construction.

- Assets under management – larger funds mean less risk of ownership concentration for our clients.

- Market liquidity – the more liquid a fund, the lower the spread cost is (the difference between buying and selling prices).

Is investing in the Evolving Consumer thematic right for me?

Structural change can take time to fully embed and can require significant capital. Nutmeg thematics, including the Evolving Consumer, are centred on trends entering or within their growth phase. Therefore, investing in the Evolving Consumer, and our other thematic portfolios, is more appropriate for those who have long-term investing goals. Some of the trends covered in our thematic portfolios may not become mainstream for 15-20 years or more.

It can be a challenge to invest in rapidly evolving spaces, which is why a globally diversified approach that accesses these themes through future-focused ETFs can help to balance the risk. The option to invest in the Evolving Consumer thematic is only available to Nutmeg investors with a risk level of 5 or above. Thematic investing carries specific risks and is not for everyone. There is no guarantee that development of the trend will contribute to positive investment outcome.

The growth of the middle class in emerging markets, increasingly digitised services and media, and continued advances in healthcare, are all going to create new investment opportunities in the coming years. An Evolving Consumer thematic investment strategy can balance exposure to companies that are performing well today, with those that are shaping the way we'll live tomorrow.

Risk warning:

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Thematic investing carries specific risks and is not for everyone. There is no guarantee that development of the trend will contribute to positive investment outcome. All Nutmeg themes, including Resource transformation, should not be considered as incorporating ESG considerations.

Past performance and forecasts are not a reliable indicator of future performance. We do not provide investment advice in this article. Always do your own research.