The financial services industry is full of jargon, and ‘Bed and ISA’ is probably one of the more unusual terms you may come across. To demystify the term, we take you through exactly what ‘Bed and ISA’ is, and how the process may help you make the most of your tax-free allowances when investing.

In the 2024/25 tax year, which begins on 6th April 2024, the annual capital gains and dividend tax-free allowancesare set to shrink again, with the capital gains allowance falling to £3,000 for individuals, and dividend allowance dropping to £500.

Now's an important time to make sure you're investing as tax efficiently as possible, particularly when it comes to investments that you may hold outside of any ISAs or pensions.

One solution for those who have investments not within a stocks and shares ISA is to follow a process called ‘Bed and ISA’.

It may have an odd name, but it can help you maximise your annual ISA allowance without needing to find extra cash.

What is Bed and ISA?

A Bed and ISA transfer involves moving investments that you own outside your stocks and shares ISA (for example, in a General Investment Account) into this tax-efficient wrapper.

These assets cannot be transferred directly, so you sell the assets outside the ISA and simultaneously buy the same assets back within the ISA. This pair of transactions mirror one another, so you aren’t exposed to movement in the stock market that may occur in the time between buying and selling.

The aim is to end up with the same portfolio as before, but with everything inside an ISA wrapper. Once the transfer has taken place your investments will be free of tax on any potential growth or returns.

Who might consider a Bed and ISA?

A Bed and ISA strategy can be useful in several scenarios.

You may have inherited or accumulated investments outside an ISA in earlier years – perhaps because you were using your ISA to save for a house deposit or you were able to invest more than the annual allowance.

Perhaps you simply wish to secure this year’s ISA allowance without finding extra cash to put into a tax-efficient account after day-to-day living expenses.

Maybe you've made gains on investments outside your ISA. If you decide to sell them, it may be worth doing so in the 2023/24 tax year, so you can make the most of the £6,000 capital gains tax-free allowance before it falls to £3,000 in the new tax year.

For Nutmeg clients, if you already invest in one of our portfolios through a Nutmeg General Investment Account (GIA), a Bed and ISA transfer can make sense.

Why Bed and ISA with Nutmeg?

With Nutmeg, carrying out a "fund redistribution" (a Bed and ISA transaction between your Nutmeg GIA and your ISA) means you won’t pay capital gains tax on future growth and returns from your investments within the ISA, nor will we charge you for the transaction. It's important to remember that selling your GIA holdings to move them into an ISA could trigger a capital gain or loss, which could result in tax to pay if any gain exceeds the capital gains tax allowance.

Our simplified process means you can carry this out in one transaction, while maintaining access to your Nutmeg portfolios.

Once the transaction is complete and your investments are held within the ISA wrapper, any future returns will be free from capital gains and income tax.

How does Bed and ISA affect your ISA allowance?

Everyone has an annual ISA allowance, currently £20,000 per tax year, which can be used in a stocks and shares ISA, a cash ISA, Innovative finance ISA, Lifetime ISA or a mixture of them all.

If you carry out a Bed and ISA transaction, this must be done within your £20,000 a year annual limit. If you have more money in your GIA to transfer into an ISA, you can redistribute more funds into your ISA in the next tax year.

For example, if you already have £4,000 in an ISA, and £20,000 in a GIA, the most you could redistribute from your GIA to your ISA would be £16,000. You'd have to wait until the new tax year to add the remaining £4,000 in your GIA.

What are the benefits of funds redistribution?

The benefit of a Bed and ISA transfer is that you won’t pay capital gains tax or income tax on any future returns on your investments. It’s also a helpful way to ensure the money you have invested is working as tax efficiently as possible, even if you don’t have new money to invest in the current tax year.

Is Bed and ISA worth it?

A Bed and ISA transaction could potentially save you a significant amount of money over time. Once your assets are held in the ISA, they can grow over many years, free of both income tax and capital gains tax. However, please be aware that past performance is no guarantee of future investment returns, and you may not get back what you invest.

You also need to understand the potential costs you could incur through a Bed and ISA transaction. Even though the transaction itself is free, you may find that you end up with a slight price difference between your old GIA and your new ISA. This is because many investments have a lower price for you to sell at than the cost of buying them – a phenomenon known as the “spread” – which is how some fund traders make their profit. Your money will not be out of the market, however, as Nutmeg will buy the ISA stock from the GIA in the same trade.

Does Bed and ISA trigger capital gains tax?

If you sell shares or funds outside an ISA for more than you bought them for, you may trigger capital gains tax. Everyone is currently allowed to make £6,000 of tax-free capital gains a year, and the rate of tax payable depends on your income tax band. However, over time, these costs may be outweighed by the benefit of any tax-free growth. If you make a loss on any investments, this could offset any other capital gains you have made this year or will potentially make in future years.

You could also choose to carry out several Bed and ISA transactions across tax years, so that you use your capital gains allowance each year without triggering the tax.

In the 2024/25 tax year, which begins on 6 April, the capital gains tax allowance will fall to £3,000, so now could be the perfect time to sell your GIA funds and protect them in an ISA wrapper.

What is the Bed and ISA 30-day rule?

One thing you must be aware of when considering a Bed and ISA transaction is the so-called 30-day rule.

This rule was introduced to stop a practice known as “Bed and Breakfasting” where investors sold their assets at the end of the tax year, utilised their capital gains allowance and then bought them back again quickly at the beginning of the next tax year.

