The Nutmeg Smart Alpha portfolios, powered by J.P. Morgan Asset Management (JPMAM), are run collaboratively, combining our core investment principles with the in-house multi-asset capabilities of one of the world’s leading investment houses. Here, with the help of JPMAM’s expert analysts, we update you on recent performance of the portfolios and highlight some of the key holdings.

Launched in November 2020, the portfolios have so far operated in a largely difficult period for ‘active’ managers – that is, those who are trying to beat a benchmark or index through stock selection. As the most recent SPIVA scorecards show, a large majority of active funds have underperformed globally on a one, three, five and 10-year basis to end of December 2021.

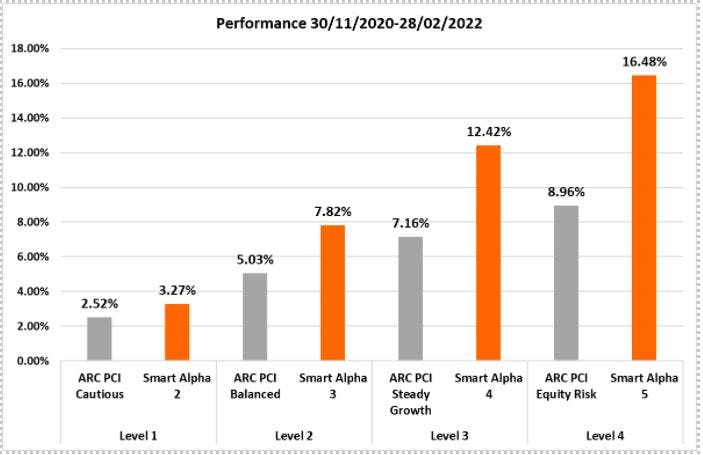

Still, the funds have delivered better than peer-group-average returns for clients, as you can see below as we measure performance against equivalent ARC benchmarks.

Nutmeg Smart Alpha portfolios performance since launch vs ARC benchmarks

Source: Nutmeg, ARC

As a reminder, the active, security selection element of the Smart Alpha portfolios is described as ‘research-enhanced’. Alongside passive ETFs which track market indices, the Smart Alpha portfolios also include innovative active ETFs that benefit from JPMAM research expertise.

JPMAM has a long track record in managing with a research-enhanced approach which, in contrast to many active security selection strategies, is focused on strictly managing risk relative to the wider market and enforcing diversification. It is this risk-managed, research-enhanced approach that has built a strong long-term track record in delivering outperformance to the benchmark, or ‘alpha’.

It is our belief that these types of active ETFs offer a unique way for investors to seek outperformance within an asset class by giving them the best of both worlds: combining the diversification, low cost and transparency benefits of a passive approach with active, research-driven security selection. In fact, we believe they are a smarter way to access alpha.

The active funds in focus

Nutmeg’s Smart Alpha portfolios currently invest across four JPMAM active equity UCITS ETFs: US Research Enhanced Index Equity ESG (JREU), Global Research Enhanced Index Equity ESG (JREG), Europe Research Enhanced Index Equity ESG (JREE), and Global Emerging Markets Research Enhanced Index Equity ESG (JREM). Here, we’ll give a brief outline of some of the key stocks which added and detracted to performance for the 12 months to 31 January 2022.

Starting with US Research Enhanced Index Equity ESG; this fund focuses on the US equity market. With tech stocks dominant in this region, it’s no surprise that an ‘overweight’ (versus the portfolio’s benchmark) position in (the parent company of Google) was a key contributor to performance in the period, helped by a robust recovery in advertising revenue. JPMAM analysts reported the stock surpassed the market’s expectations as earnings consistently beat estimates. Another holding that beat consensus earnings expectations was financial services multinational Wells Fargo, where an overweight position also served JREU well.

A position in pharmaceutical giant Pfizer was the largest detractor from performance, in part because of its volatile share price after the emergence of the Omicron variant of Covid-19. While the share price was up over the period, it was a detractor on performance because JREU held an ‘underweight’ position, which was less than its benchmark. Also within the healthcare space, an overweight position in medical devices company Zimmer Holdings hurt performance as it was impacted by pressures on the US healthcare system, coupled with staffing shortages and patient delays.

Global Research Enhanced Index Equity ESG is more globally focused, though it also benefitted from a holding in the ubiquitous Alphabet, as well as financial software company Intuit which saw strong demand for its products from small businesses, particularly for its tax solutions.

A detractor on performance was Orsted, a Danish multinational offshore wind developer that saw its share price drop on fears of increased competition in the renewable energy space.

Europe Research Enhanced Index Equity ESG is focused on European equity markets and benefitted from an overweight position in IT consultant Capgemini, a key business in the flourishing world of digital transactions and adoption of cloud-based applications. Danish pharmaceutical company Novo Nordisk was another highlight in 2021 with the US Food and Drug Administration approving its obesity treatment Wegovy™.