Under the terms of this rule, you must wait 30 days to buy the same investment again – or use the price you had previously paid for the assets to calculate your capital gains liability. However, when you carry out a Bed and ISA transaction, the investments would not be liable for any capital gains tax in the future as they would be in a tax-exempt ISA wrapper, so you would not be "Bed and Breakfasting".

An alternative is to buy the funds back in a personal pension (a process known as Bed and SIPP, or Self-Invested Personal Pension), which has the same effect. Please note, Bed and SIPP isn't currently available at Nutmeg.

Are there any risks to Bed and ISA?

No investment strategy is entirely without risk, but our Funds Redistribution feature makes a Bed and ISA strategy as easy as possible.

You should consider the following points:

1. Capital gains tax

Selling shares or funds and triggering a gain over your capital gains tax-free allowance could trigger a tax charge.

2. Use of your ISA allowance

Using a Bed and ISA transaction to fill, or partly fill your ISA, uses your annual ISA allowance in the same way as making a cash contribution. For example, if you use Bed and ISA to move £10,000 from a GIA to within an ISA wrapper, you have used £10,000 of your annual ISA allowance.

In the current tax year, this would count as a contribution to a stocks and shares ISA. Meaning, if you have stocks and shares ISAs elsewhere, you wouldn't be able to contribute to them as well.

Following a change in the rules, in the new tax year, which begins on 6th April, you can contribute to multiple stocks and shares ISAs in the same tax year, up to the £20,000 annual allowance.

How does the Nutmeg Bed and ISA process work?

Using the Nutmeg online dashboard or the mobile app, you can use Nutmeg’s Funds Redistribution feature to move money from your GIA to your ISA without any additional charges from us. You will need to ensure you have unused ISA allowance for the tax year to use this feature.

Bed and ISA in 5 simple steps on Nutmeg’s Investment App

1. Open a new ISA

If you already have a Nutmeg ISA, you can use this to carry out the Bed and ISA process. If not, you will need to open a new one via the option on the left-hand side of the dashboard or from within the mobile app. Remember, in the current tax year, you can only contribute to one stocks and shares ISA per tax year, but from 6th April, you can open and contribute to multiple stocks and shares ISAs in the same tax year, up to the £20,000 limit.

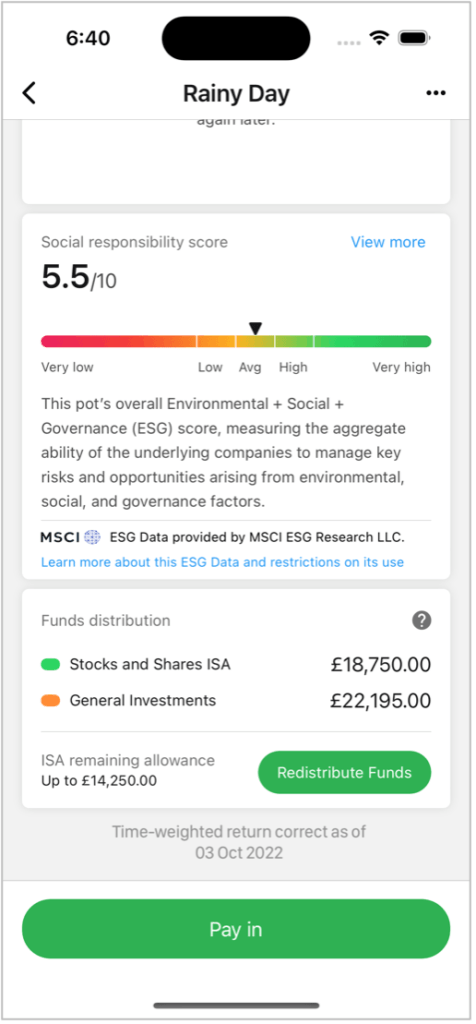

2. Check your fund distribution

Your account should show how your money is distributed between your GIA and your ISA, allowing you to decide how much to switch from your GIA to your ISA.

3. Calculate your remaining ISA allowance

The Nutmeg app will show you how much of your £20,000 a year ISA allowance you have left at this point in the tax year. Remember, any ISAs outside of Nutmeg the app will not show those ISA contributions, so you will need to perform your own calculation.

4. Consider eligibility

If you're investing in the current tax year, and you have a stocks and shares ISA with another provider that you’ve already contributed to, you cannot contribute to a Nutmeg ISA, as a Bed and ISA transaction would count as a contribution to a stocks and shares ISA even though the same investments are being held. From 6th April, you can contribute to multiple stocks and shares ISAs in the same tax year, up to the £20,000 limit.

5. Press the button

Once you’ve decided how much of your current investment to move to your ISA, click the ‘Redistribute Funds’ button on the dashboard or in the app. The app will then walk you through the steps to make your Bed and ISA transaction.

Need advice on whether to Bed and ISA your investments?

If you would like to speak to someone about your own investment goals, you can book a free call with our team who are on hand to offer free guidance on planning your financial future.

Pros and cons of Bed and ISA

Pros

- Use your £6,000 capital gains tax-free allowance where available

- Move your money into an account where it can grow free of capital gains and income tax

- Use your £20,000 a year ISA allowance without finding any extra money for savings or investment

Cons

- Trigger a capital gains tax bill if you go over your allowance

- Use up your £20,000 ISA allowance so it cannot be used elsewhere

- In some cases, moving your investments into a pension can be even more tax efficient and suitable for your circumstances, especially if you have a workplace pension and you do not need access for a medium-term goal.

Risk warning

As with all investing, your capital is at risk. The value of your portfolio with Nutmeg can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future.