Detractors for the fund included a holding in French rail company Alstom with its acquisition of rival Bombardier Transportation marred by uncertainties in the rail industry given the recovery from Covid-19 lockdowns. An overweight in Dutch internet company Prosus also underperformed given its stake in tech giant Tencent, which in turn suffered given the interventionalist crackdown on tech by the Chinese government.

Global Emerging Markets Research Enhanced Index Equity ESG looks towards emerging markets for its opportunities, an often-volatile asset class that is best approached with a long-term view. The portfolio underperformed during the 2021, with a number of consumer discretionary stocks suffering. An overweight position in China’s e-commerce giant Alibaba detracted the most on concerns around anti-monopoly measures. Also in China, tighter regulatory control on after-school tutoring was a detractor on private tutor New Oriental Education.

Engaging through ESG

Behind the research-enhanced strategies sits a team of over 90 research analysts. These stock research specialists are responsible for selecting which securities are favoured in portfolios. A core aspect of their role is meeting with companies, which offers an opportunity for engagement on their business practices, and how these align to ESG principles. All four of the active ETFs above are mandated to take into account environmental, social and governance (ESG) perspectives when forming their selection of stocks. Indeed, Nutmeg also caters for clients’ preferences in this space with our Socially Responsible Investing portfolios.

Being socially responsible is not just the domain of specifically labelled portfolios; we believe all active investors should take a view. JPMAM’s team tell us they have significantly advanced their ESG and sustainability research, particularly in emerging markets and Asia Pacific by establishing a materiality framework which now covers over 1,000 companies.

For example, with Thai state-owned oil & gas provider, PTT, meetings were focussed around concerns on climate change, particularly with regards to the company’s relatively conservative targets. \

“In August, the company presented to investors its latest vision, including new targets for carbon reduction and clean energy. Pleasingly these did represent an uplift in response to shareholder feedback. The commitments included a 15% reduction of total Scope 1 and 2 emissions by 2030 from 2020 levels and net-zero emission by 2070.

“We then met with the company to dig further into some of these initiatives, including for example learning that its internal carbon price is 0/t. We are pleased to see PTT uplifting its commitment to carbon reduction in response to shareholder engagement and we will continue to push for a faster pace of change. In particular, there remains plenty of room for PTT to align its climate change mission with the Paris agreement,” Andrew Tan and Felix Lam, executive directors in JPMAM’s emerging market and Asia Pacific equities team.

Also within the area of sustainability, the team has been dealing with Britannia Industries, an Indian branded food producer; they first engaged with the company’s CEO in March 2019 to ask the management to publish a sustainability report.

“We did this because, as is often the case, we were aware how much good work the company did that was not being disclosed to the market.

“We have continually pushed the company on this point and were therefore pleased to see it publish its inaugural sustainability report. We spent some time analysing the disclosures which can form the basis of our future engagements with the company. For example, in the last two years it has reduced the intensity of its greenhouse gas emissions (0.23 tCO2/unit to 0.2 tCO2/unit) and water usage (1.24L/Kg to 0.97 L/Kg); this is encouraging but now we can benchmark the data to peers and push for further improvement where relevant,” Anuj Bansal, vice president in the Emerging Market and Asia Pacific equities team.

Even sustainable leaders have room for improvement, with Novo Nordisk a case in point. The company is a leader in tackling diabetes, providing half of the world’s insulin and helping to lower the price of insulin vials, particularly in low and middle-income countries, where 80% of people with diabetes live. However, despite this good work JPMAM sees the company falling behind on internal gender diversity credentials.

“As a sign of inclusion, we expect similar levels of diversity in senior roles or targets to bridge the gap. In the case of Novo Nordisk, we identified a significant mismatch between women in the workforce and women in management. This was confirmed by the company, which quoted 49% of women in the workforce compared to 24% at senior management level. Novo Nordisk acknowledged the problem, and cited unconscious bias and low employee turnover as causes of the discrepancy. We outlined our expectations for goals to reach parity, and the company explained that it aims for a 50/50 gender split across senior management by 2025. Novo Nordisk plans to achieve this target through talent programmes and succession planning, and the agenda is supported in short- and long-term incentive plans,” Victoria Darbyshire, equity analyst.

Partnering for you

We hope this has given you an insight into how the JPMAM team strive to add value to Smart Alpha portfolios, though of course these are not just about stock selection. The biggest driver of performance remains a global multi-asset approach to investment, in this case a joint effort between JPMAM and the Nutmeg investment team.

These teams continually monitor the portfolios, adapting the allocation through changing market conditions while ensuring they remain aligned with your long-term objectives.

A guide to Smart Alpha is available via the Nutmeg website, while late in 2021 we also recorded an update on the performance of the portfolios one year on from launch.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicators of future performance. Tax treatment depends on your individual circumstances and may change in the future.